N26 Review: The Best Bank Account For International Travellers? (Updated 2020)

Banking fees. Oh man.

They're one of those nuisance travel expenses that you might be happy to ignore if you only travel abroad occasionally, but if you're a person who travels regularly or who takes extended international, those pesky fees can really start to have a significant impact on your bank balance.

When travelling in a foreign country, it's painful to watch as your home bank tries to gouge you with percentage-based foreign transaction fees, flat fees for ATM withdrawals and other charges you don't incur when you're at home.

In fact, according to one currency analyst, British holidaymakers alone are wasting a staggering £1.3 billion a year on travel money mistakes, with £644 million of this squandered by not using fee-free debit and credit cards.

And if you’re a fully nomadic, long-term traveller who’s continuously on the road, the situation is even worse, as you’re constantly incurring such pesky banking fees day after day, week after week, all year round.

The unfortunate thing is, that if you’ve got a bank account that’s not travel-friendly, there isn’t a lot you can do about most of these fees; while there are ways to reduce or minimize them – you can’t evade them entirely until you set up a more suitable bank account.

Hence why it’s so critical for travellers to possess a travel-friendly bank account that deducts minimal or zero fees for the types of foreign-currency based transactions that you’ll be regularly making overseas.

One travel-friendly bank account that has greatly served me over the past 5 years of travel is that of a rapidly growing neobank called N26 and I've written this comprehensive guide to cover every aspect of banking with them.

Virtually everything you need to know about N26 before deciding to open an account can be found here on this page, all in one place.

Let's get started then, shall we?

How I stumbled upon N26 (a personal story)

When I first started travelling full-time back in 2015, I only had my domestic Irish bank account - a checking account with Bank of Ireland, one of the country's four largest banks.

But this checking account was hammering me with onerous foreign transaction fees whenever I made an ATM withdrawal or in-store card payment abroad, in addition to account maintenance fees that were levied quarterly.

This gave me the impetus to start seeking out more travel-friendly banking options, both in my own country and abroad.

It wasn't long before I stumbled upon N26 (then called Number 26), a revolutionary German Fintech start-up that promised to charge almost none of the usual fees that are imposed by traditional high-street banks.

After doing my due research, I set up a new checking account with N26, downloaded their smartphone app and started enjoying significantly reduced banking fees on the road and a much more efficient and streamlined banking experience overall.

I had finally found the solution to my travel banking woes. And what worked for me might also work for you.

Before we take a look in more detail at the costs and benefits of having an N26 bank account and how to set one up, I want to quickly cover some of the fundamentals, like what exactly N26 is, where the company is based and why it was established.

What is N26 bank?

N26 is a revolutionary mobile-first banking start-up that is headquartered in Berlin, Germany. It was founded in 2013 by two Austrians from Vienna, Valentin Stalf and Maximilian Tayenthal, and was known as Number 26 up until July 2016.

The Fintech firm has reinvented the standard banking experience by creating a mobile-friendly, app-based banking platform that runs very smoothly and is better adapted for those with a mobile lifestyle than a traditional bank account.

There is no need to ever visit a physical branch as an N26 customer – everything can be accomplished through the N26 smartphone app or through the web app.

This makes an N26 bank account especially useful for travellers who need to be able to execute banking transactions from their smartphone while on the go.

Since the company’s original product launch in 2015, over 5 million customers across 22 European countries and the US have signed up for N26.

The firm has raised a total of $215,000,000 in funds from some of the world’s most well-known investors, including Allianz X, Tencent Holdings Limited, Li-Ka Shing’s Horizons Ventures, Valar Ventures (backed by Peter Thiel), members of the Zalando Management Team and Earlybird Venture Capital.

Who is eligible to bank with N26?

An N26 bank account is currently available to residents of 22 European countries, as well as to everyone living in the US.

The European countries where N26 is available are Austria, Belgium, Denmark, Estonia, Finland, France, Germany, Greece, Iceland, Ireland, Italy, Liechtenstein, Luxembourg, the Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, Switzerland and the US.

For many years, N26 was not available to US customers, but that all changed on June 11th, 2019, when the firm initiated a staged rollout of its services in the US.

Unfortunately, N26 is no longer able to offer its services to people living the UK, since the company only has a European banking license and the UK left the EU on the 31st January 2020.

If you’re not from the US or the Eurozone you won’t be able to set up an account with N26 for the time being unfortunately, but don't despair yet because the situation is always changing.

Is N26 actually a legit bank?

If you're having any doubts about the legitimacy or credibility of N26, I'm here to reassure you that it is an authentic German bank.

N26 has been in possession of a full European banking license since July 18th, 2016, which means it is fully regulated by BaFin, the Federal Financial Supervisory Authority, which is the financial regulator for Germany.

Your holdings with N26 are guaranteed by the German bank deposit protection scheme, up to the sum of €100,000.

You can also check what other users are saying about N26 on independent consumer review websites like TrustPilot.

On TrustPilot, N26 has received over 12,000 reviews and scores a 4.2/5 average star rating, which is considered to be "great".

67% of reviewers on TrustPilot have rated their experience with N26 as "excellent" (5 stars), while 17% have rated their experience as "bad" (1 star), with the rest of users rating their experience somewhere in between these two extremes.

One thing you do have to keep in mind when looking at these review websites is that people are more likely to leave a review when they've had a negative experience than when they've had a positive one, so the actual ratio of positive to negative experiences is likely to be higher than what these websites would suggest.

How N26 Can Benefit Travellers

One of the most exciting things about N26 for you, the traveller, is the amount of money it can save you on currency conversion fees, ATM withdrawal fees, foreign currency transfer fees, account maintenance fees and other common banking charges.

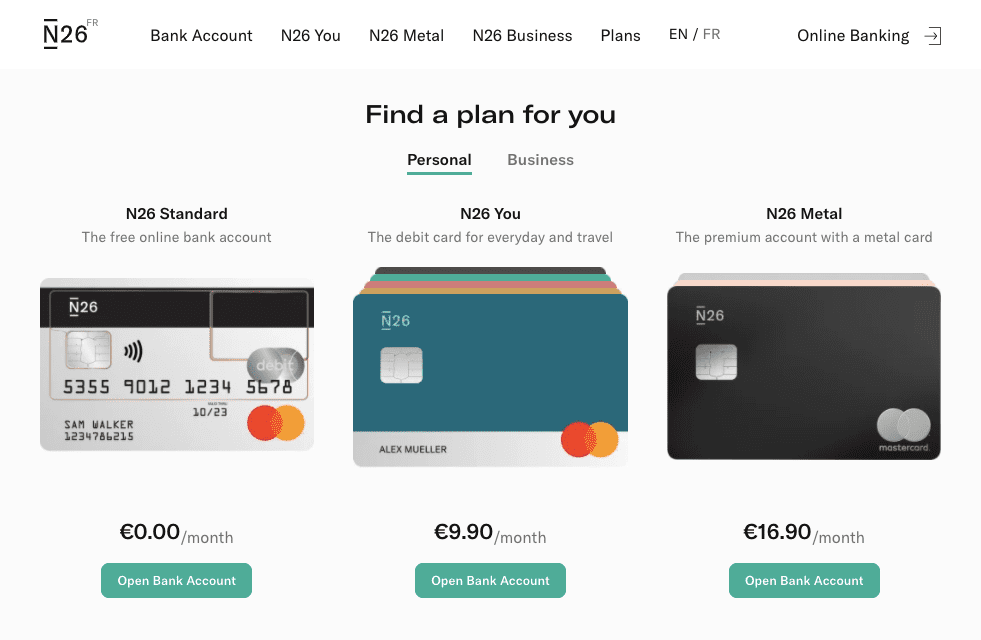

There are now four different N26 products; N26 standard, N26 Business, N26 You and N26 Metal, and they come with many overlapping but also differing features, perks and benefits.

No matter which product you opt for with N26, it’s virtually guaranteed that as an international traveller you’re going to save money over the traditional domestic bank account that you’re currently using.

What are N26's products?

N26 Standard

The N26 standard current account is completely free to set up, and after you've created your account the free plastic Mastercard debit card will be mailed to your address and should arrive after anywhere between 4 and 14 days, depending on your location.

If you need the card quicker than that or if the free delivery service has failed you, you can also use the express delivery service.

With express delivery the card is delivered via UPS for a fee of €25 and should arrive the next working day between 8 a.m and 12 p.m. This service is free of charge with N26 Metal (discussed further below).

The Mastercard for the standard account has a frosted, translucent surface and a black magnetic stripe spans the length of the card on the front face. The card also has an EMV chip and is NFC-enabled for contactless payments.

Here’s what's great about this free N26 account:

No account management fees

The N26 standard account is completely free to set up and there are no account management fees whatsoever. You won’t be charged monthly, quarterly or annually for having the account, as happens with many old-school banks.

No currency conversion fees for card payments

If you make a card payment in a foreign currency with your N26 card, the payment is processed with the Mastercard exchange rate at the time of the transaction, which is usually very close to the "true" interbank or mid-market exchange rate.

There is no marking up of the Mastercard exchange rate, nor are there any currency conversion fees deducted afterwards. This benefit alone will save many travellers hundreds of dollars every year.

Whenever you book a flight with your card, pay a restaurant bill, book a hotel or buy a bus ticket in a foreign currency, your home bank is screwing you over with currency conversion fees.

Most banks charge a 2% or 3% fee (some charge even more) for any card payments that you make in a foreign currency, so you can imagine just how much money that’s costing you over the course of a single year.

Free ATM withdrawals within the Eurozone, 1.7% fee elsewhere

Another great benefit of N26 Standard for travellers, is that you can get 5 fee-free (Euro) ATM withdrawals within the Eurozone each month. If you are not using N26 as your main bank account, then you still get 3 free withdrawals each month.

For any withdrawals after that, the charge is €2 per withdrawal, in accordance with the N26 fair use policy.

For N26 customers from Austria and Italy it’s even better; they get unlimited fee-free Euro withdrawals every month.

If you’re travelling outside the Eurozone there’s normally a 1.7% fee for ATM withdrawals in a foreign currency, which beats the majority of the high-street banks out there.

The majority of traditional banks will charge a 2% or 3% currency conversion fee for every foreign currency ATM withdrawal and many will even compound that with their own ATM withdrawal flat fee, which can be $5 or higher for many American banks.

This benefit alone could save you hundreds of dollars annually if you spend a lot of time travelling in countries where cash is king and you’re forced to make a lot of cash withdrawals from ATMs.

International money transfers via Transferwise

SEPA money transfers within the Eurozone are free with N26 and international money transfers to foreign banks are handled via TransferWise, which means that you get the lowest possible transfer fees - up to 8 x lower than transferring money from your home bank.

TransferWise is directly integrated into the N26 app for personal account holders (this feature is not yet available for N26 Business users) for a seamless experience transferring money to more than 36 foreign currencies.

Transfers within the SEPA payments system, both national and international are normally completed within one working day, but occasionally can take two working days, while transfers in foreign currencies via Transferwise can take up to four working days.

To be able to make international money transfers via TransferWise with N26, all you have to do is create a free TransferWise Borderless Account, which is a multi-currency current account that allows you to hold 50+ currencies and convert between them at the mid-market exchange rate for a small fee. The account is free to create, has no annual fees and the debit card comes free of charge too.

We've reviewed TransferWise as an international money transfer service in our article on the best bank accounts for international travellers.

Free N26 Maestro Card

Customers from Germany, Austria and the Netherlands can also get a free optional NFC-enabled Maestro card and this is true regardless of which N26 product you’ve chosen.

The N26 Maestro Card can be used for withdrawals and making fee- free payments anywhere in the world where the Maestro card symbol is displayed.

The fee for Maestro card withdrawals in Euros is €2, whereas foreign currency Maestro card withdrawals are charged €2 in addition to a 1.7% fee.

The card can be ordered directly from the control centre in the N26 app and should arrive at your address within 2-3 days after ordering.

Moneybeam

MoneyBeam is a really convenient N26 feature that allows you to instantly send money to friends, family and other phone book contacts without knowing their bank details.

All you need to know to send money via MoneyBeam is the payee's e-mail address or phone number. You can also allow N26 to access your phone contacts, in which case you'll be able to see which of your contacts are N26 users. MoneyBeam transfer will arrive virtually instantly for other N26 users.

If the payee is not an N26 customer, N26 will send the payee an offline MoneyBeam link via SMS or e-mail requesting the payee's bank details, and if the payee co-operates, the money should reach his/her bank account within two banking days.

Your account will be immediately debited after you request a MoneyBeam transfer, but if the payee doesn't accept the MoneyBeam within a period of 7 days the money will be re-credited back to your account.

Note that with MoneyBeam, European users are limited to sending €1,000 to N26 users, and €100 to all other contacts, in any 24-hour period. US users can send up to $3,000 per day ($12,000 limit per month).

Request money

The request money feature within the N26 app allows you to easily request money from an N26 contact that owes you. It comes in handy whenever a person needs a little reminder to pay you back.

You can request any amount up to €1,000/$3,000, can make up to 20 requests in one day and can request money from the same person 3 times within a single day!

The recipient of the request has 7 days to either accept or reject the request and when the person does so you’ll be notified of the result. If after 7 days the request is not confirmed it will expire.

Full control over your account

Let’s face it. It can often be a total pain in the ass to deal with old-school banks.

With many banks, if you want to change your PIN code or update your mobile number, you have to wait days for a letter with a security to be posted to your address, in order to confirm the change.

Moreover, many traditional banks enforce daily spending caps or ATM withdrawal limits on your account while you’re overseas, that you have no control over and no power to remove.

For example, my Bank of Ireland home bank limits me to a maximum ATM withdrawal amount of €100 per day in many Southeast Asian countries.

This is actually a nightmare because it means I have to withdraw cash several times during a trip since I can’t make a single large withdrawal at the beginning of the trip, thus incurring me repeated flat fee charges from foreign ATM machines.

Unfortunately when you’re travelling it’s simply not always possible to find an ATM machine that doesn’t charge a fee for withdrawals with foreign bank cards.

Many travellers also frequently face the problem where their home bank blocks their debit card for security reasons when they make their first transaction abroad.

Of course, your bank is taking all these measures in the name of securing your account, but incidents like these can be incredibly frustrating and often require you to wait on hold for hours to resolve the problem over the phone with the bank.

N26 however uses a totally unorthodox approach to account security. It places all the responsibility into the customer's hands.

Within the N26 banking app, you have close to full control over your daily card spending and ATM withdrawal limits.

You can set your daily withdrawal limit anywhere between 0 and €2,500, and your daily spending limit anywhere between 0 and €5,000. You have a fixed monthly maximum of €20,000 for both withdrawals and card payments.

You can lock and unlock your card with a single button tap or for finer control you can toggle a switch in the N26 app to block payments abroad, online payments, cash withdrawals or all three if you wish.

These are all useful features to have if your card is lost, has been stolen or if somebody has gotten a hold of your card details.

Changing your PIN number also couldn’t be easier to do from within the N26 app. All you have to do is enter the 10-digit number on the back of your card and then enter your new PIN.

N26 Spaces

N26 Spaces is a handy feature of all N26 products that allows you to create spaces or sub-accounts within your main account.

Money can be moved from your main balance into these sub-accounts and vice versa. You can also move money from one space to another. Once money has been moved from the main balance into a space, it can't be spent, since the N26 debit card is only linked to your main account.

You might create a space if you wanted to set money aside for a holiday, a birthday gift or perhaps a new car. You can set savings targets for each space and see how close you are to reaching your goal.

N26 Spaces thus offers an innovative way to organize and compartmentalize your money, and can help you to be more disciplined with saving while also helping to prevent impulsive spending.

With N26 Standard, you can create 2 sub-accounts, but premium N26 products allow you to create up to 10 spaces.

Spending insights

N26 offers spending insights and statistics to help you better analyze how you're spending your money.

You can view your monthly spending and income totals, your 4-month averages and you'll also get a breakdown of exactly how much you spent and earned in each category (i.e. leisure & entertainment, shopping, insurance & finance, media & electronics).

Transactions are automatically categorized by N26 but you can also change the category manually if you wish. You can also add hashtags to your transactions to make them easily searchable in the future.

N26 insights and statistics are available in the N26 app, which we cover in more detail further below.

CASH26

The CASH26 feature is presently only available to N26 customers in Germany and Austria, although that may change in the future.

In a nutshell, it allows you to do two things; withdraw money or deposit money at more than 11,500 supported retail partner locations across Germany and Austria, without needing your Mastercard.

Supported retail stores include REWE, Penny, Real, dm, BUDNI, Ludwig, Eckert, ON Express, Adam’s, Barbarino and mobilcom-debitel.

Withdrawing money at a retail partner works similarly to traditional cashback and you can make unlimited free withdrawals every month.

You present a barcode generated by the N26 app to the cashier and once the barcode is scanned the cashier hands you the cash.

The money is actually debited the moment you create the barcode, but if you delete the barcode the money will be immediately returned to your account and if the code remains unused it will be returned within 24 hours. The maximum withdrawal per transaction is €200 and you can withdraw up to €900 per 24-hour period.

To deposit money into your N26 account, you also need to fetch a barcode from the app and then hand the cash over to the cashier once the code is scanned. Your account will be credited immediately.

The first €100 is free to deposit each month, and after that there’s a 1.5% charge on the total sum paid in. The minimum deposit is €50 and there’s a deposit limit of €999 in any 24-hour period.

N26 Business

N26 Business is a dedicated business account for freelancers and self-employed people. If you sustain your travels by working online from a travel laptop, the N26 Business account could be right up your alley.

To get an N26 Business account you can’t already be an N26 user – you must be signing up for the first time. It’s currently not possible to have two separate N26 accounts at the same time.

With N26 Business you get a MasterCard that you're supposed to only use for business purposes, but you can also order an additional Maestro card that can be used for personal spending on the same account.

N26 Business can be chosen with any of the three main N26 products (N26 Standard, N26 You and N26 Metal).

One of the exclusive benefits of a business account is that you get 0.1% cashback on all Mastercard purchases for N26 Standard and N26 You, and 0.5% cashback for N26 Metal. The cashback is automatically credited to your account at the end of each quarter.

N26 You

Previously known as N26 Black, N26 You is the next step up from the standard N26 account.

It includes everything you get with standard, plus some extra perks like comprehensive insurance coverage and unlimited free ATM withdrawals in any currency (up to 5 free Eurozone withdrawals per month), and all that for the recurring fee of just €9.90 per month.

The contactless Mastercard for N26 You comes in five different colours (Ocean, Sand, Rhubarb, Aqua & Slate) and you can choose the one you like best.

N26 You has a minimum membership term for one year and it will be automatically renewed for another year unless you cancel it at least one month before the expiry date.

So what criteria determine whether you should go for N26 standard or N26 You?

Well, if you spend much of the year outside the Eurozone and you usually withdraw at least €582 per month from foreign ATMs while abroad, it would make probably make more economic sense to go for the N26 Black card.

Why is €582 the cut-off point? Because if you withdraw more than €582 per month with the standard N26 card you're going to exceed the €9.90 monthly cost of N26 Black in withdrawal fees (1.7% of €582 = €9.90).

But this is just from a purely financial standpoint. There's more to consider, as you also get comprehensive insurance coverage with N26 You from Allianz Global Assistance Europe, one of Europe's largest insurance providers.

This insurance coverage doesn’t come with N26 standard and includes the following types of cover:

Mobility cover for vehicle rental

This covers you up to €20,000 for damages incurred to rental vehicles during your trip, inclusive of your e-scooter, e-bikes and car sharing rentals.

Travel cancellation insurance

This covers you for travel cancellations due to a death, accident, medical emergency or other reason, up to a maximum of €10,000.

Travel curtailment insurance & early return

This compensates you up to a maximum of €10,000 per trip if you are forced to curtail your trip prematurely.

Flight delay insurance

This covers you for additional expenses incurred as a result of a flight delay of more than 4 hours. You can be reimbursed up to €100 per hour and for a maximum of €500 per trip. No deductible applies.

Luggage delay insurance

This covers you for additional expenses incurred as a result of delayed arrival by more than 12 hours of checked luggage. You can be reimbursed up to €100 per hour and for a maximum of €500 per trip. If your bag is lost by the airline, you can receive up to €2,000 compensation.

Emergency medical expenses

This covers you and your family for general medical expenses incurred while abroad up to a maximum of €1,000,000, inclusive of dental care and winter sports, subject to the policy terms and conditions.

Note that the travel insurance is only applicable if you pay for the entire trip with your N26 card or bank account. Here, the definition of “trip” means a stay abroad of up to 90 days. If your trip continues beyond 90 days in length you will no longer be insured.

With N26 You, you can create 10 sub-accounts in N26 Spaces, which is a lot more than the 2 sub-accounts you're restricted to creating with N26 Standard.

You also gain access to Shared Spaces, a feature that is not available to N26 Standard account holders. A shared space is similar a regular sub-account in N26 Spaces, only that you can invite up to 10 other N26 account holders to access it.

The participants of the shared space will be able to freely add money to the space or withdraw money from it to their own N26 accounts. Legally speaking, the participants of the shared space are granted "Power of Attorney" by the owner of the space.

You could set up a shared space with your significant other, roommates, friends, family and other people that you trust, like the way you might set up a joint bank account.

Unlike N26 Standard, N26 You comes with exclusive partner offerings.

Some of these partners produce new innovative tech to make your modern lifestyle easier and others help you to stretch your money further with special online shopping offers and discounts.

The partners include WeWork, Hotels.com, IHG, Tannico, GetYourGuide, Outfittery, Caya, Zipjet, Home24, Helpling, Drivy, Lanieri, Babbel and Mobike.

N26 Metal

N26 Metal is the company's premium offering, and costs €16.90 per month with a minimum term of one year. It offers all the aforementioned features of N26 You, plus some additional perks and benefits.

The contactless, stainless steel card comes in three distinct metallic shades (Charcoal Black, Slate Grey & Quartz Rose) and has a tungsten core. It weighs 18 grams, making it three times heavier than standard bank cards. It is Europe’s first metal core card that supports contactless payments.

The card logos are mechanically etched and it has a double-coated matte black finish. The card number, CVV and 10-digit card ID number (token) are printed on the back.

N26 Metal grants you up to 8 free ATM withdrawals in the Eurozone and, like N26 You, unlimited free ATM withdrawals worldwide.

Priority customer support is a feature exclusive to N26 Metal; you get a dedicated phone line, whereas other N26 products only offer chatbot support and in-app live chat.

Another benefit of N26 Metal is that you can order an extra N26 You card for a one-time fee of €14.

With N26 Metal you have same comprehensive insurance coverage that you get with N26 You, but with the addition of mobile phone theft coverage (up to €1,000) and car rental insurance coverage (up to €20,000).

How does N26 work in the US?

In the US, N26 partners with Axos Bank to provide you with their services. Your deposits are FDIC-insured up to $250,000 and unlike in Europe, Visa issues the N26 debit cards instead of Mastercard.

Right now, you can only get a free N26 Standard account in the US, but you can bet that they will be launching the US versions of their premium N26 You and N26 Metal accounts in the near future.

Some of the features that are available to European N26 account holders are not available in the US yet (i.e. N26 Overdraft), but other features, like N26 Spaces and MoneyBeam, have already made it across the pond.

Like in Europe, US users can enjoy a free N26 account with no maintenance fees, no minimum balance, and no foreign transaction fees when they use their N26 card overseas.

US users can make unlimited free ATM withdrawals at more than 55,000 Allpoint locations across the US, Canada, Puerto Rico, Mexico, Australia and the UK. These ATMs can be easily located using the ATM map feature within the N26 smartphone app.

You are also entitled to 2 fee-free, out-of-network ATM withdrawals in the US each month, and there's talk that N26 will soon start reimbursing customers for access fees charged by ATM operators. You'll also be able to withdraw cash from bank tellers or at supermarkets free of charge.

Foreign ATM withdrawals for US users however, are a little more expensive, costing $2 per withdrawal plus 2% of the transaction amount.

US customers will also be able to get their paychecks 2 days earlier (so on Wednesday instead of Friday) with direct deposit, can link their N26 card to Apple Pay and will be able to enjoy cashback on subscriptions from N26 partners (Udemy, 8fit, Fiverr, YOOX etc.), as well as exclusive discounts and promotions.

Other features and aspects of banking with N26

What we've discussed so far is only the tip of the N26 iceberg. The following features and aspects of banking with N26 will give you a more complete picture of the services you gain access to when you become an N26 customer.

Note that all the following features are available to all N26 products, although many are presently only available in specific countries.

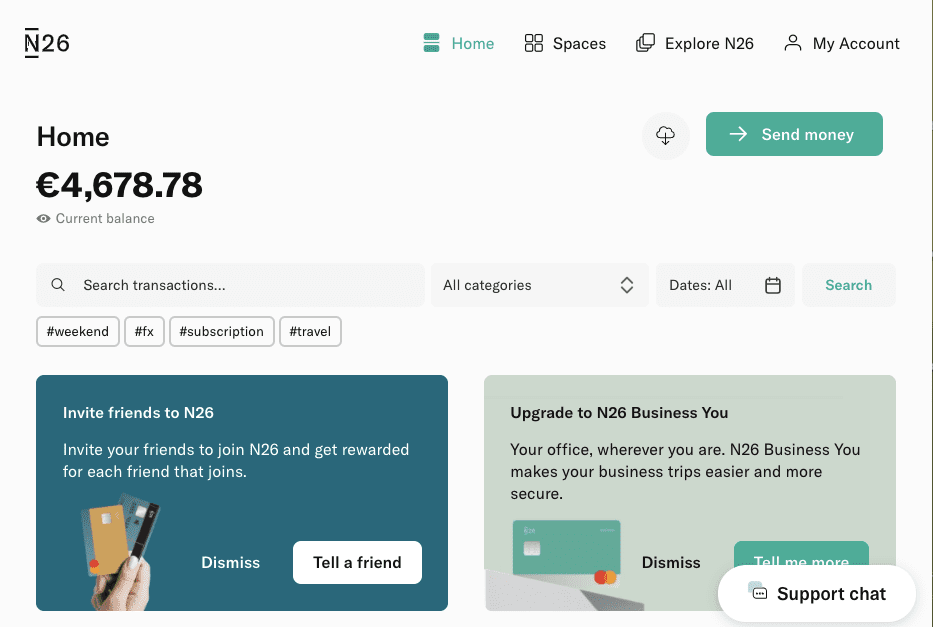

N26 mobile app

The N26 smartphone app is integral to the whole N26 banking experience. You can view your account in the N26 web app but you need the smartphone app to confirm certain transactions.

You can log into the app on your phone using either a password or Smart Login (fingerprint or pattern login). You can also disable the Smart Login feature if you want to only have the password login option.

You should update the N26 app whenever updates are available in order to maintain the highest possible level of security for your account.

When you first download the app you will have to pair it with your smartphone. Once the pairing process is complete you are ready to go.

The N26 app allows you to set up real-time push notifications for events like successful payments, failed payments, incoming bank transfers, outgoing transfers, direct debits and more. You can also opt to receive e-mail notifications.

Your transactions appear in a list format on the home screen, and each transaction is assigned a category like shopping, ATM, bars & restaurants, education, income, leisure & entertainment, food & groceries, business expenses, salary, household & utilities, transport & car, travel & holidays, and many others.

With the aid of artificial intelligence N26 can usually guess the category that an expense belongs to correctly, but if it gets it wrong you can always re-assign the correct category to the expense manually.

Transactions are made easily searchable by tags, which are often automatically assigned, and you can also add your own tags manually.

Tapping once on a transaction in the list opens it up and gives you further details about it and you can also upload a photo to go with the transaction.

You can also export PDF statements for each month from the N26 mobile app and from the N26 web app you can export your list of transactions for a specified date range in CSV format.

The statistics feature of the mobile app tells you your total income for each month, your total expenditure for each month, as well as a 4-month average for both of these.

It also gives a breakdown of how much you earned and spent in categories like shopping, family & friends, media & electronics, travel & holidays etc.

Another nice feature of the app is the ATM locator, which displays the locations of ATMs near you on Google Maps. You can also see which bank owns each marked ATM, how far it is from you and whether it’s open or not.

N26 is also recently launched a couple of other cool new features in the app, including dark mode (great in dimly lit environments) and discreet mode, which was designed for users to better protect their privacy when using the app in crowded places like the metro at rush hour or a busy café.

Thanks to the inbuilt proximity sensor in your smartphone, you can toggle discreet mode simply by waving your hand close to your phone's screen. Your account balance and the values of recent transactions will immediately be blurred out.

N26 web app

Although the mobile app is the cornerstone of the N26 banking experience, there's also a decent web app that has much of the same functionality.

Users of other challenger banks often complain that they're mobile-only and don't support a web app, so N26 definitely stands out from many of its competitors in this regard.

A web app is nice to have sometimes when you don't want to be fiddling around with entering lengthy usernames and passwords on your smartphone to access your bank account.

N26 Savings

With N26 Savings, Austrian and German customers can open a savings account from within the N26 app without any paperwork.

Unfortunately this feature is not available to other countries just yet, but hopefully it will be sometime in the near future.

Your money will be deposited at one of N26’s partner banks (i.e. FirstSave €urope in UK, InBank AS in Estonia & Younited Credit in France) and will start to accrue up to 1.57% interest.

You can compare plans and choose the partner bank that you think is offering the best deal.

It’s a fixed savings account, which means you make a chosen one-time deposit (min €2,000, max €100,000) for a fixed and chosen period of time (min 3 months, max 60 months) and you can’t withdraw the money until the time period ends. When the term is up, you get your original deposit back plus interest.

Deposits of up to €100,000 are protected by EU law in all EU member states so your money is safe.

N26 Insurance

N26 insurance is a relatively new feature that’s currently only available to all customers in Germany.

I can’t say too much about it as I don’t have access to this feature personally, but basically, for the moment it allows you to digitize your insurance policies and view them all in one easy to use dashboard in the N26 smartphone app.

Soon you’ll be able to manage your insurance from the dashboard and do things like make claims, renewals and cancellations with a few finger taps, instead of having to fill out stressful paperwork.

You’ll also get expert advice on insurance policies and can view quotes for online insurance, so that you can find the best possible deals.

N26 Credit

N26 Credit is another service offered by N26 that allows you to take out a personal loan directly within the N26 app.

N26 works with credit specialists like auxmoney in Germany and Younited Credit in France and for the moment the service is only available in these two countries.

The way it works is that at any time you can request an offer for a personal loan of between €1,000 and €25,000 with a repayment term of between 6 and 60 months from within the N26 app.

You will have to answers a few questions and provide some additional information about your financial situation, income, Schufa credit score and so on. Once N26 makes you a binding offer you can either delete it or accept it.

In France you can confirm the loan inside the app while in Germany you have to do a video call, verify your ID document and then sign electronically on the screen of your smartphone.

Once the loan is confirmed the money will be credited to your account within an hour if the loan is with N26 Credit, or within 3 business days if it's with auxmoney.

You can be offered interest rates anywhere between 1.99% and 19.99% p.a and additional fees may be due if you’re in default of monthly payments or want to change your credit plan.

Google Pay/Apple Pay integration

If you’re from Denmark, Finland, France, Belgium, Germany, Ireland, Italy, Norway, Poland, Slovakia, Spain, Switzerland or Sweden, you can add your N26 card to Google Pay (formerly known as Android Pay), so that you can make contactless payments in stores using your mobile phone.

For this to work the store needs to have a point-of-sale system that supports this technology and your Android mobile device has to support NFC (near field communication) and HCE (host card emulation).

To pay in a store using Google Pay all you have to do is unlock your phone and hold the back of it near the terminal until a check mark appears on the screen. You don’t even have to launch any app.

If your phone doesn’t support the necessary protocols you can still use Google Pay to purchase apps in Google Play Store, make in-app purchases and make payments on websites, wherever it’s supported as a payment method.

If you’re an iOS user, N26 also integrates with Apple Pay if you’re from Germany, Austria, France, Italy, Spain, Finland, Ireland, Iceland, Greece, Liechtenstein, Luxembourg, Portugal, Slovakia, Estonia, Belgium, Poland, Norway, Netherlands, Slovenia, Sweden, Denmark, Switzerland or the UK.

You can pay in apps, in stores and on the web with Apple Pay as long as your device is supported.

N26 Overdraft

If you are from Germany or Austria you may be able to avail of the N26 overdraft facility. You can apply from within your account settings within the N26 app under “Overdraft facility”.

Whether you are approved or not will depend on your SCHUFA/CRIF credit rating, as well as the duration and value of regular payments into your N26 account.

New customers can receive up to a €1,000 overdraft limit, while existing customers are eligible for up to €10,000. You can also set your own limits within the app. There’s an 8.9% yearly interest rate on overdrafts and you’ll be sent an invoice at the end of every quarter.

N26 referral program

N26 has a referral program that's available to most of its users, although there are a few excluded countries.

Through the program you can invite your friends to join N26 and earn a cash reward when your friend uses their N26 Mastercard for the first time. At the time of writing, they are offering me €30 for each friend I sign up that spends €30 with their card.

The invitee has to sign up through the special invite link that you provide and you can earn up to €1500 through the program. If successful your account should be credited within 2-3 days.

The referral program is currently offered in the following countries: Germany, Austria, Ireland, France, Spain, Italy, the Netherlands, Belgium, Portugal, Finland, Luxembourg, Estonia, Greece, Slovakia, Slovenia, Sweden, Switzerland, Norway, Denmark, Poland, Iceland and Liechtenstein.

Is N26 Secure?

Okay, so N26 generally offers a much smoother and better banking experience than most traditional banks, but how about the security? Is it up to par?

At the Chaos Communications Conference in Hamburg, a research fellow and PhD student in the computer science department at the University of Erlangen-Nuernberg named Vincent Haupert showed how the N26 app could leak user data and allow hackers to hijack user accounts.

He disclosed these potential vulnerabilities to N26 on September 25, 2016 and less than 3 months later N26 had apparently patched all the security holes.

Some of the changes the company made were blocking brute-force attacks where hackers try to guess user credentials, reducing and encrypting data transfers and fixing voice-recognition security vulnerabilities in its app for the latest iPhones.

Luckily no accounts were affected by this vulnerability before the problem was addressed and nobody’s data or funds were impacted.

Since that incident back in 2016, N26 appears to have considerably upped its game and now promises state of the art security. Some of the technologies and strategies the company employs to enhance security for its users are the following:

Three layer security architecture - N26 has a three layer security architecture consisting of a secure login to access your account, a 4-digit payment transfer PIN to initiate a transaction, and pushTAN, which is a secure message sent out to your paired smartphone via the Internet, that must be confirmed to authorize an outgoing transaction.

Pairing – We mentioned that your smartphone has to be paired with your N26 account. Doing so means that nobody can log into your N26 account from another device, even if they have your SIM. So it’s not enough for somebody to just know your login credentials to hack your account – they also need to possess your mobile device.

Realtime account notifications – You receive push notifications whenever any transaction occurs in your account. This immediate knowledge of unauthorized activity means you can act fast to lock your card from within the app and prevent further damage from being done. With traditional banks you often need to wait days to see transactions appear, allowing hackers to drain your account without you even realizing.

Customized security settings – We already discussed above how much control N26 gives you over your account in allowing you to manually disable online payments, payments abroad and cash withdrawals, as well as set daily limits for cash withdrawals and payments. This means that even if a hacker gets a hold of your card details, you can have already decided in advance the maximum damage the hacker can do. One of our many travel safety tips is to switch over to a challenger bank like N26 for this very reason.

Deposit protection – N26 is a holder of a banking license and is obliged to comply with the rules of the German financial regulatory authority. Because of this, all deposits held in the member states of the EU are guaranteed under the compensation scheme of German banks up to €100,000, irrespective of country.

3D Secure – This is a protocol that helps to prevent fraud when you make online purchases with your Mastercard by adding an extra layer of security to payments. N26 uses Mastercard SecureCode, a service which is based on the 3DS protocol. It appears as an additional authentication step when you make an online purchase that may be fraught with danger.

Bug Bounty Program – This is a program run by N26 that offers cash incentives to security researches who can inform the company about bugs and security holes so that they can be fixed before they create problems.

Just for the record, while I was travelling in Sri Lanka a couple of years ago my domestic Bank of Ireland bank account got hacked, but my N26 account has remained invulnerable to data thieves to date. Touch wood.

How is N26's customer service?

I’ve rarely needed to use N26 customer support over the past few years that I’ve been using the standard account for travel, so I don’t have too much personal experience with the bank's customer support, and that's definitely a good sign.

You can contact N26 in four different ways:

1. Phone (N26 Metal users only)

2. Email (support@n26.com)

3. AI chatbot - Neon the AI chatbot speaks 5 languages, is available 24/7, can answer 30% of basic customer queries and is available in both the mobile and web apps.

4. Live human chat - With average response times under a minute, this is typically the fastest way to get in touch and is available from 7 a.m to 11 p.m from Monday to Sunday, including bank holidays. N26 has a team of 600+ skilled customer support agents spread across 7 locations around the world. Live chat is available in both the web and mobile apps.

N26 also has a very helpful support centre with lots of FAQs, tutorials and articles addressing important subjects, where you can find most of the answers you’re looking for.

The in-app live chat service could be improved by making it 24/7, and adding a hotline for when your N26 Mastercard is lost or stolen would also be very useful, but overall, I think they're doing a great job when it comes to customer service.

So what's the rub with N26?

This whole mobile banking concept sure sounds really convenient and progressive but surely there must be a major catch somewhere?

Well, one of the downsides with N26 is that there’s no way (as yet) to lodge a cheque or cash, so if you still receive the odd cheque or payment in cash, you might not want to close your other bank account just yet.

It’s also unfortunate that some of the services, such as N26 Invest, Savings, Insurance and Credit, are not presently available in all countries that N26 offers accounts to, although they seem to be working on the problem.

How to open an N26 account

Opening an account with N26 is a very straightforward and painless 6-step process that takes about 8 minutes to complete. You can do it easily while you’re travelling as long as you have a decent internet connection.

We’re not going to do a step-by-step tutorial here but we'll give you a basic outline of the process. Here are the six steps in a nutshell:

1. Choose your country and confirm your email address.

2. Complete the online registration form and create your N26 account.

3. Download the N26 mobile app and choose your product.

4. Verify your identity.

5. Pair your smartphone.

6. Add funds to your N26 account (optional)

The first step is choose your country and confirm your email address.

Next, you'll need to fill out the online registration form. You’ll have to enter your personal information like your name, address (where they'll send your card), mobile number, job title, nationality, city of birth, gender, tax information and a few other pieces of information. The final steps are to create your password, agree to all the terms and conditions, and create your N26 account.

After this you can download the N26 app and log into your newly created account. You can now choose your N26 product from the ones that are available to you.

The next step is verify your identity. Every nationality that's eligible for an N26 account can verify their identity with their passport and some nationalities can also verify with an ID card.

If you are resident outside of Germany, you will need to verify by providing a selfie and a clear photo of your ID document. Just follow the instructions in the app.

If you are resident within Germany, you can verify your identity remotely through a video call (this service is provided through N26's German partner IDnow), provided that you possess one of the requisite documents (passport or ID card) for your nationality.

If you don't have any of the requisite documents to verify through the ID now method, you can always verify your identity at a German post office. We'll get to that option further below.

Verification method #1 : IDnow (remote verification via video call)

You can make the video call from within the N26 mobile app and you’ll need to call between 8 a.m to midnight German time, which will either be Central European Time (CET) or Central European Summer Time (CEST).

Find a quiet place with good lighting, as you’ll be speaking to a representative and you'll need to hold your passport up to the camera at different angles so that the agent can verify its legitimacy. You should also make sure you have a fairly fast and stable Internet connection before placing the call.

You’ll also be asked to verify a few details from the online application form and will need to type in a code sent to the phone number you registered with.

Verification method #2: PostIdent (German post office method)

The German post office method of identity verification or PostIdent method is useful if you don't have a passport or ID and is free of charge.

With the PostIdent method, you'll request to have a coupon sent to your e-mail, which you then print out and bring to your nearest German post office, along with your ID and residency proof.

It should be an official Deutsche post office as opposed to a third party parcel shop. You should receive an e-mail a day or two later when your account is ready.

Once your identity is fully verified, N26 should mail your card to your address.

The next step of the process is pairing your smartphone with the N26 app to make your account fully functional. After you’ve downloaded the app just log into your account and follow the in-app instructions for pairing your smartphone.

After confirming your phone number you’ll be sent a verification code via text message that you’ll have to enter in the app. After your device is paired, your account should be fully operational.

The final step, which is entirely optional, is to add funds to your N26 account. This can be accomplished through a variety of means.

You could ask your employer to deposit your salary into your account or you could make a SEPA transfer to your new N26 account from your existing bank account, if it's based in the SEPA zone.

You can also transfer funds to your N26 account from a bank account in another currency using an international money transfer service like TransferWise (they have the lowest fees of all the money transfer companies we've tested).

If you're based in Germany, Italy or Austria, you could fund your account using the CASH26 service as well.

Note that if you're an Android user, your smartphone should be running iAndroid 6.0 or higher to support the N26 app. iPhone users will need to be running iOS 11 or above, and will need an iPhone 5s or newer model.

Conclusion

N26 is one of the most attractive digital banks out there right now for a lot of travellers and the company’s customer base is growing rapidly as a result.

It offers a highly user-friendly, smoothly operating and secure app-based mobile banking platform for those with a mobile lifestyle and eliminates most of the irksome fees associated with using a traditional bank account overseas.

Since it’s limited to Europe and the US for the moment, it’s not yet a solution for everyone, but the company is expanding to other countries all the time, so do keep a watchful eye on them.

If you enjoyed this article, please share it with other travellers. What do you think of N26 as a bank account for international travellers? Let us know your thoughts in the comment box below!

Pin this article!

JOIN OUR LIST

SUPPORT US

FOLLOW US

ABOUT US

Our names are Eoghan and Jili and we hail from Ireland and India respectively.

We are two ardent shoestring budget adventure travellers and have been travelling throughout Asia continuously for the past few years.

Having accrued such a wealth of stories and knowledge from our extraordinary and transformative journey, our mission is now to share everything we've experienced and all of the lessons we've learned with our readers.

Do make sure to subscribe above in order to receive our free e-mail updates and exclusive travel tips & hints. If you would like to learn more about our story, philosophy and mission, please visit our about page.

Never stop travelling!

FOLLOW US ON FACEBOOK

FOLLOW US ON PINTEREST

BOOK ACCOMMODATION

Copyright © 2017: Twobirdsbreakingfree | All rights reserved.

-lw-scaled.png.png)

.png)

.png)

.jpg)

.png)

.png)

.png)