The 7 Best International Money Transfer Services For Travellers in 2020 (Complete Guide)

.jpg)

Money makes the world go round and it’s always on the move, always flowing.

According to the World Bank, total global remittances reached a record high of $689 billion in 2018, an increase on the previous year’s figure of $633 billion.

Out of this total remittance flow of $689 billion, $529 billion (76% of the total) flowed to low or middle-income countries (LMICs), with India receiving the largest chunk ($79 billion), followed by China ($67 billion), Mexico ($36 billion), the Philippines ($34 billion) and Egypt ($29 billion).

Now you might wonder who is sending all of this money and the truth is that a lot of it comes from migrant workers.

There are an estimated 266 million migrants (refugees are included here) in the world and many of them work in high-income countries, remitting about 15% of their earnings (on average) to their families back home.

Although this may sound like a meagre portion of the total earnings, it provides almost 60% of a migrant's family's total income. Remittances pay for a family's education, health care and housing, helping to improve people's general standard of living in developing countries.

The other major contributor to these high remittance flows from high-income to low-income countries, as you might have guessed, is international aid.

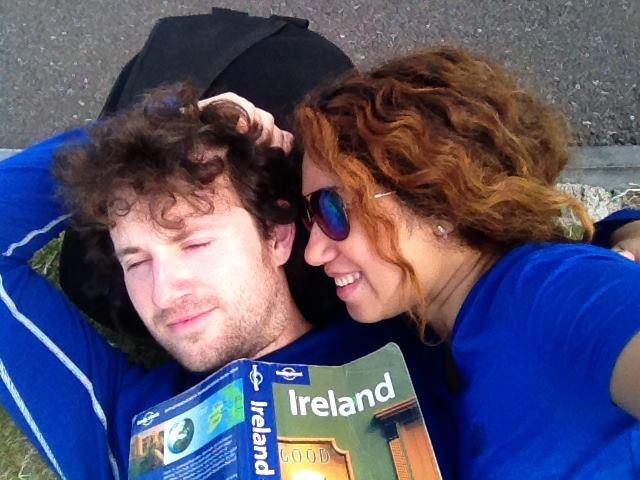

But apart from migrant workers and international aid, who else contributes to this total annual global remittance flow of $689 billion? Well, one group, of course, is people who travel.

In order to keep their personal lives or businesses running smoothly, travellers, digital nomads, holidaymakers and other that roam often need to send and receive money while they’re on an extended trip, living abroad or taking a short vacation.

We have prepared this comprehensive guide to address the topic of transferring money internationally as it pertains to a person travelling or living a nomadic lifestyle abroad.

In the guide we'll cover why you might need to send and receive remittances (money transfers) while overseas, why a dedicated money transfer service is usually superior to a bank for this purpose, and how to choose the best money transfer service for your specific needs.

In order to help you choose the best provider, we'll be reviewing, analyzing and comparing the 7 best money transfer services on the market in 2020.

Let's get started.

Table of contents

Travellers have always needed to send and receive money during their trips overseas, but in the past this need was not adequately met by the existing services at the time.

It used to be that the banks, along with a limited number of money transfer operators and local agents, enjoyed a virtual monopoly on providing this vital service to travelers.

Sending or receiving money was a painful, slow, inconvenient and expensive process, and operators were not widely available.

ATMs slightly improved the receiving side of things. They were first invented in the late 60s and by the late 70s or 80s had become a common sight in big towns and cities in many developed countries.

Cashpoints at least made it harder for travelers to run out of cash during a trip, but travelers could still be separated from their debit cards and ATMs could still malfunction, debit accounts without dispensing cash, swallow cards, and they still weren’t found everywhere.

Moreover, for ATMs to be useful to travelers, they needed to be able to accept international bank cards, and these types of ATMs were almost non-existent in many countries up until very recently indeed.

Nowadays of course, ATMs are everywhere and you can find ones that accept international cards in pretty much any country.

According to one estimate, there will be 4 million ATMs in the world by 2021, which works out at about 1 ATM for every 2,000 people on the planet.

But despite the proliferation of cashpoints across the face of the globe, travelers continue to run into emergency situations overseas where they can’t access the funds in their bank accounts.

Money transfer operators continue to step in to provide a valuable cash pickup service for travellers in these critical situations.

But it’s not only in the case of emergencies that money transfer operators come in handy for travellers.

Here are just nine of the myriad possible reasons you might need to use a money transfer service during (or immediately after) a trip or holiday.

#1 - To settle debts when travelling with others

Imagine that you’re travelling as a duo, trio or with a group.

During your trip, it probably won’t be possible to split all the expenses (hotel bills, restaurant bills, train tickets, entrance fees etc.) evenly between all the group members.

Who owes exactly what to whom can be tracked during the trip by using mobile apps like Splitwise and debts can be settled during and after the trip using a money transfer service.

#2 - To avoid running out of cash at an inopportune moment in a cash-dominated economy

Running out of cash at an inopportune moment in a cash-dominated economy is a threat that travellers often face for various reasons. Luckily, money transfer services often make it possible to avert such a crisis.

Take the following travel scenario.

You've been village-hopping in a remote rural district for a while now and you’re starting to run very low on cash.

You didn't take a lot with you when you set out from the city because you mistakenly assumed that you'd be able to find an ATM in at least one of the hamlets along the route you'd planned.

In the village you've been exploring over the last few days, you've racked up a large bill for the food, lodging and other services that you’ve consumed at the guest house where you're staying.

Cards are not accepted at the property, and paying the bill in cash would mean that you'll have no money left for public transportation to the nearest town, where you'll finally be able to get to a working ATM and restock.

You then come up with an ingenious solution. The owner of the guest house is willing to accept payment via international bank transfer, so you wire the money that you owe directly to the owner's bank account using your favourite money transfer service, thereby allowing you to avoid getting stranded in the village because you've spent the last of your cash.

This was actually a real situation that we faced when travelling for 1 month in the isolated and predominantly rural state of Mizoram in northeast India.

#3 - When you actually do run out of cash at an inopportune moment in a cash-dominated economy

Running out of cash during a trip isn't a problem if you're near a working, well-stocked ATM that accepts one of your bank card(s) or if you're in an economy where cards are widely accepted.

But what if you're in a cash-dominated economy, there are no ATMs anywhere near you when it happens and now you don't have any cash to pay for transport to get to one?

If there are ATMs near you, what if all are out of order, out of cash or are shuttered? What if none of them accept international bank cards?

I once faced a scenario like this, where I ran out of cash late at night in a hill town called Haflong in Assam, northeast India.

There were no ATMs operating in the town at this late hour and I needed cash to hire an auto-rickshaw to take me to the railway station, as I had an early-morning train to catch.

Luckily, I met a local man out on the streets and he was willing to help me out. I was able to transfer money to his bank account using a money transfer service while he paid me out the same amount in Indian rupees.

I was then able to use the cash to hire an auto-rickshaw to the railway station, where I succeeded in catching my train.

#4 - When you lose all access to the funds in your bank account

Even worse than running out of cash when you temporarily can't access a viable ATM, is when you lose all access to the funds in your bank account and you can't even make card payments or withdraw cash from a working international ATM that's fully stocked with cash.

This type of situation can very easily transpire if you are only carrying only one debit card and it gets damaged, lost, stolen or frozen by your bank. Cards can also expire or get eaten by an ATM.

A money transfer service can again come to the rescue here while you're waiting for your new debit card to reach you or trying to persuade your bank to unfreeze your card.

You could wire funds to yourself using a money transfer service like Western Union or MoneyGram and receive the money in cash at a brick-and-mortar agent location.

You could also use a money transfer service to wire money to the bank account of a friendly local or fellow traveller and have them pay you the same amount in cash. This cash would then tide you over until your new debit card arrives or your debit card gets unblocked by your bank.

#5 - When your bank account runs completely dry

.jpg)

It's an embarrassing situation for any traveller to have to face, but if you're not careful, your bank balance could end up dwindling to a big fat zero during your trip.

If this happens, money transfer services can often come to the rescue again. In this case you'll probably only be on the receiving end of one of these services. You might have to ask a friend or family member to transfer a few quid to your bank account to bail you out.

It's important to understand that your bank balance could hit rock bottom even if you didn't irresponsibly spend all of the money in it.

One way you could find yourself in this situation is if your account gets hacked and drained to the dregs by the hacker during your trip.

Someone managed to get a hold of my debit card details when I was travelling in Sri Lanka; fortunately, the hacker only spent about €100 in an Italian online shopping store called Beltom Online and my bank reimbursed me the stolen money after cancelling my debit card.

Another time when I was Couchsurfing in Kuala Lumpur, Malaysia, my bank balance was virtually reduced to zero by an evil ATM machine.

I had attempted a few withdrawals with my Visa debit card from a CIMB bank ATM outside a petrol station shop, and all my withdrawals had failed.

I then logged into my online banking to check what was going on, and saw that with each attempted withdrawal my account had been debited, even though no cash had been dispensed by the ATM.

After 3 or 4 withdrawal attempts at €300 a pop, my already-dwindling bank balance after more than 2 years on the road had been reduced almost to zero and now there was no way at all that I could withdraw cash, even from a working ATM.

I ended up having to visit a CIMB bank branch, where I had to fill out and submit a form explaining the situation.

The money was returned to my bank account several days later, but in the meantime I had to ask my family to wire me some emergency funds, which I was able to pick up in cash from a Western Union agent location in the city.

#6 - To send or receive gift money during festivals, birthdays and other special occasions

.jpg)

When a special occasion, like a family member's birthday, graduation or wedding, or a festival like Christmas or Easter coincides with your trip, you might need to use a money transfer service to send money to your family members.

Likewise, if you are on the receiving end of such a gift during a special occasion, being able to recommend a low-cost money transfer service to the sender will allow you to maximize the amount that you receive based on the amount they are willing to send.

#7 - If you're a traveller that runs an online business

If you're a digital nomad that runs an online business you might use a money transfer service to pay the wages of your employees or to make one-time payments to freelancers for services rendered.

It’s likely that you’ll be dealing with a lot of international money transfers as an online business owner, which is exactly the type of scenario where a money transfer service can save you big bucks versus sending the money through your bank.

#8 - If you're on a working holiday visa and want to send money back home to help your family out

If you're travelling and working on a working holiday visa in a country like Canada or Australia, you might want to send some of your earnings home to help your family out.

Since you'd be earning money in a foreign currency in this situation, you’ll require a dedicated money transfer service that’ll enable you to make low-cost, international money transfers.

#9 - When you want to make a big-ticket purchase during a trip

Occasionally when you’re travelling, you might want to make a one-off expensive purchase. Maybe you got reeled in by a swanky-looking Macbook Pro beckoning to you through the window of an electronics store in a mall. And maybe it’s about time you replaced your derelict, crumbling laptop with a new one.

But you’re not going to be paying for that brand new Macbook Pro in cash, since you’d probably need to make more than ten ATM withdrawals to do so, and that could end up costing you more than $60 in ATM service fees in some countries, let alone the fees your own bank might charge.

You might not even be able to pay for the laptop with your debit or credit card, as many banks impose daily spending limits that can be as low as $1,000 or $2,000.

A money transfer service would allow you to inexpensively transfer money to the foreign bank account of the electronics store and avoid any crazy transfer fees or bad exchange rates offered by your bank.

You can surely see from the above examples, that money transfer services can be very advantageous to travellers in today’s world and in many situations can greatly help to avert a crisis.

However, a question that must surely be on your mind is this:

But Eoghan, do I really need to use a money transfer service all the time? Wouldn’t I able to send and receive money using my home bank’s own inbuilt money transfer capability in many of these scenarios?

Well yes, in some of the hypothetical scenarios described above, you would be able to send and receive money using your bank’s own money transfer service.

But while describing these scenarios above, we already alluded to some of the reasons why this is usually a terrible idea.

The main reason that these specialized money transfer services have survived and prospered is because banks are simply an inferior option when it comes to the task of transferring money internationally.

Below we are going to briefly cover the six principal reasons why money transfer services can be a much better option than transferring money through your bank.

#1 - Much lower transfer fees & better foreign exchange rates

When it comes to transferring money internationally, most banks charge exorbitant transfer fees and their exchange rates are often so weak that you can end up losing hundreds of dollars from a single transfer if you're sending a large amount.

Dedicated money transfer services, on the other hand, can often be a staggering 8 times cheaper than sending money directly through your bank.

This because they normally offer stronger exchange rates and lower transfer fees than banks. There are a few operators that don't mark up the exchange rate at all and most have international transfers that they will process without any transfer fee.

But how do money transfer services manage to undercut the banks?

One reason that they are able to do this is because they use a completely different mechanism to transmit money.

When you make a transfer through your bank, the money typically passes through a series of intermediary banks and physically crosses international borders as it makes its way to the recipient's bank account in the foreign country.

These intermediary banks that the money passes through on the way all take their piece of the pie and the end result is that the recipient receives far less of the originally transferred amount than they ought to have.

Either that or the sender has to send far more money than they should to ensure that the recipient receives a specified amount.

But many of the newer money transfer services are using a clever trick that means your money never has to cross any borders, thus saving on costs.

The way it works is that the operator sets up local bank accounts in all of the countries in which it operates.

The company will have a bank account in your home country where they will receive your payment for the money transfer.

Once they receive the payment from you, the company then locally transfers the equivalent amount in foreign currency (minus commission) from their bank account in the recipient's country to the recipient's bank account.

In this way, only local bank transfers are ever involved in getting the money to the recipient, and there is no money crossing international borders.

It's basically the fully legal equivalent of the illegal Hawala system used in Africa, India and the Middle East.

In the Hawala system, a street broker takes money from a sender in one country and a street broker in another country pays out the equivalent in foreign currency (minus commission) to the recipient.

The reason that the Hawala system is illegal and this isn't, is because the Hawala system operates fully outside of the banking system, whereas this system operates fully within it.

#2 - Greater transparency

Transferring money through the banking system has always been a rather opaque affair, with a lot of sneaky fees and surprises that only serve to disempower customers and leave the banks richer.

Many money transfer services, on the other hand, have a commitment to transparency, so that before a transfer is executed, the sender is told upfront exactly how much a transfer is going to cost them and exactly how much the recipient is going to receive. There is no uncertainty, no hidden fees and no surprises.

#3 - Faster transfers

When transferring money internationally through the regular banking system, you generally have to wait for several days for your funds to reach the recipient. It's a slow and inefficient process.

Even just adding new payees and setting up a transfer can be a painful process with many banks.

Money transfer services, on the other hand, make it possible for funds to be delivered almost instantaneously in many cases, especially if the money is delivered to a mobile wallet or received as cash at an agent location.

Even when sending money to a bank account, money transfer services are often faster because you can pay for the transfer instantly with a debit/credit card and no money ever has to cross international borders, which speeds things up considerably.

#4 - More delivery options

.jpg)

With transferring money through your bank, you're limited to having the money delivered to a bank account.

But many money transfer services allow you to send money not only to bank accounts, but also to mobile wallets, agent locations (where the money can be picked up as cash) and even to a recipient's door.

Money transfer services give you so many additional options for delivering your funds to the recipient and they allow you to send money to a person who might not even have a bank account or who might be having trouble with withdrawing cash from a foreign ATM.

#5 - More payment options and payment modes

Banks generally give you limited options when you want to transfer money. Normally you log in to your online banking and initiate a transfer from there.

Money transfer services on the other hand offer so much more flexibility in terms of payment modes and payment options.

You can set up a transfer on the operator's website, mobile app or at an agent location.

You can pay for the transfer via debit/credit card, via online banking payment systems like iDEAL, Trustly, Klarna and Interact, via bank transfer, via Google Pay or Apple Pay, or by handing over cash at an agent location.

#6 - Extra perks

Signing up to a money transfer service can come with lots of perks that you'd never get by sending money through your bank.

For example, many operators will let you make your first transfer or first few transfers completely free of charge, and many also have loyalty programs or referral programs, where you can earn cash or discounts by persuading your friends to sign up for the service using your unique referral link.

One money transfer service called TransferWise even comes with a free multi-currency account for certain nationalities, where you can receive, hold and spend money in 40+ currencies and convert between them for a very small fee.

The bottom line

The bottom line is that money transfer services can save you a ton of money, reduce transfer times, and can give you a lot more payment and delivery options.

Transferring money is what these operators do best and when you want something done right, it’s always better to go to specialist.

But when it comes to choosing the right service for sending or receiving money, that’s where things can get a bit tricky.

In the next section we’ll cover the most important factors you need to keep in mind when deciding which money transfer service to use when you want to send or receive money during a trip.

#1 - Coverage

Coverage refers to both the countries that the operator lets you send money from and the countries it lets you transfer money to.

Most operators support significantly more receiving countries than sending countries.

A money transfer service is no use if it supports transfers to virtually every country in the world but it doesn’t support transfers from the country you’re currently in.

In general, the long-established, traditional money transfer services provide much greater global coverage than the relatively new Fintech start-ups, and if you want to send money from or to relatively obscure countries, they will often be your only option.

If your recipient needs to receive your transfer in cash or you need to pay for a transfer in cash, you also need to consider how good is the operator's coverage in terms of physical agent locations.

The traditional providers again have much better coverage in this regard than the newer Fintech companies.

Some of the new start-ups have begun to develop a network of cash pickup locations by partnering with banks, post offices, supermarkets, pawnshops and other local business, but they still have a long way to go.

#2 - Supported payment methods

.jpg)

To execute a money transfer you’ll always have to make a payment to the money transfer service provider in some way or another.

Some of the traditional operators have limited support for cashless payments via debit/credit card, bank transfer or online payment systems like Trustly, Klarna or Sofort.

For these old-fashioned operators you’ll often have to go to an agent at a brick-and-mortar location and submit the payment for the money transfer as physical cash.

Most of the newer Fintech companies, on the other hand, will not accept cash as a payment method at all, and will only support online payment methods like debit/credit cards, online payment systems and bank transfers.

#3 - Supported receiving options

.jpg)

The supported receiving options or delivery options are the various ways that the recipient can receive the money transfer.

Some money transfer companies, for example, only support sending money directly to a recipient’s bank account.

Others support a wide range of receiving options, allowing you to send money to a recipient’s bank account or mobile wallet, to an agent location for pickup as physical cash or even to a recipient’s doorstep in some cases.

If there’s a specific way that you need or want the funds to be delivered to the recipient you’re sending to, you’ll obviously need to use a service that offers that specific delivery option for the specific destination country that you want to transfer money to.

#4 - Delivery speed

The delivery speed or transfer time refers to how long it normally takes for the funds to reach the recipient after the money transfer company receives the payment from the sender.

The transfer time is the sum of:

(a) The time it takes for the operator to process the transfer internally after receiving the payment from the sender. Some providers offer a more costly expedited delivery option to reduce the delay here.

(b) The time it takes for the money to be delivered to the recipient after the operator has processed the transfer. This is outside of the operators control

If your money transfer is time-sensitive, you might want to choose a provider that offers an expedited delivery option where you can get your transfer prioritized and have its internal processing time (a) reduced.

The payment options that a provider offers can also limit the speed of your transfer. If debit/credit cards are not supported as a payment method and you can only pay by bank transfer or at an agent, your transfer could take a lot longer.

The delivery methods that an operator supports will also dictate how quickly you can get money to a recipient.

Delivery methods like mobile wallets and cash pickup usually only take minutes, but some operators do not offer these, and only support delivery to a bank account, which is much slower and can take days.

#5 - Security & credibility

When you’re entrusting a company with the task of handling your hard-earned money, you obviously want some kind of assurance that the company is legitimate and trustworthy.

For starters, I wouldn’t advise dealing with any money transfer companies that are not licensed and regulated by financial regulatory bodies like the FCA (Financial Conduct Authority).

Another good way to start evaluating the reliability of a money transfer service provider is to check the company’s rating on independent consumer review websites like TrustPilot.

Assuming that the vast majority of reviews on these websites are genuine, a high average rating will indicate that your money is likely to be in safe hands.

Typically, the relatively new, upstart companies that are attempting to dethrone the incumbents have a very high proportion of positive reviews, while the traditional service providers that have monopolized much of the industry for decades have a high proportion of negative reviews.

#5 - Customer service

Excellent customer service is a very important thing to look out for when choosing any company to do business with, but especially with a money transfer operator.

What if your funds unexpectedly get lost in cyberspace after making a transfer and you need urgent assistance?

Customer service should ideally be available 24/7, 365 days a year, as you might be travelling and need to call from different timezones.

You should be able to reach the customer support team via a number of different channels like phone, live chat and e-mail support, as all of these come in useful at different times.

Agents should be polite, attentive and well-trained so that they can actually solve your problems.

#6 - Fees & exchange rates

One of the most important factors to consider when choosing a money transfer service is undoubtedly the fees and exchange rates, which can vary considerably within and between the different operators.

While some operators might let you make your first transfer or first few transfers free of charge, after that you’ll start paying a fee for virtually all of the transfers that you make.

This fee can come in two flavours; an explicit transfer fee and a hidden fee that springs from the operator marking up the exchange rate. Often you will pay both of these fees when making a transfer.

The explicit transfer fee is normally tacked onto the amount that you're being asked to pay for the transfer in your own currency.

This transfer fee can vary greatly depending on the operator, the currency pair involved, the amount being sent, the chosen payment method, the chosen receiving method, the delivery speed option selected (if any), and other factors.

Even when operators don't charge any explicit transfer fee, they'll still normally impose a hidden fee by marking up the exchange rate. A select few companies however, do not mark up the exchange rate at all.

A marked up exchange rate will mean that you will be asked to pay more (in your own currency) than you should when you need to get a specific amount of foreign currency to the recipient.

Or, if you are sending a specific amount in your own currency, it will mean that the recipient receives less foreign currency than they should. Either way, there is a cost involved to one of the parties.

Although some money transfer services can possibly be said to be cheaper than others overall, there are so many variables involved (countries, currencies, payment methods, receiving methods, delivery speeds etc.), that in practice it’s better to compare which services are cheaper for a specific set of variables.

#7 - Bonuses & incentives

When you've compared all of the options and you're still sitting on the fence about which provider to go with, the last thing to consider is bonuses and incentives.

Fee-free transfers, special exchange rates, ongoing Refer a Friend programs or loyalty programs can often be enticing enough to make you finally choose a particular provider when you're having a difficult time making a decision.

Many disruptive new Fintech start-ups have entered and revolutionized the money transfer space for the better in the past decade or so, and we've allocated a generous number of the seven positions to these types of services.

But we've still reserved space for the traditional stalwarts of the industry, who are still matchless in their global coverage and support of offline services.

The old school operators have already begun their own digital revolution in response to the challenge posed by the new Fintech upstarts, and it will be interesting to see if they will be able to regain some of the lost market share in the coming years.

Founded back in 2010 by two Estonian friends (Kristo Käärmann & Taavet Hinrikus) who were searching for a way to cut their own cross-border money transfer costs, TransferWise is a London-based Fintech start-up that claims to be saving its customers €1.5 billion euro annually on international money transfers.

The firm, now valued at $3.5 billion, operates across 4 continents, has 11 offices, over 1,300 employees and processes €5 billion worth of transfers every month from its customer base that's over 7 million strong.

The company caters to both personal and business users alike, with separate accounts offered for each type of user. TransferWise was the very first Fintech remittance service that I used and I've used it many more times since and have always been very satisfied with the service.

TransferWise not only provides a money transfer service, but also offers some of its users a borderless multi-currency account, which lets you hold more than 50 currencies and instantly convert between them for a very small fee.

We reviewed the TransferWise borderless account in this article but here we'll be concentrating on the money transfer aspect of the service.

Security & credibility

In the UK, TransferWise is authorized as an Electronic Money Institution (EMI) by the FCA (Financial Conduct Authority) and has passporting rights across the EEA (European Economic Area).

In Australia, the firm is regulated by the Australian Securities and Investments Commission (ASIC) and registered as a money transmitter with the Financial Intelligence Unit (AUSTRAC).

In the United States, TransferWise is registered with the Financial Crimes Enforcement Network (FinCEN) and is a licensed money transmitter in almost all of the 50 states.

In Canada, the company is registered with FINTRAC (Financial Transactions and Reports Analysis Centre of Canada) as a Money Service Business (MSB) and also has an MSB license with the AMF (Authorité des Marchés Financiers).

The above are just a few examples. TransferWise is also regulated and licensed by the relevant authorities in Belgium, Hong Kong, India, Japan, Malaysia, New Zealand, Singapore and the UAE.

TransferWise is also a hit with its own users.

On the independent consumer review website TrustPilot, the company has earned a very high 4.6/5 average TrustScore from over 84,000 customer reviews. 86% of reviewers have rated the service as “excellent” (5 stars), while only 3% have rated it as “bad” (1 star).

Coverage

TransferWise supports more than 750 currency routes and you can transfer money from a total of 24 currencies.

Supported currencies include the US Dollar, Euro, Indian rupee, British pound, Canadian dollar, Australian dollar, New Zealand dollar, Singapore dollar, Hong Kong dollar, Malaysian ringgit, Japanese yen, United Arab Emirates dirham and others.

From these 24 sending currencies, money can be transferred to a total of 56 receiving currencies across 66 countries.

Transfers to Colombia are currently closed to new customers for the time being and in some countries, such as Pakistan and Vietnam, TransferWise can only support transfers to private recipients (business payments are not supported).

Payment methods

TransferWise supports all of the following payment methods, though the methods that are available to you will depend on the particular currency you’re sending and the country you’re sending it from.

Bank transfer – SWIFT, SEPA etc.

Direct Debit - ACH Direct Debit and other types

Debit/credit card - Visa, Mastercard & some Maestro card. Cards can only be used to send smaller amounts.

Online payment methods – Open Banking (UK) Sofort (Austria, Belgium Germany, Italy, the Netherlands, Spain, Switzerland), Trustly, (EUR, PLN, SEK DKK), Boleto (Brazil), iDeal (Netherlands), POLi (Australia), PayID (Australia)

Apple & Google Pay – Restrictions apply

TransferWise usually doesn't allow you to pay for your transfer in cash, by cheque or over the phone.

However, there is at least one exception; if you’re transferring money from Brazil, one of the payment options is Boleto, which lets you pay for your transfer in cash at bank branches, supermarkets, post offices and lottery agents.

Receiving methods

TransferWise, like TransferGo (reviewed below) currently only allows you to transfer money to a recipient’s bank account.

This means that the recipient won’t be able to receive the money by cash pickup, door-to-door delivery, mobile wallet delivery or by any other delivery methods.

Delivery speed

If you pay by debit/credit card or with your TransferWise borderless account balance, TransferWise can often begin processing the transfer within seconds and will rarely need to wait longer than 2 hours before they receive the money from you.

If, however, you send the money to TransferWise by bank transfer or by direct debit, there is a much higher likelihood of it taking longer than 2 hours (and in many cases longer than 24 hours) for TransferWise to receive the money, so these two payment methods are slower on average.

In order from fastest to slowest, the payment methods are as follows:

1. Borderless balance

2. Debit/credit card

3. Bank transfer

4. Direct debit

After TransferWise receives the money they will initiate the transfer after performing a few important internal checks.

After the money has been sent, the time that it takes for the funds to reflect in the recipient’s bank account mainly depends on the structure of the payment system(s) that operate in the country of the recipient, which is outside your control.

Other than paying by card or with your borderless balance, the other thing you can do to ensure as speedy a transfer as possible is to pro-actively verify yourself before initiating your first transfer.

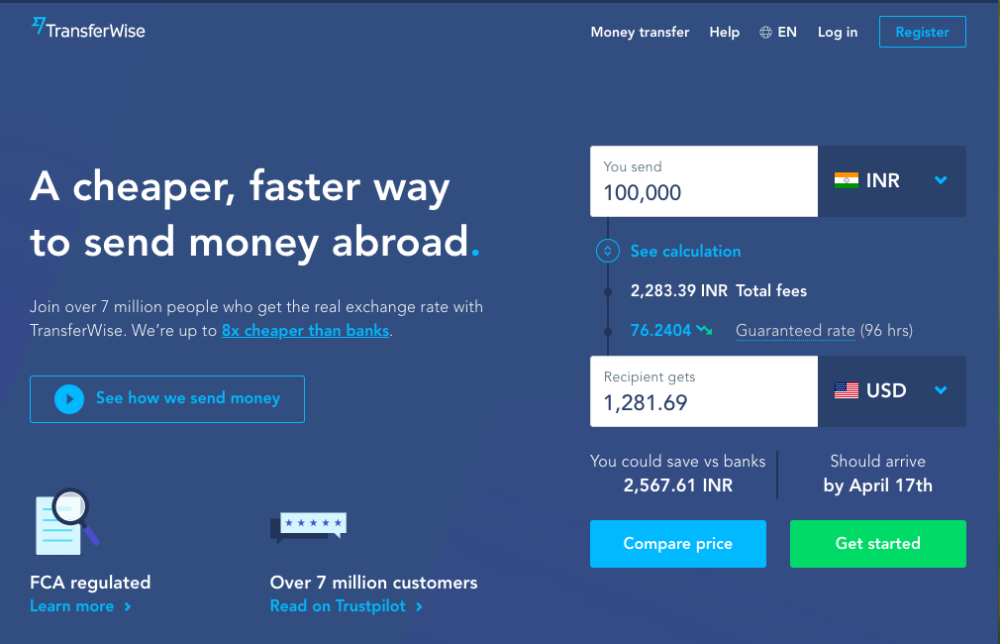

Fees & exchange rates

Contrary to many other money transfer services, TransferWise only charges an explicit transfer fee and does not mark up the exchange rate in order to surreptitiously charge you extra.

The transfer fee is highly variable and depends on the payment method you choose (faster methods tend to be more costly), the currency you’re sending from, the currency you’re sending to and the amount you’re sending.

If the amount you’re sending is very small, there’s a fixed minimum fee, but once you exceed a certain send amount the fee is percentage-based. This percentage is not fixed but normally becomes gradually smaller as the amount you’re sending is increased.

In practice you need to use the pricing calculator on the website or mobile app to determine the exact transfer fee for a specific set of variables.

TransferWise only uses the real, mid-market exchange rate to calculate the amount you have to pay, so you never have to worry about hidden fees and unpleasant surprises.

The exchange rate you get is also a guaranteed rate, which means that the rate you were offered when you began setting up your transfer will remain locked in until TransferWise receives your payment.

The only condition is that the payment must be received within a certain deadline (usually 24 working hours, but can be 48 working hours or even 72 hours for some currency pairs).

This guaranteed rate ensures that your transfer goes through even if the mid-market exchange rate suddenly drops before TransferWise receives your payment.

If however, the rate was to drop by more than 5% in the allowed period, TransferWise does reserve the right to cancel and refund your transfer.

Fee example

If I wanted to send 50,000 INR to a bank account in India from the UK, making the payment in GBP by bank transfer, how much would it cost me?

Well, it would cost £535.95 based on the exchange rate (which is the mid-market rate) plus a “low cost transfer” fee of £3.10, for a total cost of £539.05.

If I were to instead choose the “advanced transfer” option, which lets me send GBP to TransferWise via SWIFT from a bank account outside the UK, the fee would still be £3.10.

If I wanted to transfer the money as fast as possible, I could choose the “fast and easy transfer” option where I pay by debit/credit card, although if I do that the fee increases to £4.70.

The bottom line is that I always know exactly how much the transfer is costing me and there are no bad exchange rates or hidden fees that I have to worry about.

Customer service

TransferWise has an excellent help centre with a comprehensive collection of detailed articles and FAQs that should help solve most of your problems.

If you can't find a remedy there, the customer support team can be contacted by e-mail or over the phone.

There are over 14 phone numbers that you can use to get in touch with TransferWise, depending on what part of the world you’re based in. Currently, there is no live chat facility available.

Bonuses & Incentives

TransferWise runs a number of different invite programs, and experiments with new ones all the time.

The program(s) that is/are available to you will depend on what country you’re from and will also change from time to time.

Just to give you an example, TransferWise is currently offering me a £50 bonus (paid out to my bank account) if I invite 3 friends using my personal invite link, and if all 3 friends transfer over £200. The invitees also all receive a free international transfer up to the value of £500.

How to transfer money with TransferWise

To transfer money with TransferWise, you have to first create an account, either on the company’s website or on the mobile app, which is available for both Android and iOS.

Making your first transfer is a simple 4-step process.

Step 1 - Start by choosing to make either an international or local money transfer. Enter the amount you want to send or the amount you want the recipient to receive, select your transfer type (payment method) and if you’re happy with the exchange rate, transfer fee and the total cost of the transfer, you can proceed to the next step.

Step 2 – Add your recipient by entering their full name and bank details.

Step 3 – Choose a reason for making your transfer from the drop-down menu.

Step 4 – Review all the details of your transfer.

Step 5 - Choose your transfer type (payment method) and make the payment. You can just follow the instructions given by TransferWise from here on.

Pros

- Very popular and highly rated Fintech money transfer service.

- Some users get a free, multi-currency current account and debit card

- High transparency - no exchange rate mark-up or hidden fees.

- Guaranteed exchange rate (24-72 hours).

- Often the cheapest money transfer service out there.

- Excellent help centre.

Cons

- Receiving options are limited.

- Automated transfers are not supported.

- No live chat option to reach customer support.

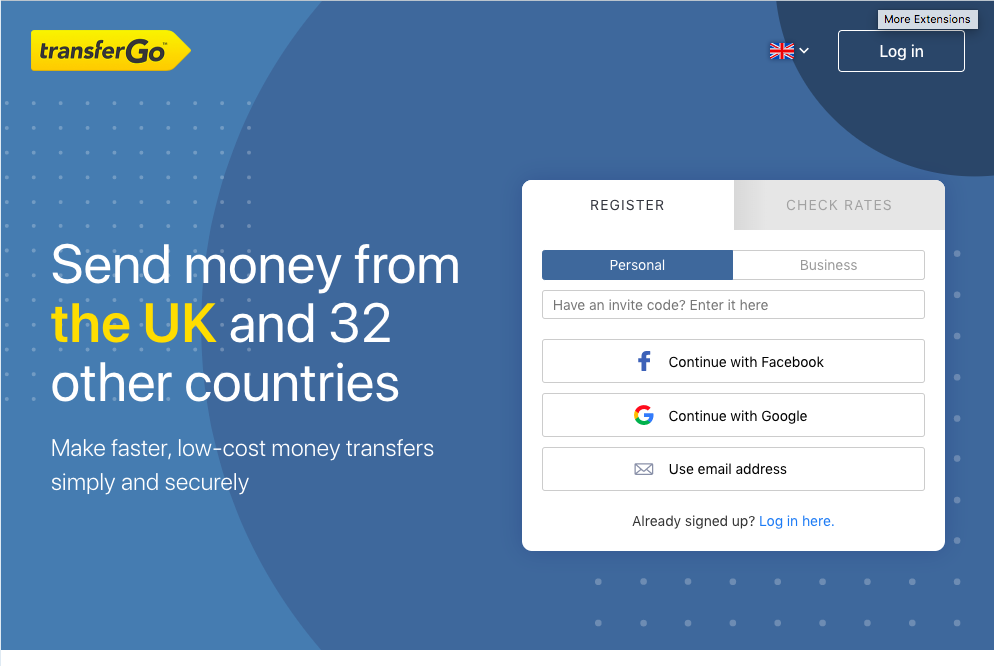

Founded in 2012 by four Lithuanian partners, London-based (with offices also in Vilnius, Berlin, Istanbul & Warsaw) TransferGo is another excellent Fintech start-up in the money transfer space. It's only slightly younger than its cousin TransferWise.

The company has already won a number of awards, including the “2013 Most Innovative Business Talent Award” from the Danish Chamber of Commerce and Lithuanian Internet portal Delfi.

TransferGo now claims to have amassed over 1.8 million users and is supposedly growing at a rate of 2,000 new users every day. The firm already surpassed the million customer milestone back in May 2019.

Security & Credibility

TransferGo has an exceedingly high 4.8/5 TrustScore gleaned from over 15,000 reviews on the independent consumer review website TrustPilot. 91% of consumers rated the service as “excellent”, while only 3% rated the service as either “poor” or “bad”.

Additionally, the company is a fully licensed and authorized payment institution, regulated the FCA (Financial Conduct Authority) and overseen by HMRC (Her Majesty’s Revenue and Customs) in England, so it’s basically as safe to use as any commercial bank.

Coverage

TransferGo currently supports money transfers from all 19 of the Eurozone countries plus Croatia, Czech Republic, Denmark, Hungary, Iceland, Liechtenstein, Monaco, Norway, Poland, Romania, San Marino, Sweden, Switzerland and the United Kingdom.

That makes a total of 33 countries and 15 currencies that funds can be transferred from.

From these 33 countries you can transfer money to 54 different countries (and counting), where it can be received in 29 different currencies.

Unfortunately, you cannot currently send money from the US with TransferGo. Only transfers to the US are supported at the moment.

Payment methods

TransferGo supports all the following payment methods, although which ones are available to you will depend on the country/currency you’re transferring money from and the device you’re using (Apple Pay).

Bank transfer – CHAPS/Bacs payments are not accepted

Debit/credit card – Visa and MasterCard cards are accepted but only for payments in GBP, EUR, PLN, NOK, SEK and DKK.

Apple Pay – Only available for Apple devices

Google Pay - Only available for Android devices

Currently, there is no option to pay for your transfer by cash, cheque or over the phone.

Receiving options

Like TransferWise, TransferGo currently only supports online transfers to a recipient’s bank account.

Delivery speed

TransferGo offers a lot of flexibility with its various delivery speed options, such as:

Standard - delivered by the end of the next business day

Express – delivered the morning or afternoon of the next business day

Today – delivered the same day

Now – delivered within 30 minutes

It should be noted however that in countries where TransferGo’s service is more limited, delivery can take up to one business day longer than in the main countries.

Countries where deliveries could be delayed include the USA, Australia, Bulgaria, Canada, Switzerland, Czech Republic, Hong Kong, Israel, Mexico and South Africa.

While the Standard delivery option is always available, you will often only have one or two of the three expedited delivery options (Express, Today, Now) to choose from.

Fees & exchange rates

TransferGo keeps money transfers low-cost by using the same local bank to local bank transfer system as TransferWise.

The fee for transferring funds is comprised of a fixed fee that’s based on how quickly you want the money delivered, as well as a markup to the exchange rate that ranges from 0% to 3.3%, depending on the currency pair involved.

The Standard delivery option (slowest speed) is often free but when there is a fee it will normally be somewhere between £0 and £0.99. Faster delivery options cost more.

Fee example

If I wanted to send 50,000 INR to an Indian bank account from the UK, there would be no fee if I were to choose the “Standard” delivery option (two business days in this case), and a fee of £2.99 if I were to choose the “Express” option.

The other two delivery options (“Today” & “Now”) are currently not available to me.

The total amount due for the transfer is £536.47, and that figure is entirely based on the TransferGo exchange rate.

According to the current exchange rate on Google, 50,000 INR is equivalent to £533.08 , which means that I’m paying a fee of just £3.39 due to the slightly weakened exchange rate.

This is a competitive fee and is only slightly higher than the fee that TransferWise charges for the same transfer.

If I were to choose the "Express" delivery option, the total fee would rise to £6.38 (£3.39 exchange fee + £2.99 fixed fee), which is getting a little pricier but still very cheap compared to sending the money through a typical bank.

Customer service

TransferGo has a useful help centre on its website where you’ll find links to dozens of articles covering all of the major topics relating to the service.

You can also get in touch with customer support via e-mail, Facebook or by calling customer support. The team is available from 7 AM to 4 PM GMT, Monday to Friday. There is currently no live chat facility available.

Assistance is available in 9 languages, namely English, Polish, Lithuanian, Latvian, Russian, Romanian, Ukrainian, Turkish and German.

Bonuses & Incentives

One of the incentives for signing up to TransferGo is the company's invite programs.

There are a number of these invite programs, the details of which vary according to your country, but basically you can earn a cash reward every time a friend signs up to TransferGo through your unique referral link.

In the invite program available to UK users, you and your friend can both earn a cash reward of £10 (paid out to your bank accounts) once your friend has joined TransferGo through your invite link.

The reward is released as long as your friend transfers at least £50 internationally (same currency transfers don't count) within 6 months of signing up, and the program allows you to invite up to 300 friends every day.

How to transfer money with TransferGo

Initiating any transfer with TransferGo is an easy 4-step process and can be done after creating an account on the website or on the TransferGo mobile app, which is available for both Android and iOS.

After registering, log in to your account on the app or website and you can then proceed to make your first transfer by going through the following steps:

Step 1 – Enter the amount you want to send or the amount you want the recipient to receive, choose your preferred delivery speed option, make sure you’re happy with the total amount due and then move onto the next step.

Step 2 – Enter the recipient’s full name and bank details or if you're sending to a business, the business's name and bank details.

Step 3 – Review the details of your transfer and select a payment method.

Step 4 - Make the payment by following the provided instructions.

Although at the moment you can only make one-time transfers with TransferGo, a feature that’s soon to be released will allow you to schedule automated recurring payments to any your payees.

Pros

- Very highly rated by users on Trustpilot.

- Gives you more control over delivery speed than most other services.

- Competitive fees if you choose the slowest delivery option.

Cons

- Coverage is fairly limited.

- Receiving options are limited.

- Usually marks up the exchange rate.

- No recurring transfers.

- No live chat to reach customer support.

Founded in 2010 by Ismail Ahmed, Catherine Wines and Richard Igoe, and headquartered in London (with other regional hubs around the world), World Remit is another very popular and fast-growing Fintech start-up in the online remittance arena.

Necessity is the mother of invention, and the inspiration create World Remit sprung from Ismail Ahmed’s frustrating experiences as a student in London in the 1980’s. To send money home to his family in East Africa he was having to pay an agent a small fortune in fees each time.

A decade later and the company has accrued over 4 million users, has a global team of 800+ employees running it and has had $375 million invested in it by the likes of TCV, Accel and Leapfrog.

The service has already helped thousands and thousands of people around the world to receive the money they need to send their children to school, to receive healthcare and to pay their bills.

Security & Credibility

On the independent consumer review website Trust Pilot, WorldRemit has earned an impressive 4.6/5 TrustScore from over 36,000 customer ratings. 83% of reviewers have rated their experience with the company as “excellent”, while just 5% have rated it as either “poor” or “bad”.

In addition, World Remit is authorized and regulated by the FCA (financial conduct authority) in the UK, and has to comply with a number of other global regulatory bodies, so the necessary safeguards are in place to ensure your money is protected.

Coverage

World Remit allows users from 50+ countries to send money in 30+ currencies.

Europe and Asia are the biggest contributors to the list of supported sending countries, but there are also representatives from Africa, the Middle East, the Americas and Australia/Oceania.

From these 50+ sending countries, money can be sent to over 150 receiving countries worldwide.

Remittances both to and from the US are supported.

Payment options

When it’s time to make the payment for your transfer with WorldRemit, the options available to you will depend on the country you’re sending money from.

Debit/credit/prepaid card - Visa and MasterCard are accepted. Amex, Diner's Card and Union Pay are not. Card payments are not supported in all sending countries.

Bank transfer - Only supported for residents of Hong Kong, Japan, Singapore, Somaliland, UK and South Africa. WorldRemit states that they must receive the funds no later than 24 hours after the transaction was placed.

Online payment options - Various options are supported, including POLi (Australia & New Zealand), Interac (Canada), iDEAL (Netherlands), Klarna (Germany, Austria, Belgium and UK) and Trustly (Denmark, Estonia, Finland, Italy, Norway, Poland, Spain, Sweden).

Apple Pay - Currently supported in 16 countries.

Note that Google Pay is no longer supported.

Receiving methods

Unlike some of its Fintech competitors that only support sending money to bank accounts, World Remit offers an impressive array of six different delivery methods, although some of these are admittedly only available in limited circumstances.

Which of these delivery options are available when making a transfer will depend on what country you’re sending money to.

Bank transfer - Send money directly to a recipient's bank account. This option is supported for the majority of countries.

Cash pickup - World Remit has a local partner network that allow recipients to receive a transfer as physical cash at supported locations in about 80 countries worldwide. The recipient needs to bring along a valid photo ID and the transaction reference, which is sent to the recipient by SMS or can be shared with the recipient by the sender.

Mobile money - With WorldRemit you can send money directly to mobile money accounts in any of the 23 countries that currently offer the service in Africa, Asia and elsewhere.

Airtime top-up - Although technically it’s not a way of receiving money, WorldRemit allows you to send Airtime credit to someone instead of money, as long as you know the person’s mobile number.

Door-to-door - Have your transfer delivered as physical cash right to the door of the recipient at their home residence. As with cash pickup, the recipient needs to present a valid photo ID and the transaction reference number for the delivery driver to release the payment. Sadly, door-to-door delivery is currently only available in one country – Vietnam.

WorldRemit wallet - This is a new way for users to send, receive and store money with WorldRemit. At any time they can withdraw the funds to a local bank account or to a mobile money wallet. They can even withdraw the funds as physical cash. The WorldRemit wallet is currently only available to customers from Somaliland that use Android phones, but it’ll be rolled out to more countries in the future.

Delivery speed

WorldRemit claims that 90% of their transfers are completed the same day, but the exact delivery time will depend on the country you’re sending the money to, your selected delivery method and how you make the payment.

Bank transfers are usually credited within 1 working day. For some countries, like Nigeria and the Philippines, the transfer may be completed within minutes, whereas for countries like Germany and Poland, it can take 1-2 business days.

Cash pickup is instantly available for collection and mobile money and airtime top-up transfers are both delivered within minutes.

Home delivery, which is only available in Vietnam, will typically take anywhere from 24 hours to 7 days, depending on the location of the recipient’s residence.

As usual, ensuring you’re verified before initiating a transfer will avoid hold-ups and paying by card whenever possible will reduce total transfer times.

Fees & exchange rates

WorldRemit makes its money by marking up the exchange rate and/or charging an explicit transfer fee.

If sending money to a bank account, the explicit transfer fee can vary from less than £1 when sending smaller amounts to £21.99 and beyond when sending larger amounts, although for some currency pairs the fee remains the same regardless of the amount you’re sending.

The transfer fee varies similarly if you’re sending money to mobile wallets, to cash pickup locations or directly to someone’s doorstep.

For airtime top-ups, there is usually no explicit transfer fee, but the total amount you have to pay is usually far more than the actual value of the airtime top-up.

I feel that transparency is somewhat lacking here, as WorldRemit is making it appear like there is no fee for sending airtime top-ups, when in fact, there is.

The other contributor to the total fee for making a transfer with WorldRemit is the markup to the exchange rate.

The exact percentage markup depends on the currency pair in question but does not normally vary according to the amount you’re sending.

Fee example

If I wanted to transfer 50,000 INR to an Indian bank account from the UK, I would have to pay £540.32 based on the exchange rate, plus an explicit transfer fee of £2.99, for a grand total payment of £543.31.

According to the current Google exchange rate, 50,000 INR is equivalent to £534.92, so the total fee to make this transfer is £8.39, with £5.40 of that total fee arising from the marked up exchange rate.

Customer service

WorldRemit provides extensive FAQ pages on its website that deal with the various aspects of their service, as well as a customer support team that can be contacted via:

Live chat – This is reserved for cases when you have a transaction in progress.

E-mail – For non-urgent issues you can fill in the form on the website and you should receive a reply within 48 hours.

Phone – WorldRemit may ask you to call them about a transaction, in which case there are 25+ contact numbers listed on the website for calling the company from various countries.

Bonuses & incentives

WorldRemit is currently offering new customers their first 3 transfers free of charge.

All you need to do is add the code "3FREE" on each of your first three transactions to get the transfer fees waived, although you will still have to pay any fees resulting from any possible markup to the exchange rate.

WorldRemit does have a Refer a Friend program, but it’s only available to selected customers. If you’re eligible, you’ll get a referral code that you can share with people you know.

If a friend signs up with your referral code and transfers a certain minimum amount (this varies by country; in the US it’s $100, in the UK it’s £100), within the first 6 months, you and your friend will both be sent an electronic voucher reward (this also varies by country; in the US it’s $20, in the UK it’s £20) by e-mail, and this voucher must be redeemed within 6 months of being issued.

The full voucher amount will be deducted from the total you have to pay when making your next money transfer.

How to transfer money with WorldRemit

Sending money with WorldRemit is a piece of cake, as with most other Fintech money transfer services.

Before you can make your first transfer, you'll need to first create an account, either on the website or mobile app, which is available for both Android and iOS.

On the website you would begin by choosing the country you want to send money to from the drop-down menu on the home page.

On the next screen you'll be asked to choose your delivery method from the available options. Let’s say that you select the bank transfer option.

From here it’s an easy 3-step process:

Step 1 - You can enter either the amount you want to send or the amount you want the recipient to receive. After reviewing the exchange rate, transfer fee, transfer time and the total amount due, you can proceed to the next step.

Step 2 - Enter the personal details and the bank details of the recipient. For the personal details you may need to enter the recipient’s full name, address, mobile number and the reason for sending the money.

Step 3 - Select your payment method and follow the instructions from here. In many cases debit/credit card will be the only available option.

World Remit currently supports recurring transfers only on its mobile app, but the feature will be launched on the website soon too.

When you set these up you’ll be sent an e-mail at least 24 hours before an upcoming transfer, letting you know the applicable FX rate and total fees for the transfer.

Pros

- Popular and highly rated Fintech money transfer service

- Decent coverage (50+ sending countries, 150+ receiving)

- Wide variety of payment and delivery options

- Supports automated recurring transfers on mobile app

Cons

- Fees need to be more transparent

- Marks up the exchange rate

Founded in January 2012 by four entrepreneurs (Michael Kent, Marta Krupinska, Ricky Knox and Marek Wawro) and headquartered in Amsterdam, Azimo is another Fintech start-up that operates a global money transfer service.

The service now has over 1 million users, almost 200 employees and has received investment from the likes of eVentures, Greycroft, Frog Capital and Rakuten.

Azimo was designed by migrant workers for migrant workers, so it’s unsurprising that a significant segment of the customer base relies on the service to send money to friends and family back home.

Security & Credibility

Azimo is a fully authorized Electronic Money Institution that’s regulated by the FCA (Financial Conduct Authority) in the UK and by De Nederlandsche Bank (DNB) in the Netherlands.

It's also licensed and regulated by HMRC (Her Majesty’s Revenue and Customs) as a Money Services Business (MSB), so your funds are well protected.

Other measures the firm has in place to protect your money are 3D secure authentication for your card payments, fraud detection systems and encrypted communication on the apps and website.

Azimo is also certified by German TÜV (Technischers Überwachungsverein or Technical Inspection Association), which ensures that they comply with data protection and IT security standards.

The company has won numerous accolades, including No. 1 money-saving app in The Guardian’s Top 10, iAMTN’s (International Association of Money Transfer Networks) Best Global Money Transfer Company in April 2017 and Best Low Cost Remittance Service at Africa’s sixth annual Kalahari Awards in 2016.

On the independent consumer review website TrustPilot, Azimo has has earned a high average TrustScore of 4.5/5 from over 36,000 customer reviews. 78% of reviewers rated the company as “excellent”, while only 3% rated their experience as “bad”.

Coverage

Azimo supports sending money in five currencies (EUR, GBP, DKK, NOK, SEK, PLN, CHF) from 24 countries, which consist of the 19 Eurozone nations plus Switzerland, Sweden, Norway, Denmark and the UK.

From these 24 countries, money can be sent to 195+ countries, where it can be received in 60+ currencies.

Payment methods

Azimo supports all of the following payment methods, although the ones that are available to you will depend on the country you’re sending money from:

Debit/credit card – The limit for card payments is 12,000 GBP or 13,500 EUR.

Bank transfer – You can make a transfer to NatWest Bank in the UK or Deutsche Kontor Privatbank AG in Germany.

Online payment methods – Sofort (Austria, Belgium, Germany, Italy, Netherlands) and iDEAL (Netherlands only) are also supported.

Receiving methods

Cash pickup – The recipient can pick up your transfer as cash at one of 200,000+ secure cash pickup locations worldwide. Azimo partners with banks and other local businesses to create these cash pickup points in over 50 countries.

Direct to bank – A direct bank transfer to the recipient’s bank account in the local currency.

SWIFT transfer - Azimo can process transfers using the SWIFT international payment network. Most major currencies (EUR, USD, GBP etc.) are supported and money can be sent to more than 100 countries this way. You need to provide the recipient's BIC and SWIFT codes so that Azimo can identify their bank account.

Mobile wallet – You can send money to mobile wallets in a number of different countries including Armenia, Burkina Faso, Fiji, Ghana, Indonesia, Kenya, Nepal, the Philippines, Romania and Sri Lanka.

Mobile top-up – You can add credit or airtime to your recipient’s phone after choosing this delivery method and entering their mobile number.

Home delivery – The money is securely delivered to the recipient’s door. This delivery method is currently only available in the Philippines.

Delivery speed

Deliveries with Azimo take one working day on average, but the exact time can obviously vary depending on the country you’re sending money to, the delivery method you choose and how you pay for the transfer.

The company recommends that you pay by card to minimize the total delivery time of your transfer, since card payments normally reach their account in a matter of minutes.

Bank transfers from the UK can take an entire working day to reach Azimo’s account and those from other European countries can take up to 2 working days, so this payment method can be significantly slower.

Fees

Azimo claims to be able save you 90% versus traditional banks and money transfer services.

The company makes its money by charging an explicit transfer fee, which depends on the currency pair and may also be affected by the amount you’re sending.

Azimo also adds a markup to the exchange rate, which can vary between 0.1% and 2.25%, depending on the currency pair involved and the amount you’re sending.

To work out the exact fee for a transfer you have in mind, you need to enter the amount you want to send on the Azimo mobile app or website. Any applicable transfer fees and the FX rate will be clearly displayed.

Fee example

If I wanted to send 50,000 INR to an Indian bank account from the UK, making the payment in GBP, how much would it cost me?

Well, I would have to pay £540.07 based on the exchange rate and there is also an explicit transfer fee of £1.49, so the total cost would be £541.56.

According to the current Google exchange rate, 50,000 INR is equivalent to £534.90, so the total fee for this transfer is £6.66, with £5.17 of that coming from the exchange rate markup.

Customer care

Azimo has a very helpful support centre, where you can find detailed guides and FAQs dealing with every aspect of their service.

If you can’t find the answer you’re looking for in the support centre, Azimo’s customer support team is available to serve you Monday to Friday, from 9 a.m to 6 p.m UK time (GMT).

The support team can converse in 8 different languages, namely English, German, French, Spanish, Portugese, Polish, Russian and Italian.

You can get in touch with the team through live chat, e-mail or over the phone.

You can actually call the team directly from your browser thanks to a voice software solution they're using called SnapCall; you’ll just need to enable microphone access on your device when prompted.

Bonuses & incentives

One of the incentives Azimo offers for joining is that you’ll be able to make your first two transfers fee-free.

You’ll still have to pay any hidden fees resulting from the exchange rate markup, but the explicit transfer fee will be waived for the first two transfers.

Azimo also has an Invite-a Friend program.

If a friend signs up through your invite link or code, they’ll receive €10/£10 off their first transfer.

When your friend transfers at least €100/£100 internationally, you then receive a voucher to get €10/£10 off your next transfer.

The reward for signing up a friend or colleague to Azimo Business through your invite link is even greater; for this I’m currently being offered a reward of €50.

How to transfer money with Azimo

To transfer money with Azimo you need to first create an account, which can be done either on the website or on the award-winning mobile app, which is available for both Android and iOS.

Let’s say you want to send money to a bank account.

Once you’ve logged in to your new Azimo account, you just need to initiate a new transfer and follow this easy 4-step process:

Step 1 – Choose the recipient’s currency and enter the amount you want to send or the amount you want the recipient to receive. Choose your delivery method and review the transfer fee, exchange rate and the total payment due. If you’re happy with everything you can proceed to the next step.

Step 2 – Enter the full name and bank details of the recipient.

Step 3 – Review the details of your transfer.

Step 4 – Select your desired payment method and follow Azimo’s instructions from here on.

Pros

- Highly rated Fintech money transfer service

- Supports sending money to 195+ receiving countries (though sending to local currencies in these countries isn’t always possible)

- Wide variety of receiving options

- User-friendly website and award-winning mobile apps

Cons

- Only supports transfers from 24 sending countries.

- Recurring transfers are not supported (yet)

Founded back in 2011 by Matthew Oppenheimer, Josh Hug and Shivaas Gulati, and headquartered in Seattle, Remitly is another relatively youthful, fast-expanding, disruptive Fintech start-up in the international money transfer space.

Idaho native Matthew Oppenheimer was inspired to create Remitly while working abroad in Kenya for Barclays. It was during that phase of his life that he experienced how painful, expensive and inconvenient it was to transfer money internationally.

Matthew remarks that of the $500 billion that is sent home by migrant workers every year, 8% or $40 billion of that total figure is siphoned off by banks and money transfer operators, and the money is taken in a non-transparent way that takes the power away from the customer.

Remitly appeared on the scene as a disruptive element, offering an international money transfer service that is easy to use, low-cost and where transparency is paramount.

As with most money transfer services, immigrant workers seeking upward mobility for themselves and their families represent a large tranche of Remitly’s market, though there are many other kinds of people that use the service as well.

Today, Remitly has over 1 million happy users, three overseas offices (in the UK, Nicaragua and the Philippines), a workforce of over 1,000 employees and transfers more than $6 billion annually around the world. It describes itself as the “largest independent remittance company” in North America.

Security & Credibility

Remitly is backed by more than 25 industry-leading investors, including Stripes, DFJ (Drapes Fisher Jurvetso) Venture Capital, DN Capital, Trilogy, QED Investors, Bezos Expeditions, Founders’ Co-Op, Techstars, TomorrowVentures, PayU and many others.

The company is compliant with all laws and Government regulations in the territories that it operates in.

In the US, Remitly is registered with the U.S Dept. of Treasury as a Money Services Business and is licensed to transmit money in all 50 states, in addition to Washington D.C and all Canadian provinces.

In the UK, Remitly is regulated by the FCA (Financial Conduct Authority) under the Payment Services Regulations 2009 and is also registered with the HMRC (Her Majesty’s Revenue and Customs) as a money service business.

For its operations outside the UK in the EEA countries, Remitly uses a different entity called Remitly Europe Limited, which is licensed by the Central Bank of Ireland (CBI).

Regarding customer feedback, Remitly scores an impressive 4.6/5 average TrustScore on the independent consumer review website Trustpilot. 86% of reviewers rated their experience with Trustly as “excellent” (5 stars) while just 6% rated their experience as “bad” (1 star).

Coverage

Remitly supports money transfers from 17 send countries (13 European countries plus the US, Canada, Singapore and Australia) to over 50 receiving countries in Europe, Asia, Africa, the Middle East, North America, Latin America and Oceania.

In total, over 600 send-to-receive corridors are supported by Remitly and dual currencies are supported for many receiving countries.

With dual-currency-supported receiving countries the recipient can receive the funds in either the local currency or in USD or EUR. Dual currency is available for cash pickup, select bank accounts and home delivery.

Remitly also has a network of cash pickup locations in many of the supported receiving countries. Remitly provides these by partnering with local banks, post offices, courier companies, money transfer agencies, currency exchange services, pawnshops, and other local businesses.

Payment methods

Remitly supports the following payment methods, although some of the below options are only supported for a limited number of sending countries.

Debit/credit card – Visa, MasterCard and Maestro cards are supported in European countries. Visa, MasterCard and Prepaid cards are supported in Australia, Canada and the US.

Bank transfer – This payment method is only available in the US, Canada and Australia.

Online payment services – Remitly also supports online payment services like iDEAL (Netherlands), Klarna (Austria & Germany) and Faster Payment (United Kingdom).

Receiving methods

Remitly supports all of the following delivery options, though the ones that are available to you will depend on the country you’re sending money to.

Bank deposit – This delivery option is available in a significant number of the 50+ receiving countries, but not all.

Cash pickup – Remitly partners with banks, postal services, and other local businesses in a significant number of the 50+ receiving countries to make it possible for recipient’s to collect the money as physical cash.

Home delivery – This service is currently only supported in Vietnam, courtesy of Sacombank.

Mobile wallet - You can send money to mobile wallets in the Philippines

(PayMaya, GCash and Coins.ph), Vietnam (Vimo), Ethiopia (HelloCash), Kenya (M-Pesa), Ghana (MTN Mobile Money, Airtel Money, Tigo Cash & Vodafone Cash), Uganda (MTN Money & Airtel Money) and Rwanda (MTN Mobile Money, Tigo Mobile Money & Airtel Mobile Money).

Alipay - Holders of a Chinese National ID or a Foreigner’s Permanent Resident Identity Card (FPRID) can receive transfers using the Alipay app.

Delivery speed

When sending money with Remitly, the transfer time depends on the countries you’re sending money from and to, the delivery method and payment option you choose, as well as the delivery speed option you select.

Remitly has two delivery speed options that are sometimes called Economy or Express.

These two options are synonymous with paying by bank transfer or debit/credit card respectively.

With the express option the funds will usually be delivered within minutes, but if the transfer is not time-sensitive, you can choose the economy option, where funds will typically be delivered in 3-5 business days.

Most sending countries only support payment by card and therefore only support the express delivery option. The slower economy option is only available for the three countries (US, Canada, Australia) that support payment by bank transfer.

Fees & exchange rates

Remitly makes its money both by marking up the exchange rate and also by charging an explicit transfer fee in many instances.

The transfer fee can vary depending on the countries you’re sending money between, the amount you’re sending and the delivery speed option you select, with the express delivery option being more expensive than economy.

The markup to the exchange rate generally ranges from 1-3% and depends on the countries you’re sending money between. It may also be affected by the amount you send and the payment method you choose (if an option exists).

Like TransferWise, Remitly locks in the exchange rate for you once you initiate your transfer, so you don’t have to worry if the rate suddenly plummets while you're completing the transfer.

If you want to get an estimate of the fees for the particular transfer you have in mind, you can use the pricing calculator on the Remitly website.

Fee example

If I wanted to send 50,000 INR to an Indian bank account with Remitly, how much would it cost me to send from a UK bank account, paying by debit/credit card in GBP?

Well, it would cost me £529.60 based on the exchange rate, plus a transfer fee of £1.99, for a total payment due of £531.59.

According to the current Google exchange rate, 50,000 INR is equivalent to £523.39, so the total fee in this case is £8.20, with £6.21 of that coming from the weakened exchange rate.

Customer service

Remitly has a help centre where you can find articles on many general topics or get more specific information about transferring money from any of the 17 supported sending countries.

You can also get in touch with Remitly’s customer support team, which is available 24/7, via e-mail, live chat or phone.

Bonuses & Incentives

Remitly has a Refer Friends program where its users can earn rewards when a friend signs up to Remitly through their unique referral link and makes their first money transfer.

There is no limit to how many friends you can sign up through the program, and you’ll earn a reward for each friend that is from a different household.

Remitly also have promotional offers for new customers, where for your first transfer (up to a specified amount) you are granted a special FX rate and the transfer fee is also waived. In my case for example, I can send my first €1,000 at the mid-market rate and the transfer fee is also waived.

How to transfer money with Remitly

Before you can send money with Remitly you need to first create an account on the website or mobile app, which is available for both Android and iOS.

We’ll do a quick run through of how to transfer money on the Remitly website.

So, after creating an account and logging in, you then just need to take the following 4 easy steps:

Step 1 – Enter the send or receive amount, select the delivery method and delivery location, review the exchange rate and transfer fee, and if you’re happy with everything you can proceed to the next step.

Step 2 – Enter your recipient’s full name and bank details (if you selected bank deposit as the delivery method), and choose the reason for sending from the dropdown menu.

Step 3 – Enter the sender details (full name, address and security details like DOB)

Step 4 – Choose your payment type, enter your payment details (if paying by card) and following the instructions of Remitly from here until you’ve completed your transfer.

Pros

- Highly rated Fintech money transfer service

- Decent selection of delivery options

- 24/7 customer service

Cons

- Coverage is lacking

- Payment options are limited for most sending countries

- Marks up the exchange rate (lacking transparency)

- Automated recurring transfers are not supported

Money transfer veteran Western Union is probably the first company that springs to mind when most people think of transferring money internationally.