The Best Travel Insurance Providers For Backpackers, Nomads & Adventurers in 2021 (Fully Reviewed & Compared)

Travel insurance is one of the more divisive issues among travellers, with slightly more than half of US travellers currently preferring to travel without it.

According to a recent survey by the AAA, about 38% of American travellers are likely to purchase travel insurance for future international trips.

In the UK however, the situation is very different, with only 21% of travellers admitting to travelling uninsured in 2017, down from 25% in 2016.

Obviously attitudes towards travel insurance will vary depending on where exactly you are in the world, but I think it’s safe to say that for some people at least, deciding whether or not to buy travel insurance can be something of a dilemma.

If you’re currently undecided about whether to buy travel insurance or not, we’d recommend that you read our previously published article where we attempt to unpack the question “is travel insurance worth it?” by laying out the arguments for and against buying travel insurance.

This article you're reading now was written for backpackers, nomads and adventure travellers who are already sold on the idea of travel insurance but are wondering which provider they should choose among the many wrestling for their attention.

But before we begin comparing the top-rated providers on the market, we’d like to first briefly cover a few preliminary topics, like the industry jargon, the factors to consider when choosing a provider, and what travel insurance will not cover.

By reading through these sections first, the reviews that follow will make a lot more sense and you’ll be able to more accurately evaluate the different travel insurance options.

So let’s begin by taking a quick glance at a few of the most commonly used terms in the travel insurance industry, as we’ll be using these terms a lot throughout the article.

Travel insurance glossary (A-Z)

Alcohol – If you get inebriated and you get injured as a result of your compromised condition, it’s highly unlikely that your claim will be honoured by your insurance company, since you will be held liable.

Claim – A claim is where you formally request reimbursement from the insurance company for financial loss you have incurred as a result of a covered incident. There is normally a deadline (often 60 days) for submitting a claim after the date of the incident. If you wait too long before submitting your claim, it probably will be denied.

Claim limit – Most insurance policies specify claim limits for the various types of cover they provide. A claim limit is the maximum amount of money that you can claim for a given type of insurance cover, regardless of the magnitude of the loss you incurred. For example, if you have $10,000 worth of electronics stolen but your claim limit for those items was only $2,000, you would only be able to claim $2,000 from the insurance company.

Coinsurance – This is a term that normally applies to medical insurance. A coinsurance scheme is where you pay a certain percentage of the total cost of healthcare after having paid the deductible.

Common carrier - A common carrier refers to an entity that transports people or goods from one place to another in exchange for money. An example is a bus, passenger train, taxi or cruise ship. You'll normally come across the term in relation to common carrier accidental death insurance cover.

Copayment – Another term that normally applies to healthcare; in a copayment scheme you pay a flat fee each time you avail of a healthcare service or take a prescription. Sometimes the policyholder has to pay an annual deductible amount first before the copay comes into effect. In other cases the policyholder the deductible is waived for the first few copay visits in a year, but then comes into effect after using them up.

Deductible – The deductible is the amount of an insurance claim that you have to pay out of your own pocket before your insurance cover kicks in. It is also the threshold amount that your claim must exceed before the insurance company will pay you anything at all. So for example, if you are claiming reimbursement of £300 and the deductible is £25, the insurance company would only pay you £275, because the first £25 has to come out of your own pocket. A high deductible means that your insurance company doesn’t have to pay out very often, but it also usually means that your premium will be lower.

Excess – Another word for a deductible.

Exclusion – An item or type of risk specifically not covered under your insurance policy. Exclusions narrow the scope of coverage and help to protect the insurance company from bankruptcy.

Indemnity value – This is the real market value of an item at the time of loss, taking into account any depreciation that the item has undergone. If your 5-year old camera was stolen most insurance companies would not reimburse you for a brand new one because that would result in you gaining, and insurance is only designed to leave you in the same financial position you were in before you suffered the loss.

Lookback period – This is how far back in time that an insurance provider will look to determine if you have a previously diagnosed pre-existing condition. Some companies look back 180 days, while others might only look back 60 days.

Personal liability – This is a type of cover that protects you from being sued for accidentally causing injury, death or illness to a third party, or for accidentally damaging or losing a third party’s property. If for example, you were to scald a fellow traveller with boiling hot water during a trip and that person tried to sue you, the insurance company would step in and cover you.

Personal effects - You'll normally come across this term when reading about "baggage and personal effects". It refers to the items you carry on your person like your keys, wallet, credit card, jewellery, mobile phone, glasses, earphones, hearing aid, dentures, mp3 players, GPS devices, gameboys and so on. Some providers may exclude some of these items.

Police report – When one of your items is lost, damaged or stolen, you should always obtain a written police report so that you can prove to your insurance company that your claim is genuine. In some cases (remote areas for example) there won’t be a police station, in which case you should get a report from another available authority, such as your hotel manager.

Policy – Your insurance policy specifies the type(s) of cover you have, the coverage area, the age limit of policyholders, the claim limits, the duration of cover, any deductibles that apply, any limitations and exclusions that apply to the various types of cover and any other relevant information that defines the agreement between you and the insurer.

Premium – The insurance premium is the amount you pay to the insurance company in exchange for cover. Companies offer different options including monthly, annual or upfront payments.

Pre-existing condition – This is usually defined as a medical condition for which a person has already received diagnosis or treatment, or was aware of and should have consulted a doctor about, prior to taking out an insurance policy. How far back in time an insurance company will look in determining if you have a pre-existing condition is the lookback period (see above).

Proof of purchase – When trying to claim for a lost, damaged or stolen item, you need to be able to prove to the insurance company that you are or were the owner of that item. The easiest way to show this is with the original receipt that proves you purchased the item, although there are other ways you can back up your claim if you no longer have the receipt.

What travel insurance does NOT normally cover

Travel insurance companies are surprisingly uniform in the things that they refuse to cover, so it is possible to generalize a little here.

So in general, you will not be covered if:

You had an accident while heavily inebriated or under the influence of drugs

A glass or two of wine is acceptable to most insurance companies, but if you were absolutely plastered at the time of the incident, be prepared for your claim to get denied. The same normally applies for being under the influence of drugs, unless you were advised to take them by a registered medical practitioner.

Your accident or illness arose from a pre-existing condition

Many travel insurance policies will exclude cover for any injuries or illnesses relating to or arising from pre-existing conditions. Others will cover you for certain pre-existing conditions, but you must disclose them beforehand.

You lack the relevant paperwork to verify your claim

In order to claim for loss, theft or damages suffered in the event of a mugging, assault, kidnapping, pickpocketing etc. you must submit a police report about the incident during your trip and this must be done within the timeframe specified by your insurance provider (usually 24 – 48 hours). If there’s no police station where you’re staying, a note from your hotel manager or some other local authority will normally suffice.

If you are claiming for emergency medical expenses, you should gather up any medical records, reports and clinical notes before leaving the hospital, as well as any receipts for expenses you incurred at the hospital. You should also obtain a police report in this case too.

The expense was going to be incurred anyway

If you’re claiming for an expense that you were going to incur anyway whether the mishap occurred or not, your claim most likely won’t be honoured.

If you were travelling on a one-way ticket for example and your trip was curtailed, your insurance provider usually won’t pay for your return flight home, since that is an expense that you were going to have in any case.

You have no evidence to prove your ownership of a lost, stolen or damaged item

Because of the potential for fraud, travel insurance companies will insist that you provide evidence that you are the rightful owner of the item you are claiming for. The best way to prove ownership is with a receipt, but if you no longer have the receipt, you can turn to pieces of evidence like a transaction that appeared on your bank statement (if it was a card payment), a receipt from the merchant or a photo of the item that you bought.

You left stuff unattended and it got stolen or went missing

Travel insurance companies often won’t cover stolen gear or luggage if you left it unattended inside a vehicle, even if the vehicle was locked. Sometimes you’ll be okay if you locked it away out of sight in the glove compartment or in the trunk, but even then some insurance companies won’t cover you.

If you left your laptop on the table of a restaurant while you went to the bathroom and it was gone when it came back, then obviously you wouldn’t be covered.

If leaving valuables, money, bank cards and travel documents unattended in a locked hotel room or vehicle you usually won't be covered, unless they're locked away inside a safe or safety deposit box.

The mishap could have been easily prevented

If you didn’t take important safety precautions that would have reduced the level of risk you were exposed to, you probably won’t be covered by your insurance.

For example, if you have an accident while riding a motorcycle without wearing a helmet, you are not taking due precautions to reduce the risk of injury, so your insurance provider is unlikely to cover you in that situation.

Another example is if you didn’t cancel your trip as soon as you became aware that it needed to be cancelled (at a time when it may have been free or cheap to cancel), and you waited so long that you incurred a high (but easily preventable) cancellation fee. In this case, the insurance company will usually only reimburse you for the cost you would have incurred if you had cancelled as soon as reasonably possible.

You incurred unreasonable additional expenses

If you incurred additional expenses as a result of a trip disruption, your insurance provider is only going to cover those expenses that are reasonable, like a stay in budget accommodation and public transport between the airport and hotel. If you indulged in gourmet cuisine, checked into a 5-star hotel, or hired a limousine, you probably won’t be covered.

Your expenses are recoverable from another source

If you stayed in a private hospital when you could have stayed in a public-funded hospital or if you have national health insurance that already covers your costs, your insurance provider usually won’t be willing to cover them.

Another example would be if you are trying to claim reimbursement from your insurance provider for additional costs incurred due to delayed or cancelled flights or denied, boarding, where your carrier will often already be liable for covering these costs under EU regulation 261/2004.

You failed to comply with the instructions given by your insurance provider during a medical emergency

If for example, your insurance provider advised that you be evacuated to your home country and you refused to comply, and you incur additional expenses as a result of your failure to comply, you may only be entitled to compensation for the costs you would have incurred if you had complied. Failure to comply may also void your cover entirely.

You were participating in high-risk activities

Some travel insurance providers specialize in covering hazardous activities and extreme sports, but your typical travel insurance policy will exclude most such activities from their scope of cover. For some activities, like mountaineering above 7,000 metres or base-jumping, it may be impossible to find any provider that will cover them.

The mishap occurred in an excluded, high-risk country

Most travel insurance providers will state that they cover you when travelling in X number of countries, but you can be almost sure that they won’t be covering any countries for which your government has issued a warning against all travel or against all but essential travel.

Factors to consider when choosing a travel insurance provider

With literally hundreds of travel insurance providers out there, it certainly isn’t easy to choose one, but one thing that makes the task easier is being armed with the knowledge of what you need to be looking out for.

Here are the most important factors to consider when choosing a travel insurance provider.

What type of traveller you are

There are obviously many types of travellers and most insurance providers are not trying to cater to all of them.

Some providers target holidaymakers, some target backpackers, some target expats, some target digital nomads, some target adventure travellers, some target senior citizens who are struggling to find providers that will insure them, while other companies try to cater to a few different segments of the market.

Try to figure out which label best fits the type of traveller that you are, and then choose an insurance provider that caters to that segment of the market. This way, you will be with a provider who really understands the needs of travellers like you.

In this guide we are primarily focusing on travel insurance providers that will suit backpackers and adventure travellers.

Types of cover

There are many types of travel insurance cover, like trip cancellation cover, trip interruption cover, emergency medical cover, baggage loss cover, baggage delay cover, personal liability cover, repatriation/overseas burial cover, medical evacuation cover. Comprehensive cover means that most of these individual items are included.

Generally, you’ll find that some companies offer comprehensive cover, while others specialize in emergency medical cover, medical evacuation cover or high value item/equipment cover.

Comprehensive cover necessarily has to compromise on some of the individual types of cover (more exclusions, lower claim limits etc.) but it’s undoubtedly very convenient to be covered so broadly under one policy.

I’d generally recommend buying a comprehensive policy and if there are still gaping holes in your cover, you can always patch them up with a supplementary policy from another provider.

Sports & activities covered under the policy

Travel insurance providers have lists of sports and activities that are and aren’t covered under their policies. If you get injured while participating in an activity that’s not covered and have to receive medical treatment for your injuries, you most likely won’t be able to claim reimbursement.

If you don’t have any specific activities planned for your trip, this may not be something you think you’d need to consider when purchasing, but most people will end up participating in at least a few recreational activities when they travel, even if they hadn’t initially made plans to.

Now if those activities are relatively tame, it’s very likely that you’ll still be covered, but if you'll need cover for extreme sports or other high-risk activities like trekking above 6,000 metres, it’s very important that you verify that those specific activities are covered under your policy.

Your country of residence

Your country of residence will often dictate what travel insurance provider you can and can’t take out a policy with. Some providers only serve residents of the UK & Europe or North America for example, while others are more global, serving customers from all around the world.

Age limitations

It’s unlikely you’ll have to think about this if you’re a younger traveller, but if you’re older than 60, you might be excluded from taking out a policy with some providers. Very few providers cater to travellers that are 85 years or older.

Claim limits

Just because an insurance provider offers comprehensive cover doesn’t mean that you will always be able to escape having to pay something out of your own pocket.

You should always check that the claim limits for the various types of cover are sufficiently high to cover what might happen during your trip.

If you have a $2k camera stolen during your trip for example, it won’t be fully covered if your baggage cover specifies a per article claim limit of $500.

Likewise, low claim limits in emergency medical cover could be a big problem if you had a serious accident while travelling somewhere like the US where healthcare is very costly. With medical cover, $100,000 is the bare minimum you should be looking for in a travel insurance policy.

Claim success rate

It’s a good idea to compare the claim success rate of your insurance provider to the industry average. Some providers will publish this figure in their FAQs, while for others you may have to contact customer support.

In the travel insurance sector about 88% of claims are successful, so you can use that as a benchmark.

The figure can never be 100% because there are always going to be people who claim without fully understanding their entitlements, as well as people who try to make fraudulent claims.

If an insurance provider’s claim rate is somewhere close to the average you should have nothing to worry about, but if you come across a provider that’s dishonouring a high percentage of valid-sounding claims, it might be time to take your business elsewhere.

Size of the excess/deductible

A travel insurance policy could be very cheap but that might only be because it comes with a high excess for most of the types of cover it offers.

A high excess means that you’ll have to pay for most smaller claims out of your own pocket and you might never be able to benefit from your insurance policy unless you need to make a really large claim.

Information about policy excesses is often buried in the terms and conditions and some providers can be less than transparent about them, so always have a look through the full insurance policy to see if there are any excesses that weren’t disclosed to you on the shiny sales page.

If you don’t want to have to pay any excess at all, you will need to choose a provider that allows you to waive the excess, but bear in mind that this will result in an increase in your premium.

Maximum duration of cover

If you’re planning an extended trip, you’ll want to choose an insurance provider that can provide cover for the full duration of the trip, or at least gives you the ability to extend the policy up until the end date of your trip.

Most of the better providers will be able to cover you for a full year and if you want to travel longer than that you will usually have to purchase a new policy.

Ease of renewing & extending policy while travelling

Often while travelling you will need or wish to extend the end date of your trip, so it will make sense to choose an insurance provider that makes it possible for you to extend an existing policy or take out a new one without you having to return home to do.

Look for insurance companies that handle everything online and don’t require you to submit any paperwork to renew or extend policies.

#1 - World Nomads

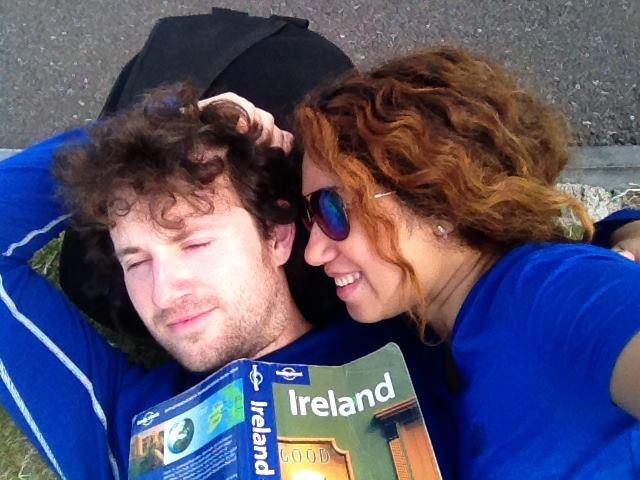

Founded back in 2002, World Nomads is one of the oldest and most well-known travel insurance providers focusing on the backpacker and adventure traveller market, although many other breeds of traveller use it too.

Simon Monk, the founder of World Nomads was a modern-day Marco Polo himself, and this really shines through in the website design, which resembles more of a travel blog than a corporate site.

Hence on the website you’ll find not only travel insurance plans and jargon but also podcasts, destination guides, travel stories, travel tips, phrasebooks, and articles on how to travel safely and responsibly in various parts of the world.

They even offer scholarships in travel writing, photography and filmmaking, where you could get the opportunity to be mentored by professionals in these fields.

One thing that sets World Nomads apart from other providers is the global community of like-minded explorers, adventure travellers, nomads and backpackers that they have built around their products. You can pose questions to other community members and participate in discussions in the community forum.

Regarding its credibility, World Nomads is endorsed by Lonely Planet, Eurail, TourRadar, Intrepid and many other well-known travel brands.

With that being the case, it may come as a surprise that on the consumer review website TrustPilot where the firm has 1,100+ reviews for its US service, it only scores a modest average star rating of 3.3/5, with 51% of reviewers rating the company as “excellent” (5 stars).

Most of the company's low ratings here are to do with poor customer service and a lack of responsiveness when submitting claims or queries; it’s probable that the company is playing a game of catch-up due to its rapidly expanding customer base.

On a more positive note, World Nomads caters to residents of over 140 countries worldwide, and they'll cover trips abroad or domestically, as long as you're at least 100 miles from your home.

You're covered in most of the world's countries, except for the ones that government agencies in your home country have issued a warning against visiting.

As regards age limits, some of the company’s products are available to people as old as 70, but in general you’ll be able to avail of World Nomads if you’re aged 64 years old or younger.

World Nomads is the insurance company that you will see almost every travel blogger fervently endorsing, as if there wasn’t a single other insurance provider in the world worth anybody’s consideration.

This is not necessarily because they are the best provider out there for everyone, but because they pay bloggers high commissions for referrals.

But don’t worry, because we’ll be giving an unbiased overview of World Nomads here and unlike many bloggers, we will not try to give the misleading impression that World Nomads is the only travel insurance provider worth using.

Plans

World Nomads’ insurance plans can normally be purchased for a maximum trip length of 12 months or 366 days, but some countries are subject to a shorter policy duration limit of 180 days. For example, residents of Brazil and the US are limited to 180 days.

If you can only purchase for 180 days and you want to travel for longer than 180 days, you will usually be able to extend your plan up to a maximum of 12 months (366 days) from your original start date, but this must be done before the plan expires.

If you are unable to extend your policy before it expires, fear not, because you can then still purchase a brand new policy, and this can be done without any issues while you are travelling. Just know that after purchasing a new policy there is a waiting periodof 72 hours before it comes into effect.

The World Nomads insurance plans do cover you for travel on a one-way ticket, although, like most other travel insurance providers, they aren’t going to cover your return ticket fare if you have to return home for a covered reason.

World Nomads offer travellers two plans, the standard and the explorer.

As you probably guessed from its name, the explorer plan is recommended for the more adventurous breed of traveller or for thrill-seekers planning to indulge in high-octane sports and activities during their trip. We’ll cover all the differences between the two plans below.

What’s interesting is that the standard plan and explorer plan are not the same for every nationality.

For example, If you request a quote as a resident of the United States you will not see the same claim limits and types of cover for the two plans as a resident of the UK would see. The amounts would also be quoted in dollars instead of British pounds.

Also, there seems to be no mention of a policy excess for US residents, but for Europeans and UK residents there is a deductible of €75 and £100 respectively for many types of cover.

You need to read the full insurance policy to find out if there's an excess for a certain type of cover, as the excess is not mentioned when you receive your quote.

For the sake of example, we’ll just compare the standard and explorer plans for a resident of Maryland, US.

Standard plan

The standard plan is a basic, budget plan for the general traveller or backpacker. It comes with a decent level of insurance cover and moderate claim limits.

In terms of activities and sports, over 150 are covered, including trekking up to 6,000 m, motorcycling (includes riding pillion), scuba diving (up to 50 m), fruit picking, farm work, manual work, wildlife volunteering, swimming, kayaking and many others. See the full list of covered activities here.

Here’s what’s covered in the standard plan (for a Maryland, US resident):

Emergency Accident & Sickness Medical Cover – You’re covered up to $100,000 dollars for emergency treatment that you require due to suffering an accidental injury or illness. You are also covered up to $750 for emergency dental visits, $500 hospital advancement to ensure admission to a hospital for emergency treatment. Pre-existing medical conditions may void this cover. Also, if you incur medical expenses due to an injury suffered while participating in an activity, that activity must be covered under the standard plan for you to be entitled to reimbursement.

Emergency evacuation cover – You’re covered up to $300,000 in the event of a accidental injury or illness requiring you to be evacuated. A physician must order the evacuation and certify that your condition warrants it.

Repatriation of remains cover – Your family is covered up to $300,000 for the costs involved in transporting your body home in the event that you die during your trip.

Non-medical emergency transportation – You’re covered up to $25,000 in the event of political or civil unrest requiring your evacuation. You may also be transported home in the case of certain natural disasters or being expelled from a country.

Trip cancellation cover – You’re covered up to $2,500 for non-refundable expenses incurred due to having to cancel a trip for reasons like accidental injury, death of you, a family member or travelling companion, certain illnesses, bad weather, strikes, unforeseennatural disaster at your home or destination and other valid reasons.

Trip interruption cover – You’re covered up to $2,500 for expenses incurred due to a trip that you have cancel part-way through for any of the same reasons listed above under trip cancellation cover.

Trip delay cover – You’re covered up to $500 for any non-refundable pre-paid accommodation or additional expenses arising from a delay of 6 hours or more, en route to or from your trip, due to a defined hazard covered in the policy. A per day maximum benefit of $250 applies here.

Baggage & personal effects cover – You’re covered up to $1,000 for loss, theft or damage to your baggage and personal belongings, provided that you took reasonable measures to protect, save and recover the item(s). A perarticle claim limit of $500 also applies here, so you won’t be reimbursed for that 16-inch Macbook Pro. There is also a combined maximum benefit of $500 for jewellery, watches, silver/gold/platinum items and items with animal fur.

Baggage delay – You’re covered up to $750 for personal expenses arising from baggage that’s been delayed for 12 hours or more. However, you can only claim a maximum of $150 for every day that your baggage is delayed. Furthermore, the cover only applies to your outward journey.

Accidental death & dismemberment cover – Reimburses you or your family up to $5,000 in the event of loss of life or limb due to a serious accident that occurs during your trip. The loss must occur within 365 days of the accident.

Generali Global Assistance 24-hour Assistance Services – With any World Nomads travel insurance plan you have access to this 24-hour service where you can get medical advice and referrals for dentists, physicians or medical facilities in the case of medical emergencies. The service will also arrange transportation (including an escort, if required) for you to a suitable treatment facility or to your home when it’s medically necessary.

Adventure sports & activities – The emergency medical cover applies in the case of injuries sustained while engaging in specified activities and non-professional sport. Over 150 activities and sports are covered under the standard plan. The full list is here.

Explorer plan

The slightly pricier explorer plan includes all the benefits of the standard plan, offers more generous claim limits for some types of cover, adds more types of cover and broadens the range of covered sports and activities.

Some of the activities the explorer plan exclusively covers are abseiling, aviation, ballooning, bouldering, bobsledding, bull riding, cave diving, cliff diving/jumping, construction & renovation work, free diving, hang gliding, jet pack, ice climbing, martial arts, mountaineering (up to 7,000m), parachuting, paragliding, parapenting, potholing, skydiving, trekking up to 7,000m and wingsuit flying.

There are still some excluded activities with the explorer plan, like base jumping and mountaineering above 7,000 m, as these are both incredibly risky.

This is the plan to go for if you’re planning to participate in any high-adrenaline extreme sports or activities during your trip, or if you plan to do any volunteering in construction, health care or disaster relief.

Here are the benefits of the explorer plan (for a Maryland, US resident):

Emergency Accident & Sickness Medical Cover – Claim limit remains the same as for standard plan ($100,000).

Emergency evacuation cover – Claim limit is increased to $500,000.

Repatriation of remains cover – Claim limit is increased to $500,000.

Non-medical emergency transportation – Claim limit remains the same as for standard plan.

Trip cancellation cover – Claim limit is increased to $10,000.

Trip interruption cover – Claim limit is increased to $10,000.

Trip delay cover – Claim limit is increased to $1,500.

Baggage & personal effects cover – Overall claim limit is increased to $3,000, per article limit is increased to $1,500 and the combined maximum benefit remains the same ($500).

Baggage delay – Claim limits remain the same ($750 and $150 per day maximum).

Gear & baggage cover – You’re covered for delayed baggage (12+ hours), damaged baggage, baggage stolen under your supervision, baggage lost by your air carrier in transit and stolen passports & IDs. To be able to claim you need to get a theft report or loss report from an authority.

Rental car damage – You’re covered up to $35,000 in the case of theft or damage done to a rental car while in your possession, provided that you can’t be held responsible for the damage or loss. This cover is not offered under the standard plan.

Accidental death & dismemberment cover – Claim limit is increased to $10,000.

Adventure sports & activities – The emergency medical cover applies in the case of injuries sustained while engaging in specified activities and non-professional sport. The explorer plan covers all the activities in the standard plan plus about 80 additional activities.The full list is here.

Note that the above is just what the standard and explorer plans cover for US residents.

UK residents, for example, will see slightly different looking policies that include some additional types of cover for incidents like hijackings, missed connections and natural catastrophes.

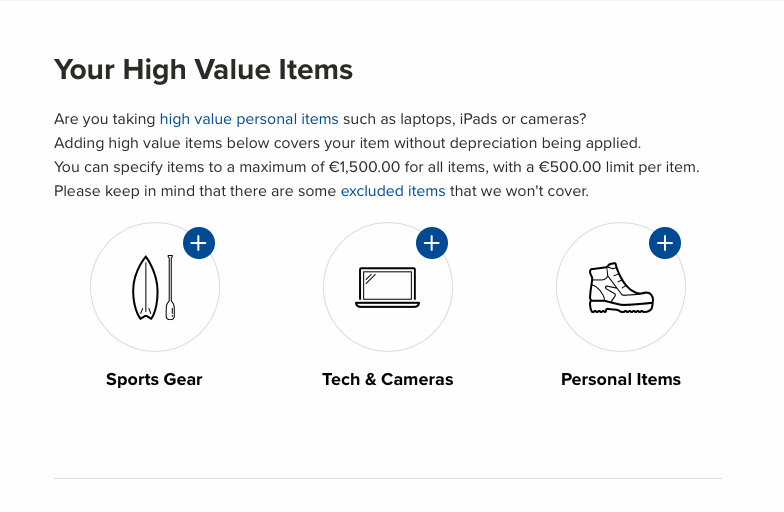

Specified items add-on

Residents of some countries will also have the option of including the specified items add-on as they make their way through the checkout process.

When you select the high value item add-on, your high value personal items like laptops, ipads, cameras and sports equipment are covered to their full replacement value rather than their value after depreciation.

The claim limits here can vary depending on your country of residence, but for residents of Eurozone countries for example, a total claim limit of €1,500 and a per article claim limit of €500 applies.

There is also an excess of €125 per person and there’s a list of items that are excluded, which includes musical instruments, antiques, precious stones (not set in jewellery), glass or china, hearing aids, dentures, prostheses, tools of trade, bicycles, bicycle accessories, dinghies, boats, vehicles (except for wheelchairs & pushchairs), vehicle accessories, mailed or freighted items and perishable items like food.

Pricing

As with other insurance policies, the price depends on your selected plan, trip duration, the coverage area, the country of residence, age and number of people you want to be covered under the policy, and a number of other factors.

In general though, plans start at around $120 per month for the standard plan, and over $200 a month for the explorer plan.

Just to give you an example, when I built a quote on the website I set my country as United Kingdom, my age as 30, my trip length as 1 month (21 Jan 2020 to 21 Feb 2020) and set the coverage area as “worldwide”,

I was then quoted a total price of £106.78 for the standard plan and a total of £131.72 for the explorer plan.

You can get your own personalized quote for your upcoming trip by filling out this form:

Note that when purchasing your insurance policy, you can also join the 80% of travellers who make an optional micro-donationof up to $10/£5/€5 to support the World NomadsFootprints program.

Through the Footprints program, World Nomads partners with various NGOs and non-profits and 100% of your donation goes directly towards sustainable community development projects in the developing world.

These include water and sanitation projects, health projects, education projects (improving schools) and agricultural projects (training farmers and creating "goat banks"). Over 1.25 million travellers have helped raise more than $3.4 million to fund more than 240 projects to date.

Pros

- Fairly comprehensive travel insurance cover at a reasonable price.

- Available to residents of over 140 countries.

- Large community of like-minded travellers (you're buying into a whole ecosystem).

- Covers a wide range of activities (the most out of any insurance provider we’ve reviewed).

- Easy to do everything online (make a claim, extend, renew etc.)

- Endorsed by Lonely Planet and several other large travel brands

- Gives you the option to donate to charity when you buy

Cons

- Could be more transparent; information about excesses, exclusions and special conditions is not readily available when casually browsing the website (requires a bit of digging). FAQ section is also very underdeveloped.

- Not the cheapest travel insurance option out there.

- Emergency medical cover limit is the bare minimum ($100,000)

- Plans are not very customizable

- Quite a few complaints about unresponsiveness and poor customer service.

Is World Nomads travel insurance for you?

If you’re a backpacker or adventure traveller living outside Europe and you’re looking for a comprehensive policy that covers an extensive range of activities, and you like the idea of joining a community of like-minded travellers that believe in giving back, then World Nomads would be right up your alley.

If you’re down with all that but you live in Europe, the other option that might suit you is The True Traveller (see below). They have more customizable plans than World Nomads and much higher claim limits for emergency medical expenses.

I’d advise you to compare The True Traveller very closely with World Nomads before deciding which policy is right for you.

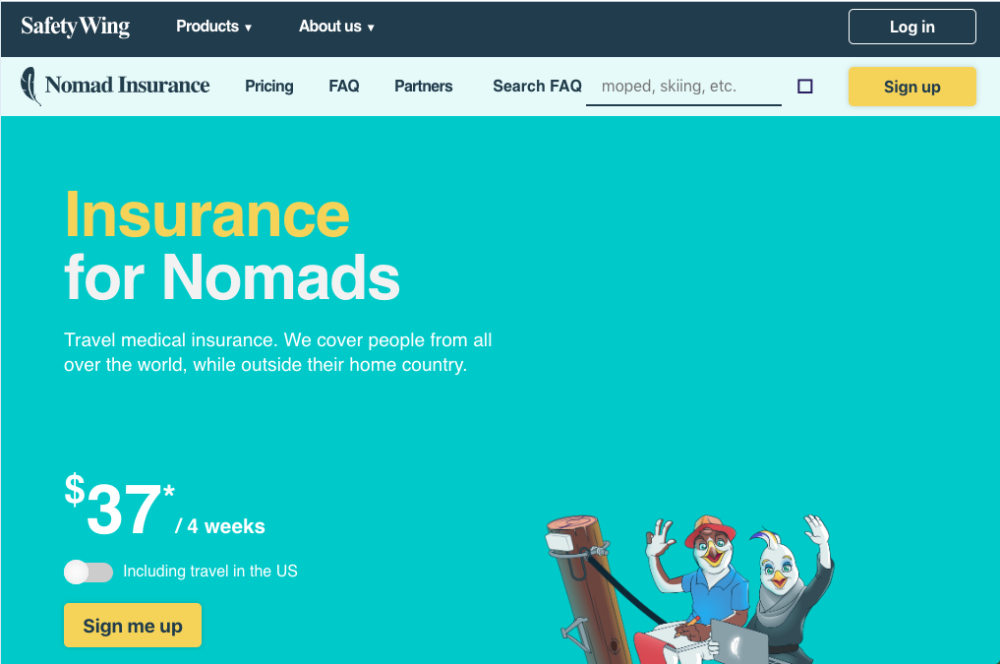

#2 - Safety Wing

Headquartered in California, US, SafetyWing is a relatively young travel insurance provider that was founded by three Norwegians in 2017.

This Y-combinator start-up markets itself as the first travel medical insurance provider for digital nomads, by digital nomads.

Unlike most travel insurance providers that are geared towards short-term vacationers, SafetyWing is designed to meet the needs of long-term travellers, entrepreneurs, online freelancers and remote workers who are travelling and living abroad for extended periods.

The travel medical insurance firm behind SafetyWing that processes all the claims is actually Tokio Marine HCC Medical Insurance Services (MIS) Group, which was established in Indianapolis in 1998 and is one of the largest insurance companies in the world.

Note that SafetyWing is not a primary health insurance, and will not cover things like cancer treatment, routine check-ups and pre-existing conditions.

As well as medical insurance, SafetyWing also provides standard travel insurance cover for things like trip delays, lost checked luggage, displacement due to natural disasters, accidental death & dismemberment, political evacuation and personal liability, although trip cancellation cover is omitted.

In the event that you require advice or medical treatment while travelling, SafetyWing support is available 24/7 and the company maintains a network of qualified doctors, hospitals and specialists, which you can search when seeking treatment options close to your location.

Using the medical partners in the SafetyWing network has the added benefit of the medical office often being able to bill your plan administrator directly, meaning that you won’t have any upfront costs.

So lets go ahead and take a look at their plans, coverage and pricing.

Plans

SafetyWing makes it really simple by only offering a single insurance plan, which is available to travellers of virtually every nationality, apart from those whose home country is Iran, Cuba or North Korea.

The plan covers you in over 180 countries (including limited cover in your home country) worldwide, with the three exceptions being (again) Iran, Cuba or North Korea.

You’re also not covered for kidnappings or express kidnappings in Afghanistan, Nigeria, Somalia, Venezuela, Pakistan, Afghanistan and any other country where SafetyWing is prohibited from paying claims due to Government-imposed sanctions.

The plan can be signed up for if you’re already travelling and includes a medical insurance component and a travel insurance component.

Medical insurance component

SafetyWing covers you for any medical treatment you might require if you suddenly fall ill or have an accident while travelling.

However, you are not covered if the injury or illness was related to a high-risk sporting activity (see the insurance policy for the full list of excluded sports) or a pre-existing injury or medical condition.

Moped accidents are covered as long as the accident isn’t subject to any exclusions like intoxication or racing. Cancer treatment is not covered.

A $250 deductible generally applies here unless stated otherwise, as well as an overall limit of $250,000, and a limit of $250,000 for any individual illness or injury.

If you are a resident of the US, eligible medical expenses incurred in the US are covered up to a maximum of 15 days for every 90-day period during which you are covered by SafetyWing insurance.

If your home country is not the US, your eligible medical expenses incurred in your home country are covered up to a maximum of 30 days for every 90-day period during which you are covered by SafetyWing insurance.

The following expenses are covered by SafetyWing’s medical insurance:

Hospital – Includes nursing and room services.

Intensive care – Up to the maximum overall limit of $250,000

Ambulance – The usual, reasonable ambulance charges when the illness or injury results in hospitalization as an inpatient.

Urgent Care – If the claim is incurred inside the US, you are responsible for the standard $50 co-payment. If the claim is incurred outside the US, you won’t have any co-payment to make. No deductible applies here.

Emergency Room - If the claim is incurred inside the US, you are responsible for a $100 emergency room co-payment. Outside the US there is no copayment.

Emergency dental – You’re covered up to $1,000 for emergency dental treatment.

Outpatient physical therapy & chiropractic care - You’re covered up to $50 a day, but the treatment must be ordered in advance by a physician.

Emergency eye exam – You’re covered up to $150, with a $50 deductible per occurrence. The normal deductible is waived here.

Acute onset of pre-existing condition - You're covered up to the overall limit of $250,000 and up to $25,000 lifetime maximum for emergency medical evacuation related to such.

All other eligible medical expenses – These are subject to the overall limit of $250,000.

Travel insurance component

As we mentioned previously, SafetyWing insurance also comes with some standard travel insurance cover that includes the following items:

Trip interruption – You’re covered up to $5,000 and there’s no deductible.

Travel delay - You’re covered up to $100 a day (max 2 days) in the event of a 12+ hour delay that calls for an unplanned overnight stay. There’s no deductible.

Lost checked luggage – You’re covered up to $3,000 per policy period and there’s a per item limit of $500. Additionally, there’s a lifetime limit of $6,000 and a family/group limit of $250,000. There’s no deductible. Note that electronics like cell phones, laptops and cameras are excluded.

Natural disaster – You’re covered up to $100 a day for 5 days in the event of a natural disaster that displaces you from accommodation you’ve paid for and that forces you to find a new place to stay. There’s no deductible.

Political evacuation – If you need to be evacuated to your home country or to the nearest safe country due to a political problem, the lifetime maximum limit of cover is $10,000. The US Government must have issued a level 3 or level 4 travel advisory for you to be able to claim. There is no deductible.

Emergency medical evacuation – The lifetime maximum cover is $100,000 and you will only be evacuated to the nearest suitable treatment facility, and only if the attending physician deems the evacuation medically necessary to avoid loss of life or limb. No deductible applies.

Emergency reunion - You're covered up to $50,000 if a family member has to be transported to see you during a medical emergency. The reunion period is limited to 15 days. No deductible applies.

Crisis response - You're covered up to $10,000 for a ransom you have to pay during a kidnapping or express kidnapping, for any personal belongings you have to surrender, and for all expenses incurred by Unity Resources Group as a result of your kidnapping. No deductible applies.

Personal liability – The lifetime maximum limit is $25,000. There is also a limit of $25,000 for third person injury, $25,000 for third person property damage and $2,500 for damage to the property of related third person. According to Safety Wing, a related third person means your relative, your traveling companion, your traveling companion’s relative, and any other person, individual or family member with whom you are residing or being hosted.

Accidental death & dismemberment – You’re covered up to $25,000 for the loss of one limb, up to $50,000 for the loss of two limbs and up to $50,000 for accidental death. Lower limits apply for those under 18. There’s also a $50,000 lifetime limit, a $250,000 group/family limit and there’s no deductible.

Common carrier accidental death - You're covered up to $50,000 (ages 18-69) if you die in an accident while riding on a common carrier (bus, taxi, passenger train, commercial airplane, cruise ship etc.).

Repatriation of remains - You're covered up to a $20,000 lifetime maximum. No deductible applies.

Local burial/cremation - You're covered up to $10,000 lifetime maximum. No deductible applies.

Pricing

SafetyWing nomad insurance is extremely affordable, coming in at just one third of the price of its main competitors.

It's priced according to age and where you’ll be travelling.

10 - 39 years - $37 for 4 weeks if travelling outside the US or $68 for 4 weeks including travel within the US

40 – 49 years - $60 for 4 weeks if travelling outside the US or $111 for 4 weeks including travel within the US

50 - 59 years - $94 for 4 weeks if travelling outside the US or $183 for 4 weeks including travel within the US

60 – 69 years - $128 for 4 weeks if travelling outside the US or $250 for 4 weeks including travel within the US

Note that US citizens cannot choose the US add-on, although they can avail of the 15 days of home cover for eligible medical expenses for every 90 days they are insured.

If you don’t pay upfront (min 5 days, max 364 days), your plan will automatically renew every 28 days for a maximum of 364 days, unless you decide to cancel it, in which case you will be refunded fully minus a $25 cancellation fee if coverage has started.

After 364 days your policy will expire and you have to buy a new one, which you can keep doing until you reach 69 years of age (Safety Wing does not provide insurance for people older than 69 years).

Up to 1 child per adult or 2 children per family (child must be 14 days to 10 years old) can be added to the plan at no extra cost.

Pros

- Very affordable. Starts from only $9 a week if you're aged 39 or below and travelling outside the US.

- Flexible. You can choose your start and end dates precisely, or you can have your plan auto-renew every 28 days like a subscription if you don't know how long you'll be travelling for.

- Doesn't require proof of permanent address, so great for nomads.

- Worldwide coverage (180 countries) as well as limited home country coverage.

- 24/7 support and a large global network of medical partners

Cons

- Doesn't cover electronics in the event of baggage loss or theft

- Doesn't cover as many activities as the likes of World Nomads

- No trip interruption/cancellation cover

- Becomes less affordable for older people

- Only one plan to choose from

Is SafetyWing for you?

If you’re a nomad or long-term traveller looking for a very inexpensive travel insurance policy that puts extra emphasis on emergency medical cover, and you like the idea of having an automatically renewing policy that doesn’t require you to specify an end date to your trip, Safety Wing might be just the ticket for you.

However, if you travel with a lot of expensive electronics or gadgets and you’d like them to be covered too, you might want to steer clear of Safety Wing and check out the World Nomads explorer plan instead, which covers electronics up to a maximum per item value of $1,500.

#3 - True Traveller

The True Traveller is a London-based travel insurance provider that was started up in 2010 by three travellers who first met each other in the late 1980s when working for the same travel company in London.

Hence the company’s motto is “travel insurance designed by travellers”.

When it first started out in 2010 The True Traveller was an adventure holiday company that also sold travel insurance, but by 2014 the company had decided to focus only on selling insurance, so the holiday side of the business was shut down.

This decision was made because the demand for insurance began to far exceed that for adventure holidays.

Like World Nomads, The True Traveller provides comprehensive insurance cover for travellers.

But what sets them apart is how customizable their insurance is; you build your own plan from the ground up by choosing from a range of basic policies, activity packs and add-ons.

The firm is authorized and regulated by the FCA (financial conduct authority) and is covered by the FSCS (financial services compensation scheme), so you might be able to get compensation if the company goes bankrupt and can’t honour your claim.

Their policies are insured by AWP P&C S.A, better known as Allianz Global Assistance, which is part of the Allianz Group (the world’s largest insurance company).

Medical emergencies are handled by CEGA Group, one of the world’s leading air ambulance providers.

CEGA Group deals with over 40,000 medical emergencies each year and has an expert team of doctors, nurses, dentists, international assistance coordinators and translators covering more than 21 languages. They are at your service 24/7 every single day of the year.

Like some other insurance companies, True Traveller also believes in giving back and donates 55p to the David Sheldrick Wildlife Trust*(SWT) for every insurance policy they issue.

Regarding their trustworthiness, the company has garnered an impressively high average star rating of 4.8/5 on TrustPilot, being rated as “excellent” (5 stars) in 84% of the 2,700+ reviews.

Also, their claims acceptance record from April 2018 to March 2019 was 92.5%, which is higher than the latest reported industry average figure of 88%.

Like most insurance companies, The True Traveller has to reject a lot of claims for unnecessary cosmetic procedures, as well as a small number of claims for lost articles where the traveller had no proof of ownership and no evidence of loss.

We really dig the company’s website and found it to be very user-friendly and informative with regards to the finer details of the insurance policies. The sign-up process is a breeze, as everything is done online through the website and there’s no paperwork involved.

The True Traveller also provides worldwide cover that includes the US and Canada, although you can also choose to be covered within a smaller geographical area like just Europe or just Australia & New Zealand.

The only major downside with The True Traveller is that they will only insure those who are permanent residents of the UK or another EEA country (they have passporting rights due to being regulated by the FCA).

You can also sign up if you're a resident of Guernsey, Gibraltar, Jersey and Isle of Man, which are not normally included in the list of EEA countries.

However, UK residents that have been travelling, working or living abroad for more than 5 years are not entitled to NHS treatment anymore and are also not eligible for True Traveller insurance, unless they have private health insurance, in which case they may be eligible.

The True Traveller insurance policies are also not available to persons over the age of 65, so if you are 66 years of age or older, you would not be eligible.

*SWT was established in 1977 and is involved with wildlife conservation work in East Africa. The organization is best known for its orphan elephant rescue and rehabilitation program.

Policies

Before choosing your travel insurance policy with True Traveller, you have to first decide whether you want to take out a single trip or multi-trip policy. We’ll now explain the differences between the two.

Single trip

The single trip policy is exactly that, an insurance policy designed for a single trip.

With this type of policy, you can visit as many countries as you like (and each one for as long as you like) during your trip and the trip can last for as long as 18 months (if you’re 50 or younger) or 12 months (if you’re older than 50).

In the case that you need 24 months of cover to qualify for the IEC working holiday visa for Canada, the True Traveller can also arrange that for you.

You can also return home for a visit (Christmas, weddings etc.) during the trip, an unlimited number of times, for as long as you want each visit, without invalidating your insurance cover. The moment you arrive home your policy is temporarily suspended until the moment you resume your trip again. This applies to every pack (see the packs below).

If you’re already travelling and you want to take out an insurance policy, you can only choose the single-trip option (multi-trip is only available if you haven't already started travelling).

Multi-trip

The multi-trip policy is an annual policy that may be the better option if you plan to make several shorter trips throughout the year.

Individual trips that you make can’t exceed 30 days with the True Value and Traveller policies and can’t exceed 70 days with the Traveller Plus policy. See below for more info on these.

You can only select the multi-trip option if you’re not already travelling and when you request a quote it may not even appear as an option for you if there are more than 70 days between the trip start and end dates that you have entered.

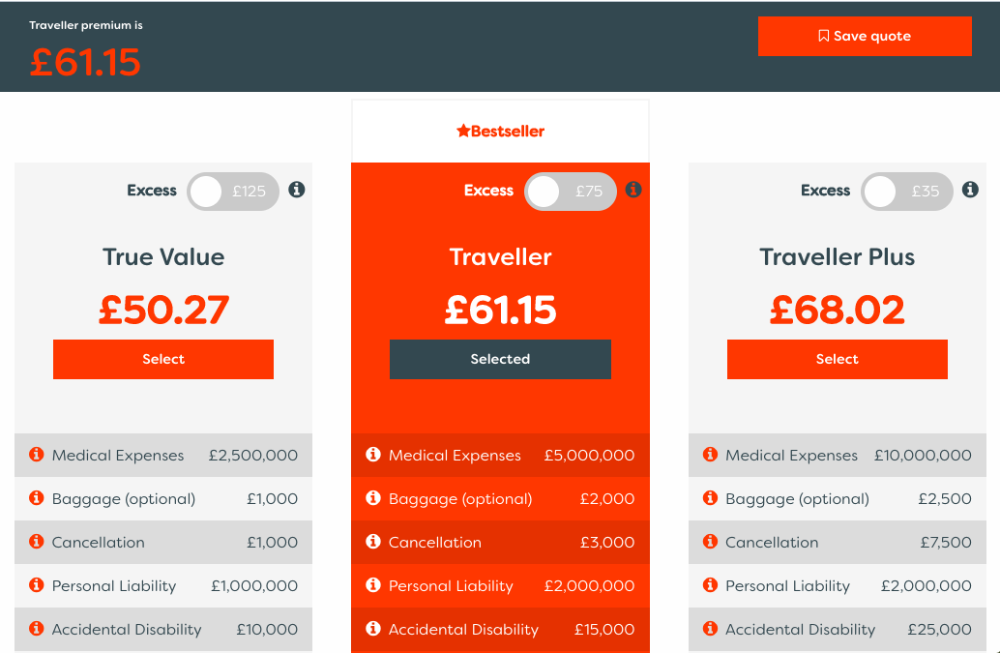

True Value, Traveller & Traveller Plus policies

True Traveller offers the same three policies for both single and multi-trips; True Value, Traveller and Traveller Plus.

The three policies have deductibles of £125, £75 and £35 respectively, but these can be waived by toggling a switch on the website if you are willing to pay a higher premium to do so.

Here is an overview of the three policies.

True Value policy

Thisis a budget policy aimed at backpackers and last-minute travellers and is only available to those who are under the age of 40.

Because it is the cheapest, this policy has the highest deductible of the three policies at £125 (you can pay a higher premium if you wish to waive it though) and also has the lowest claim limits and fewer items of cover than the other two.

True Value provides the following cover:

Medical expenses - You’re covered up to £2,500,000 if you suddenly fall ill or get accidentally injured. Emergency dental expenses and outpatient physiotherapy are also both covered up to £250.

Trip cancellation – You’re covered up to £1,000 if you have to cancel your trip before departure due to your own death, illness, redundancy, cancellation of leave (certain professions only) or the death, injury or illness of a close relative, business partner or the person you were visiting during your trip.

Personal liability - You’re covered up to £1,000,000 in case you get sued for accidentally injuring someone or damaging their property.

Accidental disability - You’re covered up to £10,000 if you lose a limb, become permanently disabled or lose your sight due to an accident. Those under the age of 16 at the time of the accident are not covered for permanent total disablement. Also, accidental death is covered up to £5,000 and up to £1,000 for those under 16.

Repatriation – You’re covered up to £2,500,000 if you need to repatriated due to becoming very poorly.

Legal expenses – You’re covered up to £7,500 for any legal expenses that The True Traveller incurs in pursuing compensation from a third party for causing death or injury to you.

Trip curtailment – You’re covered up to £1,000 if your trip has to be cut short due to accidental injury, illness or death, either your own or that of a close relative, business partner or a person you were intending to travel with or visit during your trip. The money is to compensate you for unused travel and accommodation expenses (as well as course/tuition fees) that you had already paid for.

Cash in hospital – You’re covered up to £10 a day (£100 in total) to cover incidental hospital expenses, or £25 a day up to £250 if you’re in hospital as a result of being mugged.

Traveller policy

This is a mid-range policy with decent cover and is the most popular policy. It’s targeted at holidaymakers and adventure travellers alike.

The deductible for this policy is £75, which is lower than that of True Value, but higher than that of Traveller Plus. It can of course be waived.

The benefits of upgrading to the Traveller policy are increased claim limits on most types of cover, as well as additional coverage for things not included in the True Value policy, like search & rescue, travel delay, travel abandonment, missed departure, hijack and financial failure protection (FFP).

The Traveller policy offers the following:

Medical expenses – Limit is increased to £5,000,000.

Trip cancellation – Limit is increased to £3,000.

Personal liability – Limit is increased to £2,000,000.

Accidental disability – Limit is increased to £15,000 and the accidental death benefit is increased to £10,000 (remains £1,000 for those under 16).

Repatriation – Limit is increased to £5,000,000.

Legal expenses – Limit is increased to £15,000.

Trip curtailment – Limit is increased to £3,000.

Cash in hospital – Limit is increased to £15 a day up to £150 max, or £50 a day up to a maximum of £500 if you’re in hospital as a result of being mugged.

The Traveller policy also includes the following additional coverage types that are not found in the True Value policy:

Search & Rescue – You’re covered up to £15,000 if the Government or a private organization tries to bill you for rescuing you in the event of severe weather conditions or a serious injury.

Travel Delay - If your flight, coach, train or sea vessel is delayed for more than 12 hours due to adverse weather conditions, breakdown or strike, you are covered by £25 for every 12 hours of delay, up to a maximum of £100.

Travel abandonment - If your flight is delayed for more than 24 hours for any of the reasons covered under travel delay (see above), you can abandon your trip and claim up to £3,000.

Missed departure – You can claim up to £500 for any onward connecting transport that you miss as a result of incidents like strikes, bad weather, breakdowns or road accidents holding you up or denied boarding due to overbooking. The money is to cover additional accommodation and transport costs resulting from the missed connection.

Hijack – In the event of a hijack, you are entitled to £50 in compensation every 24 hours throughout the duration of the hijacking event, up to a maximum of £1,500.

Financial Failure Protection (FFP) – You’re covered up to £1,500 in the event that one of the companies you’ve booked travel arrangements with goes bankrupt. The cover doesn’t apply to all-inclusive packages or cases where you are already insured.

Traveller Plus

This is the most expensive policy and it uniquely allows for unlimited 70-day trips (instead of unlimited 30-day trips) for those choosing the multi-trip option.

The Traveller Plus policy doesn’t provide any types of coverage that the Traveller policy doesn’t, but it does offer much higher claim limits for almost every type of cover.

Here is what you get:

Medical expenses – Limit is increased to £10,000,000

Trip cancellation – Limit is increased to £7,500

Personal liability – Same limit of £2,000,000

Accidental disability – Limit is increased to £25,000 and accidental death benefit is increased to £15,000 (remains £1,000 for those under 16)

Repatriation – Limit is increased to £10,000,000

Legal expenses – Limit is increased to £25,000

Trip curtailment – Limit is increased to £7,500

Cash in hospital – Limit is increased to £25 a day, up to £250, or £75 a day up to £750 if you are hospitalized as a result of being mugged.

Search & Rescue – Limit is increased to £25,000

Travel Delay – Limit is increased to £35 for every 12 hours of delay, up to £140 max

Travel abandonment – Limit is increased to £7,500

Missed departure – Limit is increased to £1,000

Hijack – Limit is increased to £100 per day and to a total of £3,000

Financial Failure Protection (FFP) – Limit is increased to £5,000

A brief note on extending policies

One nice thing about The True Traveller is that, if your existing policy hasn’t yet expired, you can take out an extension policy (up to a further 12 months) at a 10% discount if during a trip you decide you want to travel longer than you had originally bought cover for.

The 10% discount only applies however if the new period of cover is equal to or less than the existing period.

If the extension is non-voluntary, where you are forced to extend your cover because your return home was delayed by factors outside of your control (cancelled flight, illness etc.), then you can receive up to 31 additional days of cover at no extra cost.

Also, if your policy expires while travelling, you can still buy a new one on the road without any issues. To prevent fraud, your new policy only comes into effect 48 hours after being taken out, although serious injuries resulting from accidents are still covered within this 48-hour buffer period.

After choosing your policy

Once you have chosen one of the three basic policies, there are also optional add-ons that you can add to the mix.

You can choose one of four activity packs, a winter sports add-on and other add-ons like “baggage, money & documents”, specified items, travel disruption, collision damage waiver excess and trip resumption.

We’ll break these down a bit further now.

The four activity packs

You can choose from, in order of ascending price, the traveller pack, adventure pack, extreme pack and ultimate pack.

Each pack covers all of its own activities in addition to all the activities in all of the packs that precede it. The only exception to this rule is the traveller pack, which only covers its own activities (since it doesn't have a pack that precedes it).

Traveller pack

This is included as standard in all the policies and covers you for 92 common travel activities, which include administrative, clerical or professional work, or working as a classroom teacher, classroom assistant, au pair, bartender and waiter.

This pack also covers riding motorcycles up to 125 cc on roads, as long as you’re wearing a helmet and hold a valid license in your country of residence for riding one. If you’re from the UK you are also covered if you’ve taken a CBT (compulsory basic training) course, even if you don’t have a full license.

Note: You’re advised against riding motorcycle taxis (which you’ll come across in Asia and parts of South America), although you are allegedly covered by all packs when wearing a helmet and riding pillion on bikes that are less than 125cc.

Adventure pack

The adventure pack covers all 92 of the activities in the traveller pack as well as a further 43 (slightly riskier) activities, such as scuba diving (up to 40 m), bungee jumping, mountain biking (only off-road and cross-country), white water rafting and spearfishing.

This is the pack chosen by most backpackers as it adds cover for trekking up to 4,600 m (ideal for the Inca trail, which doesn’t climb any higher than dead woman’s pass at 4,215 m), as well as providing cover for manual work and volunteering.

So, if you’re planning to do fruit-picking, general farm work, light construction & DIY, medical work, wildlife conservation or community project work, you would need this pack.

You are even covered for climbing Mt. Kilimanjaro with the adventure pack, even though its summit (Uhuru peak) soars to a height of 5,895 m, although this is the only instance where you are covered at over 4,600 m with this pack.

The adventure pack extends the cover for riding a motorcycle on roads to bikes over 125 cc, but again this is only provided you have an appropriate license and are wearing a helmet.

Extreme pack

As the name suggests, this pack adds cover for a list of 20 moderately hazardous activities including rugby, American football, scuba diving (up to 50 m), tandem paragliding, trekking over 4,600 m (but not mountaineering), potholing/caving (as part of a group only), flying a light aircraft, trapeze/high wire, mountain biking (downhill trails) and more.

This pack would cover you if you planned to trek to the likes of Mera Peak (6,476 m) or Island Peak (6,189 m) in Nepal, as neither of these summits require any mountaineering skills to reach.

Note however that if you are trekking in Nepal, all policies and activity packs come with a £750 excess for helicopter/air ambulance evacuations. This deductible cannot be waived by taking out the excess waiver.

The company has had to implement this high excess due to the ridiculous numbers of people (almost 2,000 people per season) having to be rescued while trekking in Nepal, most commonly due to AMS (acute mountain sickness).

The extreme pack also covers you if riding a motorcycle under 250cc off-road.

Ultimate pack

This pack adds 10 more (particularly high-risk) activities, and of course includes all the other activities in all the other packs.

The 10 newly added activities are mountaineering (up to 6,000 m), ice climbing (no soloing), paragliding/parapenting, polo, powerbocking, full-distance triathlon/Ironman, hang gliding, parachuting, parasailing/parascending, sea cliff climbing (no soloing), skydiving- tandem skydiving (more than 1 jump), ultramarathon (up to 250 km and no polar cover).

Add-ons

Once you've chosen an activity pack, you can also select from a range of optional add-ons. Note that some of these are just for show and won't actually increase your premium if you toggle them on, but others will increase your premium.

Winter sports add-on

The winter sports add-on is necessary for you to be covered for injuries or repatriation as a result of an injury incurred while skiing, snowboarding or participating in other winter sports during your trip.

There are two winter sports add-ons to choose from.

One option provides cover for up to 21 non-consecutive days during your trip (available if you are travelling for longer than a month) and should be chosen if you only plan to do winter sports occasionally during the trip.

The other option provides continuous winter sports cover for the entire duration of your trip.

Activities covered under the winter sports add-on include ice hockey, skiing, cat skiing, skiboarding (snowblading), snowboarding, snowmobiling, snowshoeing, kitewing sailing on snow, snowbiking, snowrafting, tobogganing and more. Make sure to read the special conditions and exclusions for these carefully.

Baggage, money & travel documents add-on

The overall limit of cover when you choose this add-on depends on what policy you’ve chosen.

For True Value the overall limit is £1,000, for Traveller it’s £2,000 and for Traveller Plus it’s £2,500.

There are also different limits for individual articles depending on what policy you’ve chosen, as follows:

True Value policy

Cash (£150), passport & visas (£150), money & documents (£450) valuables (£200), delayed baggage (£25 for every 12 hours of delay up to £75 max) and a single article limit of £100. The £125 deductible does not apply to delayed baggage but does apply to all the others.

Traveller policy

Cash (£250), passport & visas (£250), money & documents (£650), valuables (£350), delayed baggage (£40 for every 12 hours of delay up to £120 max) and a single article limit of £250. The £75 deductible does not apply to delayed baggage but does apply to all the others.

Traveller Plus policy

Cash (£500), passport & visas (£300), money & documents (£1,000), valuables (£400), delayed baggage (£50 for every 12 hours of delay up to £150 max) and a single article limit of £300. The £35 deductible does not apply to delayed baggage but does apply to all the others.

Note: “Valuables” here refers to electronics (drones, cameras, lenses, laptops, ipads, mobiles etc.), jewellery, watches, furs, binoculars, telescopes, musical instruments, sports & leisure equipment and other items.

Specified items add-on

This add-on lets you add extra cover against damage, loss or theft for up to three very valuable items (camera, laptop, mobile phone etc.), up to a limit of £450 on the Traveller and True Value policies and a limit of £750 on the TravellerPlus policy.

One-way add-on

Did you know that most insurers won’t cover you unless you’re travelling on a return ticket?

Well, that’s not the case with the True Traveller, where cover on a one-way ticket is a standard feature of every policy.

The way it works is that you are insured on a one-way ticket until you arrive at your final destination where you plan to settle and until you take up permanent residence there.

You can travel for up to 18 months on a single policy if you’re 50 or under, or for 12 months if you’re aged over 50. If you want to travel for longer than this you can take out an extension policy for a further 12 months or buy a new policy.

Selecting the one-way add-on actually won’t cause your premium to increase since one-way cover is standard with the True Traveller - the add-on is only shown to reassure people that they’ll be covered on a one-way ticket.

Travel disruption add-on

This add-on protects you in the event of natural disasters, volcanic ash or civil unrest causing your return trip (final flight of your journey) to your home country to be delayed.

Given such an eventuality you are covered for:

Additional accommodation (up to £50 per day or £1,000 in total)

Food & drink (same limits as accommodation and excludes alcohol)

Alternative travel arrangements necessary to return home (up to £350)

Essential medication that was prescribed pre-trip (up to £100)

Essential items or services other than food & drink (£10 per day up to £100)

Additional hotel-to-airport transport costs if your pre-paid transport is 45+ mins late (£25)

Vehicle collection cost if you return through an alternative airport that was not on the original itinerary (up to £100)

Additional parking fees incurred in your home country due to delayed return (up to £50)

Additional kennel/cattery fees incurred in the UK due to delayed return (up to £100 in total)

Trip resumption add-on

Normally when you return home early from a trip and make a claim, your travel insurance policy ends right there and then, regardless of the trip end date that you chose in the beginning.

But when you select this add-on, your insurance policy won’t expire after coming home and making a successful medical or trip curtailment claim.

Not only that, but True Traveller will arrange the necessary flights to get you back to where you were, as well as flights to get you home at the end of your trip, up to £1,500. You just have to notify them within 30 days of returning home that you wish to resume your trip.

Note that this add-on can only be selected if you’re travelling for more than 32 days.

Collision Damage Waiver Excess add-on

Collision damage waiver is an agreement that a car hire company makes to waive the costs of damage done to the car you're renting in the event of a collision. Unfortunately however, this type of insurance usually comes with a high deductible.

The add-on therefore covers you for this high excess. You’re covered for car rentals up to 31 days in any given rental period, up to a maximum of £1,500 for each claim, as well as up to £500 if the car keys get lost, damaged or stolen. You’re not covered for motorcycles, buses, vans or campervans.

Pricing

Your insurance premium with The True Traveller is based on multiple factors.

When you first ask for a quote on the website, you’ll be entering details like your country of permanent residence, your trip start & end dates, the number and age of all the travellers you wish to cover under the policy and the part of the world that you'll need cover for.

Regarding the coverage area, you have five options, namely UK only, Europe, Australia & New Zealand, worldwide excluding North America, and worldwide including North America.

These factors are all considered, along with the type of trip (single trip or multi-trip) the type of policy (True Value, Traveller, Traveller Plus) and any add-ons that you select.

Just to give you an example, if I set my country as the UK, my age as 30, my trip length as 30 days and my cover as “worldwide”, the prices are £72.69, £88.44 and £98.35 for the True Value, Traveller and Traveller Plus packs respectively. That’s with the traveller activity pack and no add-ons selected.

If I then select the adventure pack and choose the baggage, money & travel documents add-on, the premium increases to £117.11, £139.49 and £151.54 for the True Value, Traveller and Traveller Plus packs respectively. Your results may vary.

There’s a 14-day cooling-off period after taking out your insurance policy, where you can receive a full refund of your premium if you decide to cancel. The refund only applies if the policy hasn’t yet started.

Note that if you return home from a trip earlier than expected you won’t be able to get a refund for the part of your trip that you didn’t use the cover on.

Pros

- Highly customizable travel insurance policy with lots of add-ons and even the ability to change add-ons (winter sports, activity packs etc.) or your geographical area of coverage when already travelling.

- Comprehensive coverage at competitive prices

- Great for long-term travellers. Single trip policies can be taken out for up 18 months (if under 50) with the possibility to extend for a further 12 months.

- High limits for emergency medical cover (£2,500,000 on cheapest plan)

- Highly rated on TrustPilot (4.8/5)

- Relatively high claim acceptance rate (92.5%)

- Policies include financial failure protection (FFP)

Cons

- Only available to permanent residents of the EEA, the Channel Islands and the Isle of Man.

- Per article claim limit for valuables (which includes electronics) is rather low

Is True Traveller for you?

If you’re an adventure traveller or backpacker residing in the UK or Europe and you’re looking for a pretty comprehensive, highly customizable, reasonably priced travel insurance policy, you’d be hard pressed to find a better option than this.

But if you feel you need greater coverage for your electronics, gadgets and other valuables, I’d suggest World Nomads instead, as they offer higher per article claim limits, especially in their explorer plan.

#4 - Medjet

Adventure travellers are particularly at risk of sustaining grave injuries or contracting infectious diseases that may require medical evacuation.

But some travel insurance policies don’t provide this crucially important medical evacuation cover and for those that do, it’s usually the insurance company that decides where you’ll receive treatment. You don’t have a say in the matter. In most cases, they’ll usually only be willing to transfer you to the nearest appropriate medical facility.

But most of the time when you fall severely ill or get accidentally hurt during a trip, you don’t want to be treated in a foreign medical facility, even if the calibre of treatment is world class.

After all, the doctors and nurses treating you may not even speak English and your friends and family can’t be there to give you moral support.

What you really want is to be treated in a country that you’re familiar with, preferably in a hospital with a physician that you know and trust, where your circle of friends and family can come and visit you while you’re in recovery.

Well, the good news is that this gaping hole in regular travel insurance policies has been filled by a company called Medjet.

Founded in 1991, Medjet is an industry pioneer, specializing in medical evacuation insurance as a compliment to a traveller’s regular travel insurance policy (it’s not designed to be a replacement for it).

As the company mentions on its website’s home page, one in 30 trips end in a medical emergency or safety concern, so MedJet is getting a lot of travellers out of deep doo-doo.

If you’re hospitalized more than 150 miles from home, either domestically or internationally, and you meet the inpatient criteria (i.e. you are hospitalized as an inpatient), Medjet will provide, at your request, a bedside-to-bedside transfer service from the foreign hospital to the hospital of your choice in your own country.

The transfer does not have to be medically necessary (this sets Medjet apart from other travel insurance providers who will only transfer you if not doing so would threaten your life) and there is also no limit on the cost of the medical transfer.

Whether you just need to be transferred from one US state to another, or from New Zealand all the way to Canada, you’re covered by Medjet.