.jpg)

If you've already read our article about how to avoid banking fees while travelling, you'll know that there are a few simple tactics that you can employ to circumvent certain banking fees.

For example, banking fees such as those incurred by opting for DCC (dynamic currency conversion) at the ATM machine or when paying the hotel bill are easily avoidable by just opting to be billed in the local currency when you're given the choice.

The vast majority of banking fees however are not so easily avoided by travellers. In reality, the only practical way to avoid most banking fees is tohave the right credit card or bank account.

In order to realize cost-free banking, you must possess a credit card or bank account that will allow you to avoid all of the following charges:

- Account maintenance fees

- International ATM withdrawal fee (flat fee)

- Foreign Bank ATM withdrawal fee (flat fee)

- Foreign transaction fees (percentage-based fee)

If you can avoid all of these, then you'll be virtually free of all the most common banking fees.

Now, depending on which country you’re from, you may not be able to find a bank account or credit card that waives all four of these fees. For example, very few checking accounts or credit card providers will reimburse you for third-party ATM fees.

However, no matter what part of the world you’re from, you should be able to find a credit card or checking account that waives at least some of these fees. Obviously, the more fees waived, the better.

To help travellers, we've prepared a list of the 11 best debit and credit cards for travelling. We've singled out the cards that waive most or all of the 4 banking charges mentioned above.

The list focuses on Europe, North America, Canada and Australia so if you're residing in one of these regions, you should definitely be able to find a card or two that will do the job for you. Without further ado, here is the list of our top picks.

Europe

1. N26 Mastercard Debit Card

The N26 Mastercard Debit Card is one of the cards that we personally use when travelling and is a true godsend for many European travellers that are currently being hit heavily with banking fees.

With N26, you'll only pay a 1.7% fee on foreign currency ATM withdrawals, as compared to the 3% that most banks charge and often that in addition to a flat fee. There are also no foreign transaction fees for card purchases with N26 bank.

We urge you to apply as soon as possible because applicants who sign up before the promotional period ends will not have to pay a monthly maintenance fee for the mastercard. If you wait too long, there'll be a €2.90 monthly fee, making the account somewhat less attractive.

Although N26 is a German bank, you do not necessarily need to be of German residence or nationality to set up a checking account and start using the debit card while you travel.

In fact, you can also set up a N26 account if you are a resident of any country within the Eurozone, except for Cyprus and Malta.

Setting up an account is very straightforward and can be done online via video call in less than 10 minutes. You just have to show the details of your passport and provide some other basic information about yourself. They will then ship the card to your home address.

The account works in conjunction with the N26 smartphone app, for which you’ll need at the very minimum Android 4.3 or iOS version 8. Inside the app you can view your balance and transaction history, send money and control the settings of your account.

Apart from the low fees, what we love about N26 is the amount of control and responsibility you’re given over your account.

You can block or enable ATM withdrawals, online card payments, card payments abroad or card payments in general. You can also set your own daily card payment and ATM withdrawal limits.

Read our full review of N26 here.

Important card/account facts:

- Mastercard/Cirrus Network

- No international ATM withdrawal fees

- No foreign transaction fees except 1.7% fee for foreign currency ATM withdrawals

- 5 free withdrawals per month in Euro currency, €2 charge for each additional withdrawal

- No account maintenance fees for applicants who apply now, otherwise a monthly fee of €2.90 applies for the optional mastercard.

- Card can be blocked or unblocked in one tap via the N26 app

- Available to residents of Germany and 7 other European countries

2. DKB Visa Credit Card

The DKB Visa card is one of the best European credit cards for travellers, but the kicker is that only native German residents speaking fluent German can open an account.

Account? Yes, this is a credit card that works in conjunction with a checking account. We will explain more about how that functions in just a moment.

One of the best things about this card for travellers is the reimbursement for all third-party ATM fees – an exceedingly rare but awesome benefit in today’s banking world. This benefit, along with no account maintenance fees (in fact you receive 0.5% pa interest on your balance) and zero foreign transaction fees, means you have the perfect recipe for fee-free banking while you travel.

Because it is a credit card, purchases made using the card will be on credit and will not immediately impact your account balance. When the balance is due later in the month, it will be deducted from your account balance.

If your account becomes ‘overdrawn’ and you don't pay back the full balance by the due date, you will be charged overdraft interest, but not to worry as the rate is much lower than the high interest rates that most other credit card companies will charge on any outstanding balance.

If you travel a lot within Germany, the card will also benefit you with its City Cashback scheme, where you can receive discounts at many local shops and business, by merely presenting the card. The DKB cashback app (available for iOS) shows you all the nearby places where savings can be made with the card.

With the DKB Special scheme, you can also get free admission into soccer games in the German soccer league and even a free admission to the tallest tower in Germany – the Berlin Television Tower (368 m).

Important card/account facts:

- Visa/Cirrus Network

- No account maintenance fees

- No foreign transaction fees

- No international ATM withdrawal fee

- Third-party ATM fees reimbursed

- 0.5% pa interest rate on balance

- Discounts and free tickets with City Cashback & DKB Special schemes

3. Halifax Clarity Credit Card

This is an absolutely top-notch credit card for UK travellers due to its virtually non-existent costs.

Travellers will be very pleased to hear that the Halifax Clarity Credit Card comes with no annual fee and no foreign transaction fees – two of the most costly banking fees when you're on the road.

Even cash advances from a foreign bank’s ATM machine are free (excluding any fees the foreign bank may charge), although you will be charged interest of 18.95% APR or greater on the cash advance. You can of course pay this balance off immediately via Internet banking to avoid being charged interest.

Important card facts:

- Mastercard/Cirrus Network

- No annual maintenance fee

- No foreign transaction fees

- No cash advance fee for ATM withdrawals

- Variable APR 18.95% - 25.95%

- Available to UK residents aged 18 or over

4. Aqua Reward Credit Card

The Aqua Reward Credit Card is another great option for travellers residing in the UK. It comes with a lot of the same money-saving benefits as the Halifax Clarity Card but with a few important differences.

Firstly, it’s an easier card to get for those with lower credit scores and secondly, it offers a tempting 0.5% cash back on all spending, whether you spent the money at home or abroad. The maximum cash back reward is £100/year, which you’ll receive if you spend £20,000 or more.

We must also mention that this card is best used only for spending, as you’ll be charged a rather high APR of 44.9% on ATM cash withdrawals and what’s more, there’s a 3% cash withdrawal fee (minimum £3). In countries where cash is king, you’d be better off trying to apply for the Halifax Clarity One or just switching to a debit card.

Important card facts:

- Mastercard/Cirrus Network

- No annual fee

- No foreign transaction fees

- 0.5% cash back reward each year (max £100/year)

- 44.9% APR on ATM cash withdrawals

- 3% cash withdrawal fee (min £3)

- Credit limits are quite low (from £250 - £1250)

- Available to UK residents over 18

North America

5. Charles Schwab High Yield Investor Checking Debit Card

This virtually cost-free online checking account initially looks too good to be true; except that it is true.

The Charles Schwab High Yield Investor Checking Account is an outstanding bank account even for most non-travelling US citizens but is especially rewarding for those that regularly venture overseas or travel domestically.

The account offers a slew of awesome benefits but the most remarkable benefit of all is the fact that it reimburses you for all third-party ATM fees incurred either while using out-of-network ATMs in the US or when travelling abroad.

This reimbursement is the final piece of the puzzle for travellers looking to realize the dream of 100% cost-free banking while on the road.

Other nice perks include earning interest on your balance (0.1% APY variable interest rate), the ability to deposit paychecks with a few taps on your mobile and overdraft protection (protects you from overdraft fees), which you must opt into manually.

Tragically for many of us, it is only available to US residents.

Important card/account facts:

- Visa/Plus Network

- No account maintenance fee or account minimum

- No international ATM withdrawal fees

- No foreign transaction fees

- All third-party ATM fees fully reimbursed

- Earn interest on your balance (0.1% APY variable interest rate on balance)

- Free bill paying and free checks

- Easy mobile paycheck deposits

- Real overdraft protection (requires opt-in)

- FDIC insurance up to $250,000

- Comes with a linked Schwab One brokerage account with no fees or minimums

- Available to U.S residents only

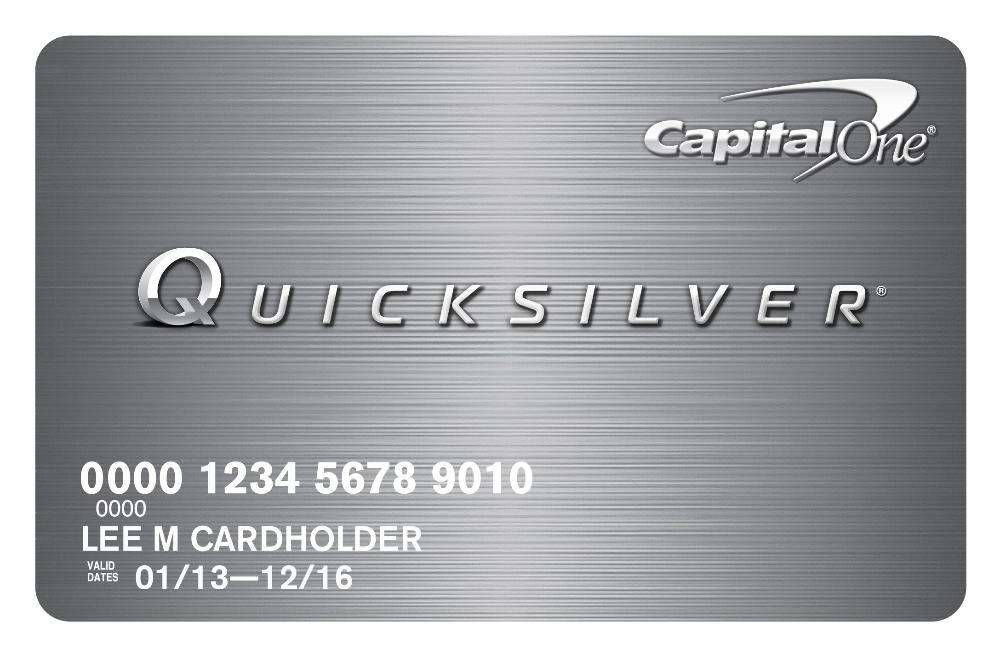

6. Capital One Quicksilver Credit Card

Fee-hating US travellers that are looking for the right credit card to take with them overseas need look no further than the Capital One Quicksilver Cash Rewards Credit Card.

The absence of any account fees or foreign transaction fees get this card off to a great start and the cash back offering of 1.5% on every purchase could be quite lucrative if you spend a lot. You will also be granted a $100 cash bonus if you spend $500 with the card within the first 3 months.

As with the vast majority of credit cards, it’s really not the best idea to use this card too much for ATM cash withdrawals while travelling. If you do so you’ll incur either a $10 or 3% fee (whichever is greater) and a 23.49% APR interest rate from the moment you withdraw.

Important card facts:

- Visa/Plus Network

- No annual maintenance fees

- No foreign transaction fees

- 1.5% cash back on every purchase

- $100 cash bonus if you spend $500 within first 3 months

- 0% APR for first 9 months, 13.49%-23.49% variable APR afterwards

- 3% fee for balance transfer

- $10 or 3% fee (whichever is greater) for ATM cash advance

- 23.49% APR on cash advances

- Late payment fee up to $35

- Only available to US residents

Canada

7. Tangerine Chequing Debit Card

With most of the usual banking fees conspicuously absent, the Tangerine Chequing Account is the ideal bank account for Canadian travellers.

Tangerine is an independently operated subsidiary of Scotia Bank and that means that you can make free withdrawals at over 3,500 Scotiabank ABMs (automated banking machines) nationwide. Out-of-network withdrawals in Canada will cost you $1 however.

While abroad, you can avoid withdrawal fees by using ATMs that fall under the Global ATM Alliance (there are over 50,000 of them across 40 countries) although it is still unfortunate that there is a $2 fee for withdrawing from a non-member bank.

Other appealing benefits of this account are the free unlimited daily chequing transactions, which include debit purchases, bill payments and e-mail money transfers, the interest accrued daily on your account balance.

There’s also a very nice $50 bonus waiting if you sign up using a friend’s orange key and make a minimum deposit of $100.

Important card/account facts:

- Mastercard/Cirrus Network

- Member of Global ATM Alliance

- No account maintenance fees

- No foreign transaction fees

- Free unlimited daily chequing transactions

- ATM withdrawals abroad free with Global ATM Alliance partners, $2 fee otherwise

- Overdraft protection available

- First book of 50 cheques is free, $12.50 per cheque book afterwards

- Cheque-In feature within mobile banking app allows you to instantly deposit cheques via smartphone/tablet by taking a picture

- Get a $50 bonus for referring a friend

8. Amazon.ca Rewards Credit Card From Chase

.jpg)

Canadian travellers seeking the perfect credit card to accompany their chequing account need look no further than the Amazon.ca Rewards Visa Card issued by Chase bank.

The biggest benefits of this card for travel are obviously the waived annual fee and foreign transaction fees, not to mention the 1% cash back that you receive on all purchases. If you tend to buy a lot from Amazon, the card will reward you even more handsomely with its 2% cash back on all Amazon purchases.

You probably won’t complain either about the $20 Amazon.ca free gift certificate that will be credited immediately to your account upon being approved the card.

As with most credit cards, you’ll want to avoid using it for cash advances as there’s a minimum charge of $5 or 1% of the cash amount - whichever is greater.

Important card facts:

- Visa/Plus network

- No annual fee

- No foreign transaction fees

- 2% cash back on amazon.ca purchases, 1% anywhere else

- Free $20 Amazon.ca gift certificate sign-up bonus

- Paperless billing not available

- 19.99% interest on cash advances, balance transfers & purchases

Australia

9. Citibank Plus Every Day Debit Card

The Citibank Plus Every Day Account is just about the most attractive current account for Australian travellers due to the absence of all the usual banking fees.

The major benefits that this account offers to Australian travellers are the waived account maintenance fees, ATM withdrawal fees and foreign transaction fees but the incentives don’t stop there.

You can also make free international money transfers to any bank account worldwide, even if it’s in another currency.

Those who like to wine and dine may also derive benefit from the Citibank dining program, which entitles you to a free bottle of wine every time you pay with your debit card at participating restaurants.

Important card facts:

- Visa/Plus Network

- No annual maintenance fees or minimum balance

- No foreign transaction fees

- No international ATM withdrawal fees

- Free international money transfers (instant to Citibank

- Free bottle of wine each time you dine at Citibank Dining Program partner restaurants and pay with your debit card

- Only available to permanent Australian residents over 18

10. 28 Degrees Platinum Credit Card

If you’re Australian and you travel a lot, the 28 Degrees Platinum Credit Card will allow for fee-free international transactions, thereby making it a contender for the best credit card for Australians who spend plenty of time overseas.

In addition to waiving foreign transaction fees, there is also no annual fee with this card, although as per normal with credit cards, there is a cash advance fee for ATM withdrawals (in this case a minimum of $4), so it’s best to use a debit card for those.

You also have a relatively lengthy 55-day interest-free period on purchases with this card, giving you plenty of time to pay back the balance in full.

The card also offers shopper’s protection for a small fee and travellers who could do without the hassle of booking their own hotels, flights, restaurants, appointments etc. will no doubt be glad to hear that the card also comes with a complimentary concierge, which is available 24/7 by calling customer solutions.

Important card facts:

- Mastercard/Cirrus Network

- No annual fee

- No foreign transaction fees

- Excellent shopper’s protection (comes with a small fee)

- Complimentary concierge

- Cash advance fee is 3% or $4 – whichever is greater

- 21.99% interest rate on purchases and cash advances

- 55 days interest-free on purchases

- Only available to Australian citizens over 18

11. Bankwest Zero Platinum Credit Card

The Bankwest Zero Platinum Credit Card is the main rival of the aforementioned 28 Degrees Platinum card and the other main contender for the best credit card for Australian travellers.

This card offers many of the same money-saving benefits to travellers as the previous card, including waived foreign transaction fees and no annual fee.

You also receive complimentary travel insurance with this card, whenever you purchase a return ticket to another country overseas. The insurance is valid for 6 months and additional terms & conditions are attached so do read those.

There’s also a complimentary concierge included with the card – your very own personal assistant available 24 hours per day to help you with booking any flights, hotels, restaurants or appointments.

The card offers additional benefits to shoppers, with its three main types of buyer protection and they are:

- Purchase security cover: Gives you three months of free insurance against loss, theft or accidental damage on goods purchased anywhere in the world ($125,000 max annual claim).

- Purchase price guarantee: Allows you to claim the difference if you find a lower price for an item you purchased printed in a catalogue. Minimum claim is $75 and the maximum is $1,000.

- Purchase extended warranty: Gives you a warranty period of up to 12 months on purchased items.

As compared to 28 Degrees, interest rates for purchases are slightly lower at 17.99% and you have the same grace period of 55 days to pay off the balance. Cash advances from foreign bank ATMs are again going to cost you and with this card the minimum fee is $4.

Important card facts:

- Mastercard/Cirrus Network

- No annual fee

- No foreign transaction fees

- Complimentary travel insurance with 6 months validity if you purchase a return overseas travel ticket (subject to additional terms & conditions)

- Excellent protection for shoppers

- Complimentary concierge

- 17.99% pa interest rate on purchases, 21.99% pa on cash advances

- 55 days interest-free on purchases

- Cash advance fee of 2% or $4 – whichever is greater

- Available to Australian residents over 18 (temporary residents with a 457 visa may also apply)

If you have any comments, questions or concerns regarding any of these cards, please leave your comment below. What card do you travel with?

JOIN OUR LIST

SUPPORT US

FOLLOW US

ABOUT US

Our names are Eoghan and Jili and we hail from Ireland and India respectively.

We are two ardent shoestring budget adventure travellers and have been travelling throughout Asia continuously for the past few years.

Having accrued such a wealth of stories and knowledge from our extraordinary and transformative journey, our mission is now to share everything we've experienced and all of the lessons we've learned with our readers.

Do make sure to subscribe above in order to receive our free e-mail updates and exclusive travel tips & hints. If you would like to learn more about our story, philosophy and mission, please visit our about page.

Never stop travelling!

FOLLOW US ON FACEBOOK

FOLLOW US ON PINTEREST

-lw-scaled.png.png)