The 15 Best Bank Accounts (+ Financial Tools) For International Travellers in 2021

Financial transactions are involved in just about every aspect of travel, whether you’re paying for flights, bus tickets, taxi rides, hotel rooms, restaurants, groceries, beers, tours, guides, laundry services…. the list goes on.

And all that transacting is just for recreational travel. Add running an online business or freelancing into the mix and the traveller’s financial world becomes even more convoluted and challenging to manage cheaply and effectively.

Rather problematically, most banks slap pesky fees (sometimes hidden) on top of most travel-related transactions and these deductions can quickly begin to add up, causing you to lose hundreds or even thousands of dollars per year to your home bank.

One of the biggest culprits is currency conversion fees, which are normally a percentage-based fee (usually 2.5-4%) added to each card purchase or cash withdrawal you make in a foreign currency.

Many banks also charge the dreaded international ATM withdrawal fee, which is a flat fee imposed in addition to the currency conversion fee (as if that wasn’t enough of a sting already).

Fees aside, many bank accounts are just generally ill-suited to international travel for such reasons as:

- The associated apps, phone banking and online banking platforms leave a lot to be desired in terms of functionality and user-friendliness

- The bank freezes your card when you forget to notify them that you’re going abroad, leaving you without cash when you need it most

- The bank doesn't send real-time notifications about activity with your account which leaves you vulnerable to hackers.

- The bank may impose their own inconveniently low limits on ATM withdrawals and card payments (limits that you have no control over).

- You may only be able to activate new mobile numbers, add new payees, and perform certain other tasks by waiting days for a physical letter to arrive in the mail.

- You may have to make a physical appearance at one of the bank’s branches in order to open an account (impractical if you're always travelling)

But luckily for us travellers, a new wave of challenger banks such as N26, Revolut, Monzo, Starling and Monese has flooded the banking landscape in the past few years to address these shortcomings of high-street banks, especially where international travel is concerned.

Challenger banks have made banking cheaper, faster, more convenient and totally paperless (even the account opening process). They’re great news for everyone, but especially for those who travel a lot.

Because they give you more control over your card security settings and spending limits, and will send real-time notifications to your phone to instantly alert you to any activity on your account, these banks are also potentially safer to use.

We actually advise safety-conscious travellers to open an account with a neobank in our guide to travel safety for this very reason.

But it’s not all about the neobanks since there are also a number of travel-friendly bank accounts offered by traditional high-street banks, if you know where to look.

In this article we’ve rounded up the very best bank accounts and financial tools (money transfer services, prepaid debit cards etc.) for international travellers and digital nomads from Europe, the UK, the U.S, Canada and Oceania.

During our research we compared a multitude of different bank accounts and tools but the ones that ultimately made the list had certain features in common, including:

- zero annual/maintenance fees

- minimal or zero fees for cross-currency card payment international transfers and overseas ATM withdrawals

- the ability to open the account online or from a mobile app in minutes

Once you’ve opened up one or two of these accounts and started using some of the tools you should immediately begin to save money on overseas transactions like ATM withdrawals, card payments and international money transfers.

Without further ado then, here is our list of the 15 best bank accounts and financial tools for international travellers and digital nomads.

The 15 best bank accounts + financial tools for international travellers & digital nomads

Europe & UK

European travellers have become quite spoilt for choice in recent years with a number of newly spawned FinTech digital banks providing travel-friendly current accounts with slick mobile apps and great customer service. Here are the best accounts for residents of Europe and the UK.

1. N26

Originally known as Number 26 when the Berlin-based start-up first launched back in January 2015, N26 has established itself in the eyes of many as the most mature and trustworthy mobile bank in Europe.

Personally, I have been doing most of my travel banking with N26 since the beginning of 2016 and it’s one of the very best options for European travellers in my opinion.

N26 acquired its full European banking license from the ECB (European Central Bank) in July 2016 and surpassed the 2 million customer milestone back in November 2018.

N26 now serves residents of 24 European countries including the UK, and has its sights set on breaking into the U.S market next.

All N26 accounts are in Euro or GBP (for UK customers) with no options to add other currencies. The account is very much designed to be managed through the N26 mobile app, but there is also a web app, which lets you do online banking from PCs or laptops.

N26 offers a free N26 standard account, a free N26 business account, an N26 black account that costs €9.90 a month, and N26 Metal, which is the bank’s premium offering and costs €14.90 a month.

The free N26 standard account has no setup fees, no annual fees and no minimums.

ATM withdrawals in the same currency as your account (GBP or Euros) are free, but there’s a 1.7% charge for foreign currency withdrawals. Within the Eurozone most users can make five ATM withdrawals for free every month.

N26 Business is essentially the same as the standard account and has no annual or monthly fee, but it's designed for freelancers and remote workers. The main differences are that you receive 0.1% cashback on all card purchases and you can also have 2 in-app sub-accounts.

N26 Black comes with several extra perks like free unlimited foreign ATM withdrawals worldwide and comprehensive travel insurance cover provided by Allianz Global Assistance Europe.

N26 Metal throws in a few more extras like free express delivery of your Mastercard debit card, premium customer service and access to exclusive N26 partner offerings.

In-store and online card payments with all accounts use the Mastercard exchange rate and there are no foreign transaction fees added for cross-currency purchases.

SEPA transfers (within the Eurozone) are free with N26, while international money transfers are powered by Transferwise (see more about the Transferwise Borderless Account below), which currently allows you to send money to 19 foreign currencies.

Like other FinTech banks, N26 gives you great control over your account security and within the mobile app you can freeze/unfreeze your card whenever you wish.

You can also enable/disable online payments, payments abroad and ATM withdrawals, and set your own daily withdrawal and payment limits.

Real-time push notifications ensure that you always know immediately when there’s any activity in your account and can freeze your card immediately if you see any fraudulent transactions taking place.

The N26 app also has a number of other nice features like automatic categorization and tagging of expenses, and "statistics", which gives you spending insights and a breakdown of what you're spending your money on.

“Moneybeam” also makes it easy to split expenses with friends, by letting you quickly send money to your phone contacts or request money from people who owe you.

“Spaces” lets you create different money compartments within the app and divide your balance between them – a useful feature if you’re trying to reach a savings goal for a holiday or something.

Beyond its basic banking functions, N26 has also launched a number of other products including N26 Overdraft, N26 Insurance, N26 Credit, N26 Invest and N26 Savings, though many of these are only available in Germany presently.

Note that N26 has no physical branches and neither cheque nor cash deposits are possible for users of most nationalities. German customers can however use CASH26 to deposit cash into their N26 accounts at 9,000 supported retailers nationwide.

N26 is a complex financial product and we don’t have time to cover every aspect of banking with N26 here, so if you wish to learn more you should check out our in-depth N26 review, which covers virtually everything you need to know.

As with other neo-banks, setting up an N26 account is a very quick and straightforward process that should take you less than 10 minutes.

You can get started by registering your details on the N26 website. Once you've done that and confirmed your e-mail you’ll need to download the N26 app to your phone or tablet, choose your desired N26 product and then verify your identity (submit ID document and selfie holding your ID).

It can take up to 5 business days to have your documents approved but once everything looks good, your contactless MasterCard debit card will be posted to your address (free delivery), which needs to be in Europe. Card delivery time is usually 4-14 days but can vary outside that range.

Customers from Germany, Austria and the Netherlands can also get a free optional Maestro Card.

The final step of the process is to pair your N26 account with your smartphone, which you can do by following the instructions within the app.

Summary:

- Mobile-first bank headquartered in Berlin, Germany

- Available to residents of 24 European countries (including UK)

- No setup fees, annual fees or minimum balance

- Mobile and web apps to manage your account

- Four main products - N26 standard, business, black and metal

- Contactless chip-and-pin Mastercard debit card (Maestro card also available in Germany, Austria & Netherlands)

- ATM withdrawals free in the Eurozone, 1.7% fee for foreign currency withdrawals (fee waived for N26 Black & Metal)

- Mastercard exchange rate for cross-currency card payments (no foreign transaction fees added)

- SEPA transfers are free, international money transfers are powered by Transferwise (up to 8 x cheaper than traditional banks)

- Standing orders and direct debits are supported

- Easily split bills, request money and send money to contacts with Moneybeam

- Real-time push notifications

- Freeze/unfreeze card, enable/disable online payments, overseas payments and ATM withdrawals, set daily limits for card payments and withdrawals

- “Spaces” lets you compartmentalize money within your account, which can help you reach savings targets

- Additional products include N26 insurance, N26 credit, N26 overdraft, N26 Savings, N26 invest, although these have yet to be launched outside of a select few countries

- No cheque deposits, cash deposits in Germany only with CASH 26

- Apple Pay and Google Pay supported

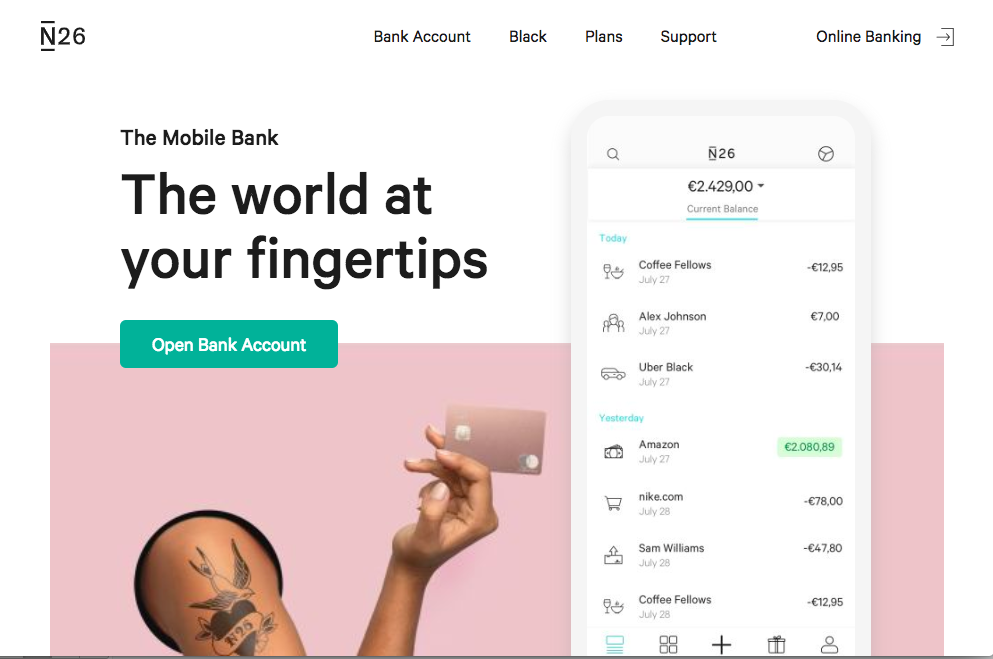

2. Revolut

Revolut is a London-based, mobile-only challenger bank that has a great deal in common with N26.

N26 and Revolut are actually the two leading challenger banks in the European market and have been in fierce rivalry with one another over the past several years.

We put the two banks head to head for traveller's to compare in our detailed N26 vs Revolut comparison guide.

Revolut made its debut in July 2016 and surpassed the 3 million users mark in 2018. The firm has expanded more aggressively than N26 and currently offers its services to residents of 32 European countries, which comprise of all the EEA countries plus Switzerland.

Despite its rapid growth, Revolut has yet to become a fully-fledged bank and many people use it as more of a prepaid debit card for holiday spending than as a fully functional bank account.

For the time being deposits with Revolut are not protected under any compensation scheme, but your money is held in a segregated account with Lloyd’s or Barclays under the current e-money regulations.

Unlike with N26, your Revolut account allows you to hold up to 24 different currencies and you can easily interconvert between all the currencies within the app at the real-time interbank rates.

Another important difference is that your Revolut account can only be accessed through a mobile app on a smartphone or tablet device. There is no web app for Revolut like the one N26 has.

Revolut offers a free standard account, Revolut premium for £6.99 a month, and Revolut Metal for £12.99 a month.

There is also a Revolut business account, which comes with three plans for £25, £100 and £1,000 a month respectively.

.jpg)

With the Revolut free standard account you can withdraw €200 for free every month and after that there’s a 2% fee. There’s a fee of €5.99 to order your debit card and additional cards, whether physical or virtual, also cost €5.99 each.

Revolut Premium increases this free ATM withdrawal limit to €400, removes the £5,000/€6,000 per month limit for fee-free cross-currency transactions and adds overseas medical insurance cover, free global express delivery (debit card is delivered within 3 business days to anywhere in the world), discounted device insurance and priority customer support.

Premium also grants you the use of virtual disposable cards, which help to combat fraud by only being valid for a single online payment. With Premium it’s also free to order additional physical and virtual debit cards.

Revolut Metal has all the benefits of premium but bumps up the free ATM withdrawal limit to €600 a month, tacks on an exclusive personal concierge service, and grants you up to 0.1% cashback on all payments within Europe, and up to 1% cashback on all payments outside Europe.

Revolut uses the real-time interbank exchange rate for all cross-currency card payments, although there's a 0.5% surcharge if you spend more than £5,000/€6000 in a month if you're on the free plan (no limits for paying users).

Additionally, at weekends there is a mark-up of 0.5% on major currencies and a mark-up of 1% on non-major currencies.

Moreover, four specific currencies (Thai Baht, Russian Ruble, Ukrainian Hrynvia and Turkish Lira) receive a markup of 1% on weekdays and a 2% markup at weekends.

Revolut supports international money transfers in 26 currencies to 150+ countries worldwide at the interbank exchange rate (0.5% surcharge for free account if you transfer above £5,000/€6,000 in a month ), although there is a small markup with select currencies on weekdays and on all currencies at the weekend.

The Revolut physical prepaid debit cards are contactless, chip-and-pin cards and the network can be either Visa or Mastercard, depending on what country you reside in.

You can link up to two physical cards to your account and can also add multiple virtual debit cards for online payments.

Like N26, Revolut makes splitting bills with friends a cinch, especially with its Near Me technology, which automatically detects other Revolut users in the vicinity and lets you send or request money from them. It’s also easy to request money from non-Revolut users by sending a Rev Me link.

When it comes to card security settings, Revolut gives you even more options than N26, letting you also control swipe payments (ones that use the magnetic stripe) and contactless payments.

You can also turn on location-based security, which blocks in-store payments if your phone and card are in different locations at the time of purchase.

Revolut can help you reach savings targets with “Vaults”. With this feature you can make automatic recurring payments into a savings vault to help you save for that holiday or whatever.

Vaults can also automatically round up each purchase you make to the nearest whole number and add the spare change to your savings vault where it starts piling up - you can accelerate or decelerate the rate at which funds accumulate too.

Revolut even lets you buy, sell, exchange and and transfer 5 different cryptocurrencies (Litecoin, Bitcoin, Bitcoin Cash, Ethereum and Ripple) within the Revolut ecosystem. It’s powered by a licensed and regulated exchange called Bitstamp.

The bank is working hard to launch other products like overdraft, credit (currently only available in the UK), investing and savings accounts, so it’s lagging a bit behind N26 in that regard.

With Revolut, insurance cover is included with the paid accounts, but if you’re on the standard free account you can also buy travel insurance and gadget insurance as additional extras, though you can only get cover for a maximum period of 40 days.

Other nice features of Revolut are its real-time notifications, budgeting tools to help you control your spending and the ability to analyze your spending. You can also set up recurring payments and direct debits (only supported in Euros currently).

Setting up a Revolut account is only possible through the mobile app, but the process is very quick and easy and can literally be done in less than 60 seconds after registering your mobile number and personal details.

Once your account is created you’ll need to upload a selfie and a valid Government-issued ID in order to activate it.

Unfortunately, you do have to pay a fee of €5.99 for the delivery of the debit card and you can expect it to take up to 9 days to arrive, unless you’re opting for a paid account where you get free global express delivery (three business days).

Summary:

- Mobile-only bank based in London, England

- Available to residents of 32 European countries (all EEA countries + Switzerland)

- No setup fees, annual fees or minimum balance

- Four main products - Revolut standard, business, premium and metal

- Hold up to 24 different currencies in your account and swap between them whenever you like at the interbank rate

- Contactless, prepaid Mastercard or Visa debit card

- Add additional virtual debit cards (online payments only) for a fee of €5.99 each (waived for paid accounts), disposable virtual debit cards available to paid account holders

- No card top-up fees

- ATM withdrawals free for the first €200/€400/€600, depending on account type, 2% fee thereafter

- Interbank exchange rate for cross-currency card payments (small markup on certain currencies on weekdays and on all currencies at weekends)

- International money transfers processed at interbank rate (again, a small markup may apply for certain currencies on weekdays and at weekends)

- Direct debits supported (Euros only), recurring payments supported

- Easily split bills, request money and send money to contacts and also to non-contacts with Near Me technology

- Real-time push notifications

- Freeze/unfreeze card, enable/disable online payments, ATM withdrawals, contactless payments, swipe payments, location-based security, set monthly limits for card payments and cash withdrawals,

- “Vaults” lets you send recurring payments to a savings vault and round up payments to the nearest whole number, helping you to accrue funds

- Additional products include overseas medical insurance, gadget insurance and credit (only available in the UK)

- Cheque deposits and cash deposits not supported

- Apple Pay and Google Pay supported

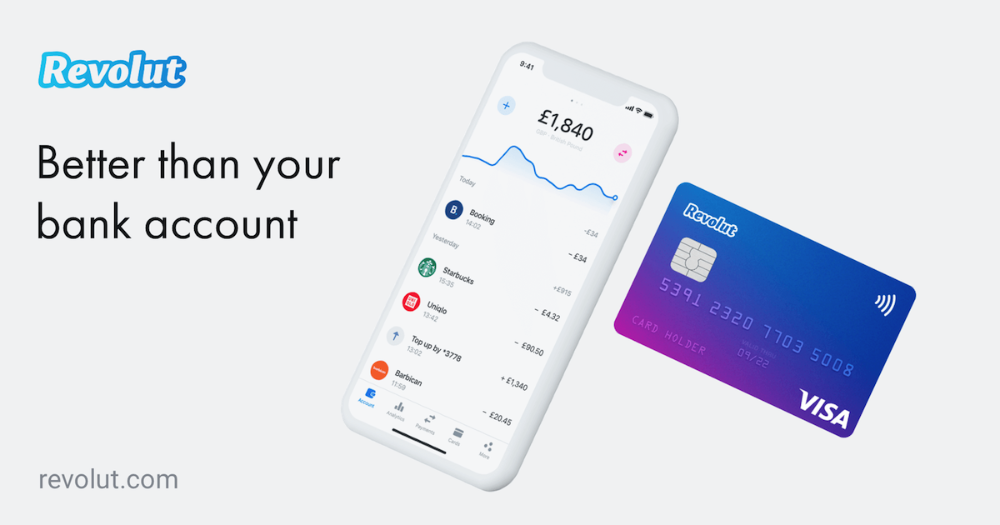

3. Monzo

Monzo is a London-based challenger bank that has a lot in common with other challenger banks like N26 and Revolut.

It was already well established in the UK long before N26 launched there in November 2018, and by September 2018 Monzo had already reached the 1,000,000 customers milestone, which is quite impressive considering that that number consists exclusively of UK users.

Although currently only available to UK residents, Monzo has plans to launch its products in Ireland next, and has already obtained the necessary passporting permission to do so.

Monzo Bank Ltd has been a fully-fledged bank since April 2017 and is authorized by the PRA (Prudential Regulation Authority) and regulated by the PRA and the FCA (Financial Conduct Authority).

Monzo has a reputation for providing world-class customer service, receiving an NPS (Net Promoter Score) of +80, which is the highest of any UK bank. The average score across UK banks was only +4 in 2017.

With Monzo, as with Revolut, you can only manage your account through the accompanying mobile app and there is no web app.

Unlike Revolut and N26, Monzo has no premium or paid bank accounts - it only offers a free current account.

After setting up your Monzo account you’ll be issued your free contactless Monzo MasterCard debit card, which is linked to your GBP bank account (one currency only).

You can withdraw up to £200 every 30 days free of charge with the card and if you exceed the limit there’s a 3% surcharge.

As with N26, the Mastercard exchange rate is applied to all cross-currency payments and there are no foreign transaction fees added.

International money transfers are powered by Transferwise and domestic UK bank-to-UK bank transfers are supported natively and are almost instant, as well as free.

As expected from a challenger bank, Monzo also makes it easy for you to split bills, request money and instantly send money to friends and contacts. It uses a Bluetooth-powered technology called “nearby friends”, which works like Revolut’s Near Me.

Monzo also has a feature called Pots that lets you create “pots” to segregate your funds so that you can more easily reach savings targets.

Pots works very similarly to Revolut’s Vaults, and can have your purchases rounded up to the nearest whole number and the extra cash deposited into your pot.

You can only sign-up for Monzo via the mobile app and after registering your details and getting your identity verified your free MasterCard debit card will be posted out to you, for which you’ll need to have a UK address. Delivery normally takes 2 working days.

Summary

- London-based, mobile-only bank

- Available to UK residents only

- Free current account in GBP (no premium or paid accounts)

- Contactless MasterCard debit card

- ATM withdrawals free up to £200 GBP every 30 days, 3% thereafter

- No foreign transaction fees on cross-currency payments (Mastercard exchange rate)

- International money transfers powered by Transferwise, domestic transfers free and almost instant

- Easily split bills, send money and request money from contacts and by using "nearby friends" Bluetooth-powered technology

- "Pots" lets you segment your funds and reach savings targets more easily

- Freeze/unfreeze debit card in the app

- Real-time push notifications

- Standing orders and direct debits supported

- Overdraft available, no fees up to £20, 50p charge per day if you borrow more than £20

- Google Pay and Apple Pay supported

4. Starling

Founded back in 2014 by former Allied Irish Bank executive Anne Boden, Starling is yet another UK-based, mobile-only challenger bank that has a lot in common with the likes Revolut, Monzo and N26.

The bank was voted best British bank and best current account provider at the British Bank Awards 2018.

Starling is licensed by the FCA (Financial Conduct Authority) and regulated by the PRA (Prudential Regulation Authority).

It’s also covered by the FSCS (Financial Services Compensation Scheme), which means that your deposits are protected up to £85,000 in the unlikely scenario that the bank becomes insolvent.

Accounts are currently only available to UK residents over the age of 16, but the firm plans to expand to Europe next, with Ireland being the first country on the list.

The bank offers a number of different account options such as a personal account, business account, joint account, Euro account (coming soon) and teen account.

Like Revolut and Monzo, Starling is 100% mobile-based, so you can only manage your account from their mobile app and there is no web app like with N26.

Despite being a digital bank and having no branches of its own, Starling does have a relationship with the UK’s post offices, and customers can deposit or withdraw cash at over 11,500 post offices nationwide - a facility that’s not offered by other challenger banks in Europe.

It’s also possible to deposit a cheque by popping it in an envelope and mailing it (for free with the address "Freepost Starling") to the bank directly.

.png)

Founded back in 2014 by former Allied Irish Bank executive Anne Boden, Starling is yet another UK-based, mobile-only challenger bank that has a lot in common with the likes Revolut, Monzo and N26.

The bank was voted best British bank and best current account provider at the British Bank Awards 2018.

Starling is licensed by the FCA (Financial Conduct Authority) and regulated by the PRA (Prudential Regulation Authority).

It’s also covered by the FSCS (Financial Services Compensation Scheme), which means that your deposits are protected up to £85,000 in the unlikely scenario that the bank becomes insolvent.

Accounts are currently only available to UK residents over the age of 16, but the firm plans to expand to Europe next, with Ireland being the first country on the list.

The bank offers a number of different account options such as a personal account, business account, joint account, Euro account (coming soon) and teen account.

Like Revolut and Monzo, Starling is 100% mobile-based, so you can only manage your account from their mobile app and there is no web app like with N26.

Despite being a digital bank and having no branches of its own, Starling does have a relationship with the UK’s post offices, and customers can deposit or withdraw cash at over 11,500 post offices nationwide - a facility that’s not offered by other challenger banks in Europe.

Starling accounts come with a contactless MasterCard debit card, which will be posted out to your address free of charge.

One thing that’s nice about Starling is that you earn interest on your balance. The rate is 0.5% AER (annual equivalent rate) for balances up to £2,000 and 0.25% for balances between £2,000 and £85,000.

Another significant edge that Starling has over its competitors is that international ATM withdrawals are completely free with the debit card, with seemingly no limit to how much cash you can take out free of charge.

As with its rivals, all cross-currency card payments and withdrawals use the MasterCard exchange rate, with no foreign transaction fees or surcharges.

When it comes to international money transfers, Starling supports sending money abroad to 37+ countries in 20 currencies, with more to come in the near future. For the time being, you can only make international transfers from Monday to Friday.

The mid-market rate is used for all international money transfers with a fee of 0.4% added per transfer. Faster bank-to-bank SWIFT payments come with a flat rate fee of £5.50. Money can also be sent via a local partner with fees starting at 30p per transfer.

Like its cousins, Starling also makes splitting bills easy with Settle Up, and it also has its own “goals” feature to help you segment your money.

You can move a chosen sum of money over to the various goals that you create any time you want, and you can also set up recurring payments into your goals.

Within the Starling mobile app you can easily lock/unlock your card, report a card lost or stolen and toggle on/off things like ATM withdrawals, online payments, location-based fraud protection, gambling payments and mobile wallets (Google Pay, Apple Pay etc.).

Starling also gives you access to a “marketplace”, where you can choose from a wide range of third-party financial products and services that are integrated with Starling. Partners provide products like mortgages, savings accounts, insurance and investment platforms.

If you need credit, Starling offers a flexible overdraft where you can adjust the amount you want to borrow within your limit. Interest is accrued daily and is charged at 15% EAR (Equivalent Annual Rate).

However, there's a maximum monthly interest charge of £2 and if you’ve accrued less than 10p of interest at the end of any given month the interest will be waived.

Starling also allows you to apply for a personal loan with a few taps in the app. You can borrow anything from £500 to £5,000 depending on your circumstances. Once approved for the loan you’ll see the money appear immediately.

The personal loan is actually taken from your remaining overdraft, i.e you can only borrow as much as you have left in your entire available overdraft.

But the personal loan is different to the overdraft, in that the interest rate is lower, it’s for something specific, and there’s a pre-defined long-term repayment plan (12 months, 18 months etc.)

Setting up a Starling account is easy and will only take you 3 minutes. All you have to do is download the app from Google Play Store or the App Store, register your personal details and verify your identity by sending in a short video of yourself along with your ID documents.

The bank even provides a free current account switching service, which moves all of your incoming payments, outgoing payments, recurring payments like direct debits and standing orders, as well as all the money in your old bank account, over to Starling. The process is usually completed in 7 days and they’ll also close the old account for you.

Summary:

- London-based mobile-only bank

- Only available to UK residents

- Deposits protected up to £85,000 under the FSCS

- Deposit and withdraw cash at over 11,500 Post Office branches nationwide

- Deposit cheques by sending them in the mail

- Earn 0.5% AER on balances up to £2,000, 0.25% AER for balances between £2000 and £85,0000

- Free contactless Mastercard debit card

- Transfer money to 37+ countries in 20 currencies, 0.4% fee for international money transfers, £5.50 for SWIFT transfers

- Lock/unlock card, toggle on/off online payments, ATM withdrawals, gambling payments, mobile wallet payments etc.

- Real-time push notifications

- “Goals” lets you segregate your balance and helps you to reach savings targets

- Flexible overdraft and personal loans available

- Standing orders and direct debits supported

- Free current account switching service (takes 7 days)

- “Marketplace” offers pensions, mortgage, savings accounts, insurance etc. from other FinTech companies

- Apple Pay, Google Pay, Samsung Pay, Fitbit Pay & Garmin Pay all supported

5. Curve

Founded in 2015, Curve is a London-based FinTech start-up that has acquired more than 300,000 users and currently offers its services to residents of 27 countries in the EEA, and has plans to expand to the U.S in the future.

The company issues a contactless Mastercard debit card that consolidates all of your other bank cards through an accompanying mobile app, allowing you to make payments with any one of your bank cards using a single card.

The Curve card essentially embodies the concept of “one card to rule them all”.

At the moment Curve supports debit cards and credit cards that use Visa or MasterCard, but Amex cards are not compatible.

The way Curve works in practice is that you select one of your linked cards within the app with a finger tap, and that card then becomes the “active card” that will be debited whenever you use your Curve card to make ATM withdrawals, online payments, in-store payments and so on.

There are many advantage of having all your bank cards linked to a single “master” card including:

- It’s safer (you only risk loss or theft of one card, not all your cards at once).

- A one-card solution is minimalist and slims your wallet significantly (although you should still carry at least one backup card).

- If you need to replace a bank card while overseas, you don’t need to have the new card physically mailed to you (you can simply add the details of the new card to the Curve app).

- You only need to remember one PIN code, not several

- Detailed information about transactions is not always passed through to your bank or credit card company. Using your Curve card linked to an underlying credit card, you can often make an ATM withdrawal that will be classified as an online purchase, allowing you to avoid cash advance fees and interest.

- Because the Curve card itself is a debit card, you may be able to use your underlying credit card to pay for goods in stores where credit cards are not accepted

If the wrong person does happen to get their hands on your Curve card, they won’t get access to all your linked bank cards, since this information is encrypted within the Curve app.

Of course, the currently active underlying card is still vulnerable if your Curve card goes missing, but in that situation you can instantly lock your Curve card from within the app.

If you then manage to retrieve your Curve card, you can then unlock it, as long as you’re sure that the information hasn’t been compromised.

The only real disadvantage with the Curve card at this time is that it severs the link between merchant and credit card, so you aren’t protected under section 75 of the CCA (consumer credit act).

This means that the credit card company wouldn’t be jointly liable with the retailer for a disputed transaction involving your credit card (applies to purchases between £100 and £30,000)

There are also some daily, monthly and yearly spending limits when you start out, though these can be increased over time as your account passes risk checks.

The Curve debit Mastercard is currently available to residents of 27 EEA countries and the company plans to start shipping cards to Croatia, Cyprus, Greece and Slovakia this year (2019).

One feature that’s really unique to the Curve Card is the ability to go “back in time”. Essentially, this allows you to charge an already-completed purchase (up to £1,000) to a different card, up to 14 days after the original transaction took place. You no longer have to regret accidentally using the wrong card to make a purchase.

Curve currently offers three products: Curve Blue, Curve Black and Curve Metal.

Curve Blue is the free option and you’ll get the card delivered for free too. You can spend up to £500 abroad every month without incurring currency conversion fees, but after that there’s a 2% charge.

There’s also a mark-up of 0.5% added to the exchange rate (Curve uses the mid-market rate) at weekends for USD, GBP and EUR, and a 1.5% markup for all other supported currencies.

For foreign ATM debit card withdrawals, you can withdraw up to €200 per month for free and after that you’ll be charged 2% or £2 (whichever is higher).

With Curve Blue you get 1% instant cashback at 3 selected retailers that you can choose from a list of different options.

Curve Black costs €9.99/£9.99 a month and lets you spend up to £15,000 per year without incurring any currency conversion fees.

You can withdraw up to €400 per month from foreign ATMs via debit card free of charge (2% or £2 charge after that) and you receive worldwide travel insurance and electronic gadget insurance cover provided by AXA.

Note however that the Curve Black insurance is currently only available to residents of UK, Ireland, France, Germany, Italy, Portugal and Spain.

You also get 1% instant cashback at 6 selected retailers and you can choose from a slightly wider range of retailers than Curve Blue users.

Curve Metal is the premium option and gets you a metal card weighing 18 grams with three colour options (Blue Steel, Rose Gold and a limited edition Red).

It costs £14.99 a month (or £150 per year with annual subscription), is currently only available in the UK and has a 6-month minimum contract.

Additional perks with Curve Metal include heavily discounted (up to 60%) access to 1,000 + LoungeKey airport lounges worldwide, rental car collision damage waiver insurance, luggage cover, and up to £600 fee-free foreign ATM debit card withdrawals per month.

Getting started with curve is simple. Once you’ve downloaded the app from the Google Play Store or App Store, open it and register your personal details. You’ll then be asked to choose between Curve Blue and Curve Black and then you just need to add your first bank card in the app.

Once the added card has been verified you’ll receive a message saying that your Curve debit Mastercard is on its way. Delivery time is expected to be 5 days in the UK and 1 – 2 weeks in the EEA.

N.B*: Make sure you enter the code MDZXKOXN after choosing your Curve card and after you make your first transaction we'll both receive £5 worth of curve reward points, which can be used to make real purchases with the card (except for ATMs).

Summary:

- London-based FinTech start-up company

- Offers a “master” card to consolidate all your existing debit and credit cards via a mobile app

- Available to residents of 27 EEA countries

- Contactless Curve MasterCard debit card can be linked to Visa and Mastercard cards, but not Amex

- Three products – Curve Blue (free), Curve Black (€9.99/£9.99 a month) and Curve Metal (£14.99 a month)

- Earn 1% cashback at 3 (Blue) or 6 (Black) select retailers

- Free foreign ATM withdrawals up to £200 (blue), £400 (black) or £600 (metal) per month

- No currency conversion fees up to £500 per month (Blue) or £15,000 per year (Black), exchange rate marked up 0.5% (USD, GBP, EUR) or 1.5% (other currencies) at weekends

- Included worldwide travel insurance and gadget insurance by AXA (Black and Metal only, limited to certain countries)

- “Back in time” feature lets you charge completed payments (up to £1,000) to another card up to 14 days after the transaction took place

- Real time push notifications

- Google Pay and Apple Pay not yet supported

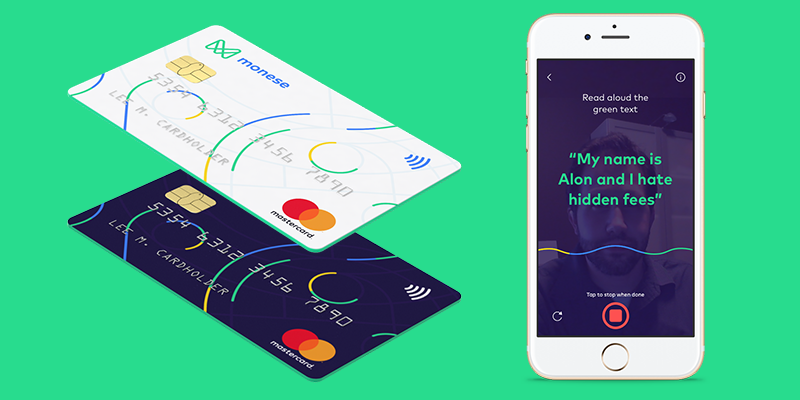

6. Monese

Founded in 2013, Monese is yet another London-based mobile-only bank that offers current accounts and money transfer services to U.K and EU residents.

The company started off by targeting migrant workers in Europe who were struggling to open a high-street bank account, and has since acquired more than 500,000 users.

Monese Ltd. is a registered agent of Prepay Technologies Ltd (PPS), which is an electronic money institution authorized by the FCA under the Electronic Money Regulations 2011 for the issuing of electronic money and payment instruments.

The bank is not covered by the FSCS (which only guarantees deposits up to £85,000), but instead the firm guarantees the protection of 100% of customer funds.

Monese is currently available to residents of the UK and 19 other European countries (Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, Spain and the UK).

As with Revolut, Monzo and many other neo-banks, your Monese account can only be managed via a mobile app (no online banking or web app available), so you'll need to have a mobile device like a smartphone or tablet to get Monese.

All Monese customers get a free Euro account with IBAN and BIC and also a free GBP account with sort code and account number.

The two accounts come with their own individual debit cards (Eurozone debit card and UK debit card) and these cards need to be ordered separately from within the app.

Monese offers four plans: the free Starter plan with no monthly fees, Plus (€4.95 a month), Business (€9.95 a month) and Premium (€14.95 a month).

The Starter plan charges €1 per ATM withdrawal, a 2% currency conversion fee (€2 minimum) for all cross-currency payments, and a 0.35% fee for an instant top-up of your balance using an EEA debit card (the fee is 2.5% for a non-EEA debit card), though you can deposit funds into your account for free via bank transfer. You also have to pay €4.95/£4.95 for delivery of your contactless Mastercard debit card.

The Plus plan allows for up to 6 free ATM withdrawals per month (£1/€1 fee thereafter), reduces the currency conversion fee to 0.5% - 0.75% (no minimum fee) and waives the €4.95/£4.95 card delivery fee. You still have to pay the 0.35%/2.5% fee for instant card top-ups.

The Premium plan allows for unlimited free ATM withdrawals, waives all currency conversion fees and allows you to make free instant top-ups.

You can only get the Business plan if you have a company registered with UK Companies House and some types of companies are excluded.

You get both a Business UK account and a personal account (with GBP and EUR accounts) for the €9.95/£9.95 a month. The Business Eurozone account should be coming soon.

The Business plan has its own contactless business MasterCard debit card and lets you upgrade your personal account to the Plus plan without you having to pay an extra €4.95 a month. Premium customers get a £5 discount if they’re on the Business plan.

SEPA transfers and UK Faster Payments are free for all customers and cross-currency transfers are converted at the interbank rate, though Starter plan and Plus plan customers have to pay a small FX transfer fee.

The foreign exchange fee is 2% (€2/£2 minimum) for the Starter plan and 0.5% (€2/£2 minimum) for the Plus plan. Customers on the premium plan get the interbank rate with no added fees.

All Monese customers can set up free direct debits on their GBP accounts, and there are plans to launch SEPA direct debits in early 2019. Recurring payments are also supported.

Unlike most mobile-only banks, Monese even supports cash top-ups at UK post offices (funds available next day) and Paypoint locations (instant).

For Starter plan customers, the fee for cash deposits is 2% (£2 minimum) at post offices and 3.5% (£3 minimum) at Paypoint locations.

Plus customers pay £1 per transaction in post offices and 2.5% (no minimum) at Paypoint locations, while Premium customers get completely free cash top-ups. Post-office top-ups normally take 1 day

As it is a FinTech bank, Monese has many the other features we’ve become used to seeing like real-time push notifications (which you can fine-tune in the app), spending analytics, the ability to request money from contacts, control over your debit card’s security settings and more.

Where Monese lags behind some of its competitors is that it doesn't yet offer any extra products such as travel and gadget insurance, overdrafts, loans, interest-gaining savings accounts, access to cryptocurrency and so on.

Setting up a Monese account is quick and easy and you won’t need to provide any proof of address (remember they started out by targeting EU immigrants).

Once you’ve downloaded the Monese app and opened it you’ll need to register your personal details, create your 5-digit passcode, verify your mobile number and then go through the automatic identify verification process (you can also verify manually if this fails).

To verify your identity you’ll need to upload one or two different kinds of ID (two if your address is not automatically validated) and you’ll probably be asked to upload a short video clip of yourself saying something like “my name is X and I love fair banking”.

After submitting your documents for verification you should hear back within 3 business days (I heard back the next day) and if you’ve been approved you can then log into the app and choose your desired plan. You can then order your MasterCard debit card(s) from within the app whenever you wish.

N.B*: Make sure that you enter the invite code EOGHA738 when prompted at the start of the account opening process. You will receive a €5 gift after you make your first deposit of €10 or more.

Summary:

- London-based mobile-only bank founded in 2013, launched in September 2015

- Available to residents of 20 European countries (including UK)

- Authorized by the FCA under the e-money regulations 2011, company guarantees protection of 100% of customer funds

- Mobile app to manage your account (no web app)

- Four plans: Starter (free), Plus (€4.95 a month), Business (€9.95 a month) and Premium (€14.95)

- All plans include free European account (IBAN & BIC) and free UK account (sort code & account no.)

- Currency conversion fees are 0% (Premium), 0.5% - 0.75% with no minimum fee (Plus) and 2% with €2/£2 minimum fee (Starter)

- Free unlimited ATM withdrawals (Premium), 6 free withdrawals per month and €1/£1 each thereafter (Plus), 2% with €2/£2 minimum fee (Starter)

- Instant card top-ups are either free (Premium) or cost 0.35%/2.5% (EEA/non-EEA debit card) for Plus and Starter customers

- Free SEPA transfers and UK Faster Payments

- FX transfers use interbank rate and are free (Premium), 0.5% with €2/£2 minimum (Plus), 2% with €2/£2 minimum (Starter)

- Cash deposits supported in UK post offices and Paypoint locations and are free (Premium), £1/2.5% (Plus) and 2% with £2 minimum/3.5% with £3 minimum (Starter)

- Card delivery fee is €4.95 on Starter plan, no delivery fee for other plans

- Free direct debits for GBP accounts, SEPA direct debits coming soon, recurring payments (standing orders) also supported

- Real-time push notifications

- Freeze/unfreeze card within the app

- No overdrafts, loans, insurance, investing, savings accounts, cryptocurrency etc.

- Apple Pay, Google Pay and Samsung Pay supported

7. Transferwise Borderless Account

Transferwise is a UK-based, FinTech money transfer service that has been saving people a ton of money on international bank transfers to its 50+ supported currencies since 2010 when it was founded.

The firm is now valued at $1.6 billion, has over 4 million users in 56 countries and is an authorized Electronic Money Institution that’s independently regulated by the FCA (Financial Conduct Authority) in the UK.

We reviewed TransferWise's money transfer service in our article on the 7 best international money transfer services for travellers, but here we'll be focusing on the company's borderless bank account.

The TransferWise borderless bank account was launched in May 2017, and lets you hold and manage more than 40 currencies under one bank account with no initial setup or annual maintenance fees.

The account is classified as an Electronic Money Account, and is not quite a fully functional bank account; your money is safeguarded but is not guaranteed by the FSCS (Financial Services Compensation Scheme).

The TransferWise borderless account is available to people of most nationalities, with just 22 countries and 2 U.S states (Hawaii and Nevada) unable to get an account.

With the borderless account you get your own local bank details for five of the 40+ supported currencies (Euro, British Pound, US Dollar, Australian Dollar and New Zealand Dollar) so that you can receive payments from employers, clients and other debtors without incurring any FX fees.

You can access and manage your Transferwise borderless account from either the mobile app or the web portal, so you aren’t confined to using a smartphone or tablet with this account.

The borderless account comes with a free contactless debit Mastercard, although the card is currently only available to residents of 38 European countries (including the UK). They are working hard to make the card available everywhere.

TransferWise charges a small currency conversion fee (normally between 0% and 1%) for swapping currencies within your account, and also when making a card payment in a currency that you don’t have in your account.

The way this works is that if you’re making a card payment in say, Euros, Transferwise will try to use your Euro balance first, but if you have no balance in Euros, you’ll pay using the currency balance in your account with the lowest conversion fee.

For transferring money from your borderless account to another bank account, there’s always a small fee, even if there is no currency conversion involved. For example, a Euro-to-Euro bank transfer from your Transferwise account will not be completely free.

ATM withdrawals around the world with the debit MasterCard are free for the first £200 every 30 days, and after that there’s a 2% charge.

Other than what I’ve already mentioned, there aren’t really any extra frills with the borderless account. You can’t deposit cash or cheques, get an overdraft or take out a loan. Direct debits and standing orders are also currently unsupported.

You can freeze your card and enable/disable online payments, ATM withdrawals, contactless transactions, chip and pin transactions, and magnetic stripe transactions, as well as adjust spending limits for all of these types of payments.

Setting up a Transferwise borderless account is a piece of cake and all you have to do is register your details on the website and then upload your ID.

The process can take a few days to complete due to the need for verification. Once everything looks right and you’ve deposited a minimum of €20, $20, £20 or your currency equivalent into your account, the card will be shipped out to your address free of charge and should arrive within two weeks.

Summary:

- UK-based FinTech money transfer service offering Electronic Money Account

- Multi-currency borderless current account (40+ currencies)

- Receive local bank details in USD, EUR, GBP, AUD and NZD

- Account is available in 170+ countries, debit card is available in 38 countries

- Mobile app and web portal to access your account

- No service fees, setup fees or minimum balances

- Free contactless debit MasterCard

- ATM withdrawals free for the first £200 every month, 2% charge thereafter

- Transfer money to 50+ countries with low fees (up to 8 x cheaper than legacy banks)

- Low currency conversion fees (usually 0-1%) for cross-currency card payments

- Freeze card, adjust spending limits, enable/disable ATM withdrawals, online, contactless, chip & pin and magnetic stripe payments

- Real-time push notifications

- No overdrafts, loans, direct debits, standing orders or cash/cheque deposits

- Google Pay & Apple Pay are supported in most countries

- Earn money with referrals (50 GBP for every 3 friends who transfer over 200 GBP)

7. WeSwap

Travellers heading in opposite directions have always directly swapped currencies with one another in order to avoid the bad exchange rates and service fees from local banks and money changers.

A FinTech start-up called WeSwap has taken this basic concept and created a peer-to-peer currency exchange platform around it.

Founded in 2011, launched in 2015 and headquartered in London, England, WeSwap was originally set up to facilitate online currency swapping between its community of 350,000+ travellers, and charges very low fees for the service.

WeSwap also issues a multi-currency, NFC-enabled, prepaid debit MasterCard that supports card payments and cash withdrawals in over 150 currencies worldwide.

The WeSwap debit card is presently only available to residents (18+) of ten European countries (UK, Denmark, France, Germany, Ireland, Italy, Netherlands, Norway, Spain, Sweden).

The card allows you to hold and interconvert between 18 different currencies, which are held in separate wallets within your account.

Delivery of the prepaid debit card to your address is free and topping up the card via debit card, bank transfer, Apple Pay or Android Pay is also free of charge.

There are no annual fees for the WeSwap prepaid debit card, except for residents of the Republic of Ireland, who have to pay an annual €5 stamp duty fee.

ATM withdrawals with the card are free of charge if you withdraw more than £200/€200/$200 but cost £1.50/€1.75/$2.25 if you take out a lower amount. Different limits and fees apply for other currencies.

WeSwap uses the Mastercard foreign exchange rate for all cross-currency card transactions and there are no additional fees for transactions in any of the 18 wallet currencies, but for transactions in all other currencies there’s a 2% fee, as with an instant swap (see next paragraph).

For currency swaps you need to first load funds into your WeSwap account and you can only load in your home country’s currency, although it is possible to make a special request to load a different currency.

WeSwap uses the mid-market rate to convert currencies but they do charge a small fee, which depends on how quickly you need the swap to be completed. There’s normally a 1% fee for a 7-day swap, a 1.3% fee for a 3-day swap and a 2% fee for an instant swap.

You can also avail of the SmartSwap feature, which lets you decide your own exchange rate, specify a deadline for the swap and wait until somebody else accepts your offer.

If nobody has accepted by the time the deadline is reached, you can have WeSwap swap the money for you anyway at the on-the-day exchange rate. There’s a 2% fee for using SmartSwap.

Setting up a free WeSwap account is a breeze and only takes 2 minutes – all you have to do is register your personal details via the app or website, upload your ID and address documents and then wait for the verification email. Your card should reach you within 10 working days.

Summary:

- London-based peer-to-peer currency exchange platform that launched in 2015

- Hold 18 currencies on the prepaid debit MasterCard

- Card available to residents of 10 European countries

- No card top-up fees

- No annual fees (except for Republic of Ireland users who pay €5 stamp duty fee)

- No ATM fees when you withdraw more than £200/€200/$200, small fee otherwise

- No fees for card payments in 18 account currencies, 2% fee for all other currencies

- Fee for currency swaps is 1-2% depending on urgency

- SmartSwap feature lets you set your own exchange rate

- Real-time push notifications

- Apple Pay and Android Pay supported

8. Azimo

Founded in January 2012, Azimo is a London-based online remittance start-up that was voted best money-saving app by The Guardian, among several other accolades.

The service is popular with immigrant workers who want to send money to friends and family back in their home country.

Like TransferWise, Azimo is a fully authorized Electronic Money Institution that’s regulated by the FCA (Financial Conduct Authority) and the HMRC (Her Majesty’s Revenue and Customs) so your funds are well protected.

Azimo supports money transfers to 195 + currencies so if Transferwise doesn’t support the currency of the bank account you want to send money to, Azimo is a great alternative.

Do bear in mind however that with Azimo it’s only possible to remit money from the following five currencies: Euro, British Pound, Danish Krone, Norwegian Krone, Swedish Krona, Polish Zloty and Swiss franc.

This means that with Azimo you can currently only send money from 25 countries - the 19 Eurozone nations, Switzerland, Sweden, Norway, Denmark, Poland and the UK.

Azimo claims to be able save you 90% versus your bank or offline transfer provider. They charge an FX fee of 0.1% - 2.25% and remittances can cost as little as £1, with the exact fee dependent on the transfer amount and the two currencies involved.

Azimo lets you pay via card or bank transfer and then the money may be sent to the recipient in the following ways:

- Direct bank transfer to payee’s bank account (typically arrives within 24 hours)

- To one of 200,000+ secure cash pick-up locations worldwide (typically arrives in less than 1 hour)

- SWIFT transfer (100+ countries, typically arrives within 24 hours)

- Mobile Wallet

- Mobile top-up (tops up the recipient's mobile credit)

- Home delivery (Philippines only)

Depending on the country you're sending money to, some of these delivery methods may not be available, but you will always have at least one of these delivery options.

Your first two transfers with Azimo are fee-free and after that you’ll begin paying the standard fees. Note that Azimo doesn’t yet support recurring transfers (neither does TransferWise).

Creating an account with Azimo takes less than 2 minutes and can be done via the app or online through the website. Verification is not usually required initially, though you may be asked to verify your identity at a later stage.

Summary

- London-based online remittance start-up, founded in 2012

- Fully authorized EMI regulated by the FCA and HMRC

- Send money to 195+ countries

- Send money from 25 European countries (7 currencies)

- FX fee typically from 0.25% - 2.25%

- Multiple options for delivery of funds (direct bank transfer, SWIFT transfer, cash pick-up, mobile wallet etc.)

- First two transfers are fee-free

9. Virgin Money Essential Current Account

Not interested in banking with a FinTech start-up? A great retail bank alternative for U.K and EU travellers is the Virgin Money Essential Current Account.

Virgin Money is a UK-based bank and financial services company that was founded by Sir Richard Branson in March 1995.

The bank is covered by the FSCS (Financial Services Compensation Scheme) so any savings you have with Virgin Money are protected up to £85,0000.

One of Virgin Money’s products, the Essential Current Account, is an excellent fee-free, travel-friendly bank account that’s available to both UK and EU residents.

This account pays credit interest on your account balance (up to £100,000) on a monthly basis with an AER (annual equivalent rate) of 0.75%.

The associated Mastercard debit card has contactless functionality and a cash withdrawal limit of £500 per day in the UK.

Foreign currency ATM withdrawals incur a small flat fee of £1.50, whereas cash withdrawals in pounds within the UK are free, though the cashpoint operator may charge their own fee.

Card payments in foreign currencies and foreign ATM withdrawals use the Mastercard exchange rate and there are no surcharges, which is great news for travellers.

One of the downsides of this account for travellers is that there is no mobile app available and the online banking service is quite limited.

You can check your balance, recent transactions and direct debits online, but you can’t set up, change or cancel standing orders and direct debits, or make any other changes to your account. To do those things you would have to pay a visit to your local branch.

You can withdraw from or deposit cash into your account at over 11,000 post offices nationwide and cheque deposits are also supported.

Another drawback is that you can’t send money outside the UK, although you can receive money from foreign banks free of charge. Same-day GBP transfers (by Faster Payment) within the UK are free.

Unlike with the challenger banks we’ve listed here, opening an account with Virgin Money is a slightly troublesome process.

You can only open an account by visiting a branch (usually by appointment only) and you need to provide 2 pieces of ID and 3 years of address history. If your application is successful your debit card will be posted to your address within 5 working days.

If you have an existing UK current account you can easily transfer it (along with any balance, direct debits and standing orders) to your new essential current account within 7 business days with the aid of Virgin Money’s Current Account Switch Service.

Summary:

- UK-based bank and financial services firm

- Deposits protected up to £85,000 under FSCS

- No annual fees or minimum balances

- Credit interest added to account monthly (0.75% AER)

- Free contactless Mastercard debit card

- ATM withdrawals free in the UK, £1.50 flat-fee per withdrawal overseas

- No currency conversion fees for cross-currency card payments (Mastercard exchange rate)

- Free same-day (Faster Payment) bank transfers within the UK, outward remittance to other countries not supported, incoming transfers are free

- Free monthly paper statements

- Cashback facility available (limited to £100 per day at supported retailers)

- Direct debits and standing orders supported

- Deposit and withdraw cash at over 11,000 Post Office branches nationwide

- No overdraft facility

- No mobile app, online banking has limited functionality

- Account can only be opened by visiting a physical branch

10. Payoneer

Founded back in 2005, Payoneer is a financial services company based in New York that, in today’s borderless digital world, strives to make cross-border payments a seamless and low-cost affair for businesses and individuals alike.

Many leading corporations, including AirBnB, Amazon, Getty Images, iStock, Upwork and Google rely on Payoneer’s mass payout services to pay their beneficiaries around the world in 150+ currencies.

But at the individual level, Payoneer offers a very simple and cost-effective solution for all the digital nomads, online entrepreneurs and freelancers who work with international clients and would like to get paid as if they had a local bank account in order to eliminate fees.

Via their Global Payment Service, Payoneer offers individuals (from 200+ countries) free receiving accounts with American, European, British, Japanese, Canadian, Australian and Chinese bank details that let you receive local bank transfers from international clients that want to pay you in USD, EUR, GBP, JPY, CAD, AUD and CNY respectively.

It’s free to receive funds from clients in all the above currencies except for USD, where the fee for receiving money varies between 0 and 1%, depending on your nationality.

Having a local bank account greatly reduces the fees involved with bank transfers for both you and your clients and Payoneer claims that their system can reduce payment fees by up to 71%.

Payoneer is also integrated with major freelancing marketplaces like Upwork and Fiverr, making it very easy for you to withdraw your earnings from those platforms to your Payoneer account.

Also, if you’re working for Amazon.com as an affiliate and you’re not a U.S resident, a Payoneer bank account is essential for receiving your earnings.

Amazon requires that you have a US bank account to receive payments from them, and if you don’t have one your only option is to have a physical checked mailed to you, which is obviously a major inconvenience if you’re a nomad.

Once you have money in your Payoneer account you can withdraw it to your main bank account for a small fee of up to 2% above the mid-market rate if a currency change is involved. This fee can be lowered if you’re a high-earning account holder.

If the bank account you’re withdrawing to has the same currency as your Payoneer balance the fee is €1.50/£1.50/$1.50.

You can also send money in your Payoneer account to other Payoneer account holders for free, although to avail of this service you have to already be actively receiving funds into your account.

Another thing you can do with your Payoneer balance is to just spend it using the debit Mastercard.

Indeed, Payoneer can send you out a free prepaid debit Mastercard so that you can withdraw your balance at ATMs or spend it online and in stores.

However, once you activate the prepaid card the account is no longer free - you’ll have to start paying an annual fee of $29.95.

Moreover, the card comes with a currency conversion fee of 3.5% on all card payments, so I think it’s probably best to avoid the card altogether and just use the free Payoneer account to receive payments from clients.

Payoneer also lets you convert between your different currency balances so that you can always have the currency you need to make a payment. The fee for converting currency within your account is 0.5% of the transfer amount.

Unfortunately, they don’t let you convert any of your currency balances to the currency of your home bank, which would have saved you money when withdrawing large amounts to your bank account.

Setting up a Payoneer account is straightforward and can be done in a matter of minutes on the Payoneer website. You'll need to enter your personal details, create a password and choose a security question.

You'll then need to enter your identity document information followed by your payment method details. Once you've submitted your application it can take up to 3 business days for Payoneer to review it. Once approved you can start receiving payments immediately.

N.B**: Make sure you sign up with this link and we'll both receive a $25 reward after you receive $1,000 in payments to your account.

Summary

- New York based financial services company that facilitates cross-border payments, founded in 2005

- Useful for freelancers, digital nomads, remote workers, affiliates

- Get free receiving accounts in 7 major global currencies (no annual fees)

- Free to receive money in 6 receiving accounts, 0-1% fee for USD

- Integrated with thousands of freelance marketplaces and networks

- Essential for receiving Amazon payments if you’re not American

- 2% fee for withdrawal to home bank account (if different currency), €1.50/£1.50/$1.50 if same currency

- $29.95 annual fee for prepaid debit Mastercard

- 3.5% currency conversion fee on debit card card transactions

- Convert between currency balances for a fee of 0.5%

North America

Although the FinTech revolution has yet to disrupt banking in North America, many of the European challenger banks do have their sights set on breaking into the U.S market in the near future and it remains to be seen whether they will be successful in that endeavor.

For the time being though, there are a few decent travel-friendly accounts available to U.S and Canadian citizens. Here are the best ones that we’ve come across.

11. Charles Schwab High Yield Investor Checking Account

N26, Revolut and other FinTech banks are coming soon to the US, but for the time being the Schwab Bank High Yield Investor Checking Account is one of the very best bank accounts for American travellers (it’s available to U.S residents), and even possesses advantages over the newer digital banks.

Charles Schwab and Co. is one of the largest brokerage firms in the U.S and its banking arm, Charles Schwab Bank, is also one of the largest banks. The firm is based in San Francisco and has been going strong for decades since it was first established back in 1971.

Perhaps the best thing about this checking account is that you won’t be charged anything for ATM withdrawals overseas and you can even claim unlimited rebates for any access fees you pay to withdraw cash from foreign ATMs while abroad.

There are also no service fees, no account minimums, no foreign transaction fees on overseas payments with the accompanying chip-and-pin Visa debit card (not contactless), and you even earn a 0.4% APY (annual percentage yield) on your account balance.

Moreover, the account has a bunch of other nice perks like the ability to deposit checks from anywhere with Schwab Mobile Deposit, free standard checks delivered by regular U.S mail, FDIC (Federal Deposit Insurance Corporation) insured deposits up to $250,000, free bill paying online or from your mobile device, a linked Schwab One Brokerage Account (lets you access a broad range of investments) and more.

Electronic funds transfers are free to other U.S bank accounts and incoming wire transfers are only accepted from banks within the U.S and its territories.

Setting up an investor checking account with Charles Schwab is not as straightforward as setting up many other bank accounts, but it’s well worth the effort for those unlimited ATM rebates.

Because this account is linked to an investing account, you’ll have to undergo a credit check when you apply. You’ll also need to link your existing bank account, verify it, and then transfer money from your existing account into your new Charles Schwab account.

Once you’ve deposited money into your new checking account, you can request your Visa Platinum debit card online, which will be mailed to you free of charge. You can also order replacement cards at no cost.

Summary

- Major U.S bank, based in San Francisco, established in 1971

- No setup fees, maintenance fees or minimum balances

- Online banking and mobile app to manage account

- Deposits protected up to $250,000 under the FDIC

- Earn 0.4% APY on your balance

- Visa Platinum chip-and-PIN debit card (not contactless)

- Unlimited rebates for foreign ATM charges

- No foreign transactions fees for card payments and cash withdrawals abroad

- Free electronic funds transfers to other U.S banks, only domestic incoming wire transfers supported

- Deposit checks on the go with Schwab Mobile Deposit

- Free bill-paying online or via the mobile app

- Linked Schwab One Brokerage Account for investing

- Google Pay, Apple Pay, Microsoft Wallet and Samsung Pay all supported

12. Capital One 360 Chequing Account

Capital One Financial Corporation is a bank holding company that was founded in Virginia back in 1988 and has grown rapidly to become the 10th largest bank in the U.S by total assets, despite being a relatively young institution.

The bank is predominantly online but it does have physical branches across nine states (Delaware, Louisiana, Connecticut, District of Columbia, Texas, Maryland, New York, New Jersey and Virginia). Correspondence with customers is exclusively through e-mail and other electronic channels.

Capital One provide a suite of financial products but of particular interest to travellers is the Capital One 360 Chequing Account, which is only available to permanent U.S residents and comes with no setup fees, no annual fees and no minimum balance.

The Capital One 360 Chequing Account also pays interest on your balance. You’ll earn 0.2% APY (annual percentage yield) if your balance is below $50,000, 0.75% APY for balances between $50,000 and $99,999 and 1% APY for balances of $100,000 or more.

The account comes with a free Mastercard debit card and the great news for travellers is that there are no foreign transaction fees when using the card for ATM withdrawals and other payments abroad.

The transaction amount will be converted to your home currency using the Mastercard exchange rate, with no surcharges.

Note that unlike with the Charles Schwab checking account we covered above, Capital One will not reimburse you for any service fees imposed by third party ATM operators.

However, if you’re withdrawing cash within the U.S, you can use over 39,000 + Capital One and AllPoint branded ATMs nationwide to avoid out-of-network fees imposed by ATM operators.

Other nice features of this account are online bill payments (automatic payments available), mobile check deposits (via the app), and peer-to-peer money transfers using the “send money with Zelle” feature.

The “Mail a Check” feature lets you fill in the blanks of an image of a check on your computer screen, and Capital One will then either send a physical check to the address you’ve provided, or transfer funds electronically to the payee to speed up the payment.

If your account is active and in good standing you can also apply for an overdraft line of credit up to a maximum of $1,000. You pay interest for the length of time that you borrow the funds.

You can also opt into Next Day Grace, which is where you authorize the bank to allow transactions that would overdraw your account, and when this happens you have a full business day to replace the amount you’re overdrawn by before you incur a $35 fee.

Setting up a Capital One 360 Chequing Account is easy and can be done via the bank’s website in about 5 minutes.

If you already have a pre-existing relationship with Capital One (another account, a credit card or an active home or car loan) the process is even faster as they’ll autofill part of the application for you.

Summary:

- 10th largest bank in the U.S by total assets, founded in Virginia in 1988

- Primarily an online bank, physical branches across 9 U.S states

- Free chequing account with no setup fees, annual fees or minimums

- Online banking and mobile app to manage your account

- Earn interest on your balance (0.2%/0.75%/1%)

- Free chip-and-PIN Mastercard debit card (not contactless)

- Fee-free cash withdrawals from 39,000+ Capital One and Allpoint ATMs within the U.S

- No foreign transaction fees for card payments and ATM withdrawals abroad (Mastercard exchange rate)

- Make peer-to-peer money transfers (“send money with Zelle”)

- “Mail a check” lets you fill out a virtual cheque online and have the bank send a physical cheque or transfer money electronically to the payee

- Mobile cheque deposits supported (only in the U.S or U.S territories)

- First checkbook is free, $5 per book thereafter

- Overdraft line of credit available (max $1,000), Next Day Grace lets you overdraw account for 1 day before incurring $35 fee

- Google Pay and Apple Pay supported

13. Tangerine Thrive Chequing Account

There aren't many travel-friendly bank accounts for Canadian travellers but the Thrive Chequing Account, offered by the online bank Tangerine, has more appeal than most.

Acquired by Scotiabank in 2012, Tangerine is a Toronto-based online bank that was known as ING Direct Canada before becoming a subsidiary of Scotiabank.

The bank offers a free current account with no annual fees and no fees for daily transactions, including debit card purchases, bill payments, pre-authorized payments and e-mail money transfers. You also get your first book of 50 cheques for free (subsequent books cost $20 each).

This chequing account also pays interest on your balance monthly. You can earn 0.15% on balances up to $49,999, 0.55% on balances from $50,000 - $99,999 and 0.65% if your balance is $100,000 or greater.

Because Tangerine Bank is a subsidiary of Scotiabank, cash withdrawals abroad are free if you use any of the 44,000+ Global ATM Alliance cashpoints found in 40 countries worldwide - otherwise overseas cash withdrawals will cost you $2 each.

An exception is if you’re withdrawing via Scotiabank ATMs in Costa Rica, Panama and Uruguay, where you still have to pay the $2 access fee.

Within Canada, ATM withdrawals are free with Tangerine and Scotiabank ATMs (3,500 nationwide) and you’ll pay a $1 fee if using other ATMs.

Information on any currency conversion fees applied to cross-currency card payments is lacking on the bank’s website unfortunately, but some users report incurring fees somewhere in the region of 1.8% - 2.5%.

This accounts supports two types of money transfers; e-mail money transfer (EMT), Interac e-Transfer and Electronic Funds Transfer (EFT).

E-mail money transfer uses the regular electronic funds procedure (EFT), so it takes 2-3 business days and is a free service. Interac e-Transfer is an almost instant service provided by Interac (a Canadian interbank network) and costs $1 per transfer.

Setting up your Tangerine chequing account is easy and can be done in 10 minutes on the website. You’ll need to register your details (including your social insurance number) create a 6-digit PIN and verify your identity, which can take several days.

Summary

- Toronto-based online bank, acquired by Scotiabank in 2012

- Account only available only to Canadian residents

- Online banking and mobile app to manage your account

- Earn monthly interest on your balance (0.15%/0.55%/0.65%)

- Free chip-and-PIN Mastercard debit card

- Fee-free access to 3,500 Scotiabank ATMs nationwide and 44,000 Global ATM alliance ATMs worldwide, otherwise $2 fee (overseas) or $1 fee (domestic)

- Transfer funds domestically with free e-mail money transfer (EMT) or faster Interac e-Transfer ($1 fee per transfer)

- Cheque-In feature lets you deposit cheques on the go from the mobile app

- First cheque book of 50 cheques free, $20 per book thereafter

- Overdraft protection available

- Google Pay/Apple Pay/Samsung pay supported

Oceania

There aren’t many great banking options for travellers from Oceania, but during our research we came across two accounts that should help to make overseas banking at least a little less frustrating and expensive.

14. Citibank Global Currency Account

Citibank in Australia is a division of NYC-based Citigroup, which is one of the world’s largest multinational financial services company.

Citibank commenced consumer operations in Australia in 1985 and was the first foreign bank to be granted a banking license.

Of great interest to many Australian travellers is the bank’s Citi Global Currency Account, which is only available to Australian residents over the age of 18.

This is a multi-currency account that allows you to hold up to 10 different currencies (AUD, CAD, EUR, HKD, JPY, NZD, SGD, GBP, CHF and USD) and interconvert between them instantly via the accompanying mobile app.

The ten currencies are held in their own “currency accounts” and have their own individual account numbers.

Unfortunately, when switching between currency balances it is Citibank’s own exchange rates that are applied (rather than the mid-market rate), and while quite competitive, these do markup the rate.

The good news however is that there are no maintenance fees and no minimum opening balance is required for this bank account.

You will also earn interest on your Australian Dollar balance with this account, as long as the balance is greater than $5,000.

Interest earned is 1% p.a. for AUD balances between $5,000 - $99,999.99, 1.5% p.a for balances between $100,000 - $249,999.99 and if you have $250,000 or more in your account, the rate is 2.5% p.a. You can’t earn interest on any foreign currencies.